Technology: Page 63

-

Brex's move has fellow fintechs ready to pounce

Brex cutting small business customers — the handling of which prompted a mea culpa from the co-founder — may provide opportunity for B2B fintechs like Ramp or Divvy. But big banks still dominate the space.

By Caitlin Mullen • June 27, 2022 -

Bed Bath & Beyond adds BNPL option

The retailer said its buy now-pay later option, Welcome Pay, allows customers to pay for purchases in four payments.

By Caroline Jansen • June 27, 2022 -

Explore the Trendline➔

Explore the Trendline➔

NatalyaBurova via Getty Images

NatalyaBurova via Getty Images Trendline

TrendlineEmbedded payment tools make inroads

Business customers demanding integrated tools is likely to keep driving a trend toward more embedded payments tools.

By Payments Dive staff -

Sponsored by Nium

Business is global by default: Why haven't payments kept up?

To compete internationally, businesses need a reliable method to make and receive real-time payments.

June 27, 2022 -

Alviere sets sights on Europe, Latam expansion

Embedded payments player Alviere has raised money from Silicon Valley Bank to support expansion in Europe and Latin America, following the hiring of a pack of new executives.

By Tatiana Walk-Morris • June 24, 2022 -

PayPal changes up its pricing

In a move that could increase or decrease charges for merchants, the company said it aims to better distinguish between personal and commercial payments on its system.

By Lynne Marek • June 24, 2022 -

Alo Yoga accepts crypto payments, allows crypto paychecks

The direct-to-consumer lifestyle brand is betting big on Web3 technology, although U.S. data suggest minimal usage of crypto for purchasing goods.

By Dani James • June 22, 2022 -

Opinion

Friendly fraud: How should fintechs view the risks?

With friendly fraud, fintechs don’t always consider the whole picture when it comes to fraudulent disputes.

By Sarah Mirsky-Terranova • June 21, 2022 -

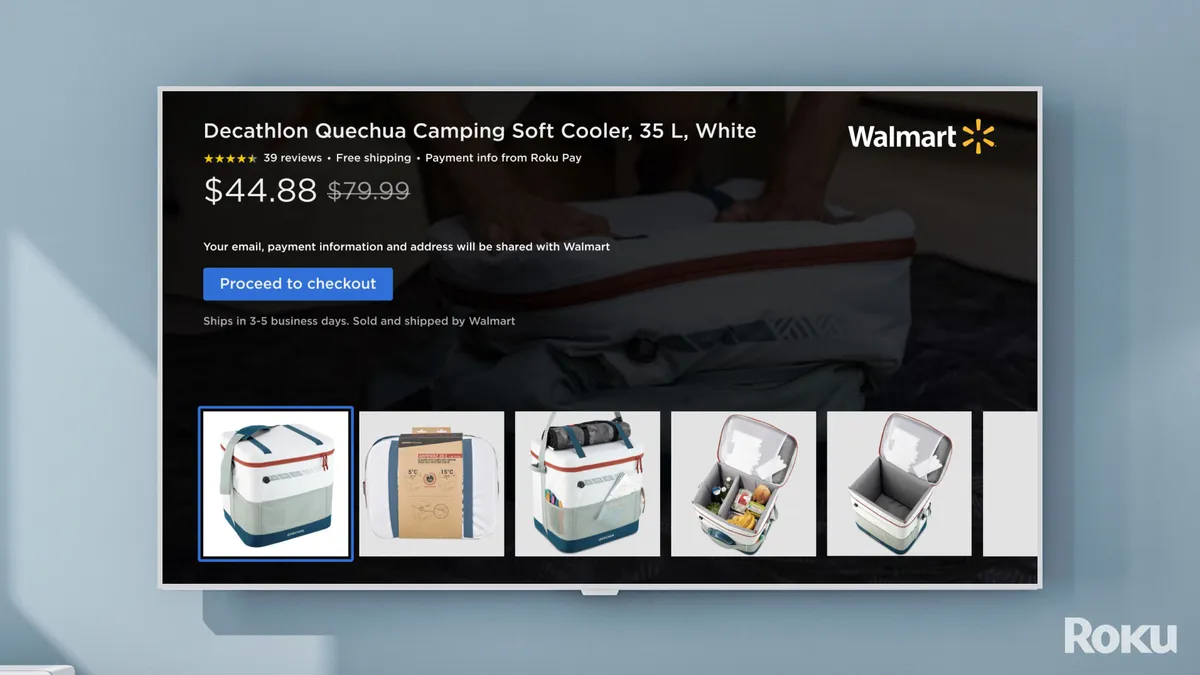

Walmart, Roku partner to evolve shoppable streaming ads 'beyond the QR code'

The mega-retailer is the exclusive partner on a new Roku feature that allows people to purchase products by clicking on ads with their remote.

By Peter Adams • June 17, 2022 -

Tipalti spearheads digitization in middle market

B2B fintech Tipalti aims to scoop up some additional businesses as startups struggle with a slowdown in equity funding.

By Caitlin Mullen • June 16, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB urges standardization in BNPL credit reporting

The agency isn’t pleased about the three big credit reporting bureaus taking different approaches to tracking consumer data for buy now-pay later financing.

By Lynne Marek • Updated June 17, 2022 -

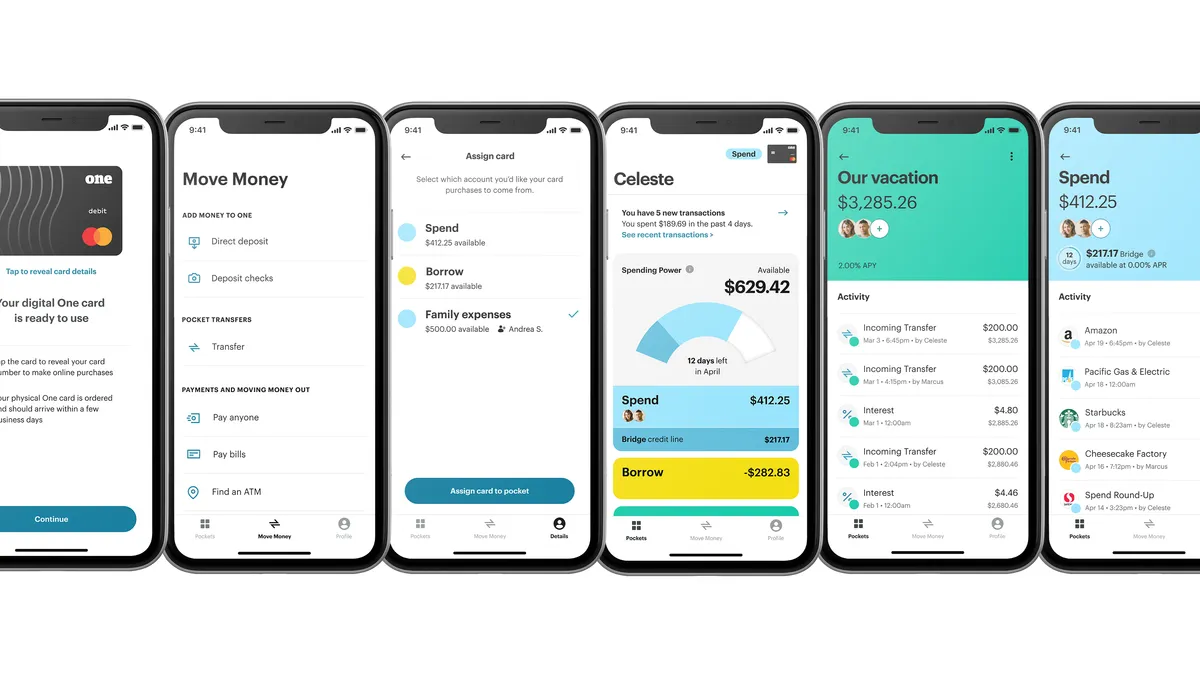

Samsung debuts a new digital wallet with crypto

The new wallet will store IDs, cards and crypto, giving the South Korean company more leverage to compete with digital payment apps from tech giants Apple and Google.

By Tatiana Walk-Morris • June 16, 2022 -

Startup Metropolis snags $167M to scale

Metropolis Technologies, which uses computer vision and machine learning for parking payments, plans to use the funding to scale, aiming to hire 500 workers by the end of the year.

By Caitlin Mullen • June 15, 2022 -

Grubhub adds instant pay option for delivery drivers

Food delivery company GrubHub will make an instant payout option available to its couriers, with an assist from PayPal and Visa, so drivers can deposit earnings to a debit card.

By Alicia Kelso • June 15, 2022 -

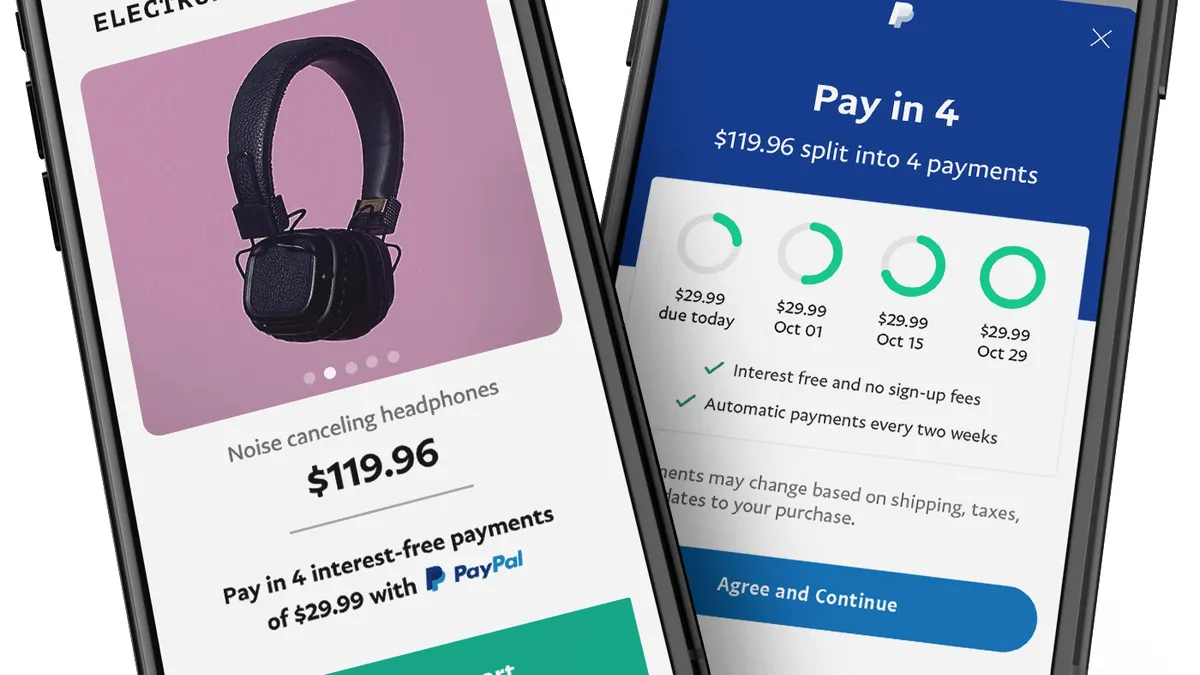

PayPal expands BNPL payment options

PayPal is making a bigger move into buy now-pay later financing as competitors in that arena multiply. It will now offer a new monthly payment plan targeted at bigger purchases.

By Lynne Marek • June 15, 2022 -

Payments startups still gaining value, for now

Payments companies “led the pack in valuation increases” and had the biggest average increase in valuation, according to S&P Global Market Intelligence.

By Jonathan Berr • June 14, 2022 -

Payrailz gains traction in battle with big rivals

The six-year-old company said it expanded its client base by a third in the first quarter and will double last year’s count to 150 by the end of this year.

By Lynne Marek • June 14, 2022 -

PayPal strives to improve checkout

The company aims to improve the checkout experience for both merchants and consumers, with new services being tested this year, CEO Dan Schulman said.

By Lynne Marek • June 13, 2022 -

AffiniPay buys legal software firm MyCase

AffiniPay will link the acquired firm with its LawPay business. The two companies combined are expected to generate about $200 million in annual revenue.

By Caitlin Mullen • June 13, 2022 -

Column

Don't count crypto out just yet

Cryptocurrency skeptics were undoubtedly delighted by TerraUSD’s collapse last month, but there are plenty of signs already this month that the crypto era is far from over. Maybe it’s just beginning.

By Lynne Marek • June 10, 2022 -

Chip cards rise 10% last year to 12B globally

That figure was the annual increase tallied this week by EMVCo as part of its work to streamline payment protocols for merchants and improve the security of their transactions.

By Tatiana Walk-Morris • June 10, 2022 -

Visa sees long runway with cash-to-card transition

For Visa, plenty of opportunity remains in cash-to-card digitization, offsetting any slowdown in consumer spending, CFO Vasant Prabhu said this week.

By Caitlin Mullen • June 9, 2022 -

Toast heats up restaurant payments competition

As Toast adds services, the Boston startup is taking business from larger rivals and fintech peers, analysts say.

By Jonathan Berr • June 8, 2022 -

Apple joins BNPL boom

Apple Pay Later will let users split the cost of an Apple Pay purchase into four equal payments over a six-week period, with no interest or fees. It will be available via the Mastercard network.

By Jonathan Berr • June 7, 2022 -

Foundation opines on crypto bill

The Stellar Development Foundation provided its take on this week’s bipartisan Senate bill to create a regulatory framework for cryptocurrencies.

By Robin Bradley • June 7, 2022 -

Customer satisfaction with card apps declines

"When it comes to delivering that level of personalization through high-touch digital channels, most banks and credit card providers are missing the mark," J.D. Power said in a new consumer survey report.

By Tatiana Walk-Morris • June 7, 2022