Technology: Page 79

-

Gemini launches crypto-based savings product offering up to 7.4% yield

Gemini said it can pay such high rates because it lends to institutional borrowers through a partner, but that puts it largely outside the regulatory sphere — leaving customers assuming considerably more risk.

By Dan Ennis • Feb. 3, 2021 -

Rangel, David. [photograph]. Retrieved from https://unsplash.com/photos/4m7gmLNr3M0.

Rangel, David. [photograph]. Retrieved from https://unsplash.com/photos/4m7gmLNr3M0.

Report: Cyberattacks cost financial firms $4.7M on average last year

Weak endpoints and a lack of policy enforcement are imposing extra costs on companies as home-based workers remain vulnerable.

By David Jones • Jan. 28, 2021 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

Payments company CFO: We won't work with partners 'not aligned with our values'

Affirm went public on Wednesday, a week after the insurrection that has spurred many platforms to reassert their values.

By Jane Thier • Jan. 14, 2021 -

Mastercard pilot turns smartphones into a point-of-sale device

Expansion into the contactless tech space has accelerated due to the pandemic and is expected to continue.

By Kaarin Moore • Jan. 14, 2021 -

Banks can use stablecoins, blockchains for payments, OCC says

The move follows a letter the agency issued in July clarifying national banks are allowed to provide cryptocurrency custody services, and hold unique cryptographic "keys" associated with cryptocurrency on behalf of customers.

By Anna Hrushka • Jan. 5, 2021 -

SEC picking crypto 'winners and losers,' Ripple tells court

The company's CEO, Brad Garlinghouse, criticized the timing of the suit and vowed to challenge it. The coin lost 60% of its value in the week after the court action, which one Twitter user called a "kill shot."

By Anna Hrushka • Updated March 5, 2021 -

Crypto firms Paxos, BitPay apply for national bank charters

The OCC has taken a series of crypto-friendly actions under acting Comptroller Brian Brooks as lawmakers and trade groups continue to push back.

By Anna Hrushka • Dec. 14, 2020 -

7-Eleven unveils mobile wallet to enable contactless payments

The retailer aims to bring cash users into the digital wallet space and make its rewards program more accessible.

By Tatiana Walk-Morris • Dec. 8, 2020 -

Teen-aimed banking app Step gets celebrity boost

The platform said it raised $50 million in a Series B funding round that included investment from singer Justin Timberlake, music group The Chainsmokers and retired athlete Eli Manning.

By Anna Hrushka • Dec. 3, 2020 -

Facebook-led digital currency, renamed Diem, could launch in January

"We like the connotation of it kind of being a new day for the project," said the group's CEO, Stuart Levey, referring to the moniker's use of the Latin word for "day."

By Anna Hrushka • Updated Dec. 1, 2020 -

Deep Dive

Is cashierless tech ready for prime time?

The pandemic has juiced demand for automated checkout systems, and retailers are having positive experiences with them, but the technology still has to prove itself over the long term.

By Sam Silverstein • Nov. 30, 2020 -

Google revamps Google Pay, adds 3 new partner banks

With a redesigned app and an expanded network of banks that have signed on to offer co-branded accounts, the tech giant continues its push into the consumer financial services space.

By Anna Hrushka • Nov. 19, 2020 -

PayPal launches crypto payment platform

The payments company will convert consumers' Bitcoin, Ethereum, Bitcoin Cash and Litecoin holdings into fiat currencies when they check out. That cuts the risk merchants assume from any volatility in cryptos' value.

By Dan Ennis • Updated March 30, 2021 -

Fed chair remains cautious on regulator's digital dollar efforts

The central bank's chief, Jerome Powell, told a panel Monday he'd rather the U.S. "get it right" than be first — and that such a currency should aim to complement rather than replace the dollar.

By Dan Ennis • Oct. 20, 2020 -

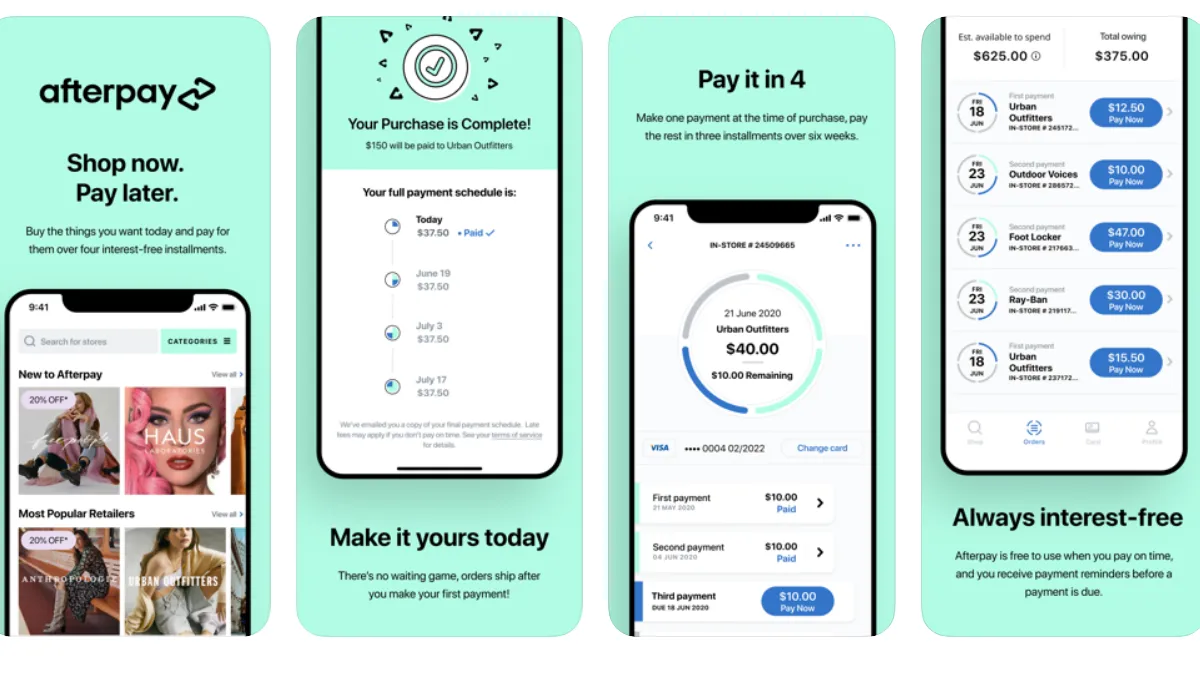

Afterpay partners with retailers for in-store payments

Shoppers nationwide can use a virtual, contactless card stored in their digital wallet to pay for in-store purchases in installments.

By Tatiana Walk-Morris • Oct. 19, 2020 -

PayPal introduces 'Pay in 4' installment payment service

The payments behemoth joins a growing list of pay-over-time competitors.

By Tatiana Walk-Morris • Sept. 3, 2020 -

PayPal expands its point-of-sale arsenal

The payments company is looking to wrest part of a burgeoning buy-now-pay-later market from the likes of Afterpay, Affirm and Klarna with a six-week installment plan for purchases between $30 and $600.

By Dan Ennis • Sept. 1, 2020 -

Ally partners with Mastercard's Vyze to enter retail point-of-sale lending

The bank will offer installment loans on retail purchases between $500 and $40,000 with interest rates ranging from 9.99% to 26.99%. Monthly fixed-rate installment loans will range from six to 60 months, the company said.

By Dan Ennis • Aug. 26, 2020 -

Retrieved from Facebook on June 02, 2020

Retrieved from Facebook on June 02, 2020

Facebook unveils payments umbrella

Facebook Financial, the social network's latest effort to lend brand consistency among its payment and commerce plans, will be overseen by Libra co-creator David Marcus.

By Dan Ennis • Aug. 11, 2020 -

CVS to offer Venmo, PayPal QR codes in stores

Other platforms, like WhatsApp and Amazon, have introduced QR codes for merchants, too.

By Tatiana Walk-Morris • Aug. 3, 2020 -

Remote work exposes payment system inefficiencies

Although most organizations want to automate payments, only about 8% have fully done so.

By Robert Freedman • July 22, 2020 -

Will COVID-19 push contactless payments into the mainstream?

Multiple barriers have curtailed retailers' contactless payment integration. But a pandemic may be the catalyst to widespread adoption.

By Tatiana Walk-Morris • June 9, 2020 -

Consumers aren't adopting mobile wallets, even during the pandemic

A PYMNTS.com study conducted in March found that mobile wallets accounted for a small portion of eligible transactions, despite the coronavirus outbreak.

By Tatiana Walk-Morris • April 7, 2020 -

Banks mostly fear payments and money transfer fintechs, survey finds

Less of a concern among banks is competition from online investment and crowdfunding upstarts.

By Robert Freedman • March 3, 2020