Technology: Page 61

-

Amazon opens a new wallet for sellers

The e-commerce juggernaut said it’s offering a new digital wallet service to its sellers and planning to roll it out more broadly over the “next few months.”

By Lynne Marek • July 26, 2022 -

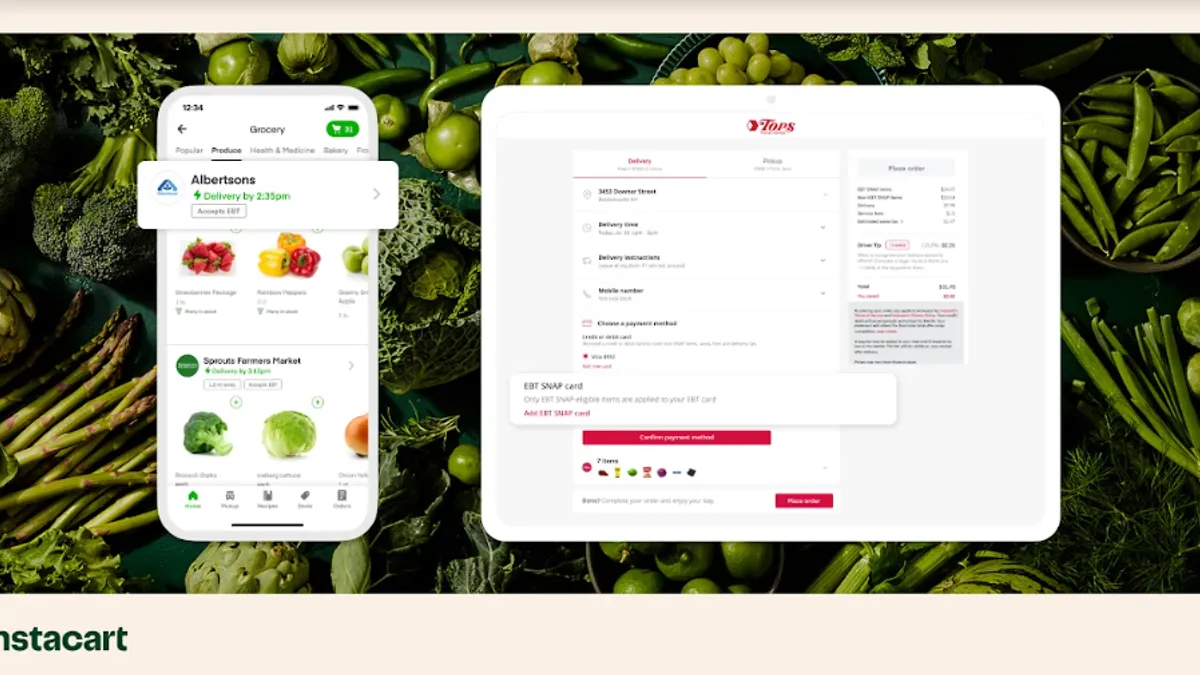

Grocery company Albertsons rolls out SNAP online payment

The company now offers the purchasing capability at five banners through its own platform as well as the Instacart app.

By Catherine Douglas Moran , Jeff Wells • July 25, 2022 -

Explore the Trendline➔

Explore the Trendline➔

NatalyaBurova via Getty Images

NatalyaBurova via Getty Images Trendline

TrendlineEmbedded payment tools make inroads

Business customers demanding integrated tools is likely to keep driving a trend toward more embedded payments tools.

By Payments Dive staff -

Fintech Cardless taps Amex network

The partnership allows brands working with Cardless to take advantage of Amex’s benefits, while Amex sees the move expanding the scale of its network.

By Caitlin Mullen • July 25, 2022 -

Domestic money transfer to jump nearly 50%, Juniper forecasts

Domestic money transfer payments worldwide are likely to jump by about 50% between this year and 2026 to some 300 billion payments, research firm Juniper Research predicted in a report released today.

By Lynne Marek • July 25, 2022 -

PayPal hands out stock to new workers

The digital payments pioneer is distributing shares of its beat-up stock to hundreds of new workers in a bid to hang onto employees after cutting others earlier this year. A spokesperson said the distribution was a “normal course” of action.

By Lynne Marek • July 22, 2022 -

Deluxe payments business to overtake check-printing

The company is “transforming from a legacy check-printing company to a payments and data company," CEO Barry McCarthy said.

By Jonathan Berr • July 21, 2022 -

Q&A

Resolve CEO touts benefits of BNPL in B2B

As Resolve’s customers manage cash closely and navigate supply chain snags, CEO Chris Tsai expects the company’s BNPL model for B2B will stand out in a challenging economic environment.

By Caitlin Mullen • July 21, 2022 -

Payments funding, deal-making declines in Q2

Payments startups are getting caught in the venture funding downdraft. Investment dollars and deal-making dropped in the second quarter, according to a CB Insights report.

By Lynne Marek • July 21, 2022 -

Opinion

BNPL will evolve as providers tweak the model

“Challengers frequently believe BNPL 1.0 is what it is, and will not evolve,” writes Brian Shniderman, CEO of Opy, a U.S. subsidiary of Australian payments fintech Openpay. “But it can, and very recently, it has proven that it will.”

By Brian Shniderman • July 20, 2022 -

Feds crack down on improper payments

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

By Lynne Marek • July 20, 2022 -

Klarna to open Los Angeles pop-up shop

Located on Melrose Avenue, the buy now-pay later firm’s two-day shopping experience will showcase sustainable brands.

By Tatiana Walk-Morris • July 19, 2022 -

Flywire expands presence in education payments

Following its second acquisition as a public company, Boston-based Flywire will continue to look for purchase opportunities that expand the payments company’s reach globally, said CEO Mike Massaro.

By Caitlin Mullen • July 19, 2022 -

ClassWallet signs string of new state contracts

Demand for ClassWallet’s education digital payments tools increased during the coronavirus pandemic, and that rise has continued this year in the company’s signing of new state contracts.

By Jonathan Berr • July 19, 2022 -

NBCU, Peacock create shoppable TV show using QR codes

Viewers of the show 'Love Island USA' will be able to shop featured products in every episode using scannable QR codes starting this week.

By Jessica Hammers • July 19, 2022 -

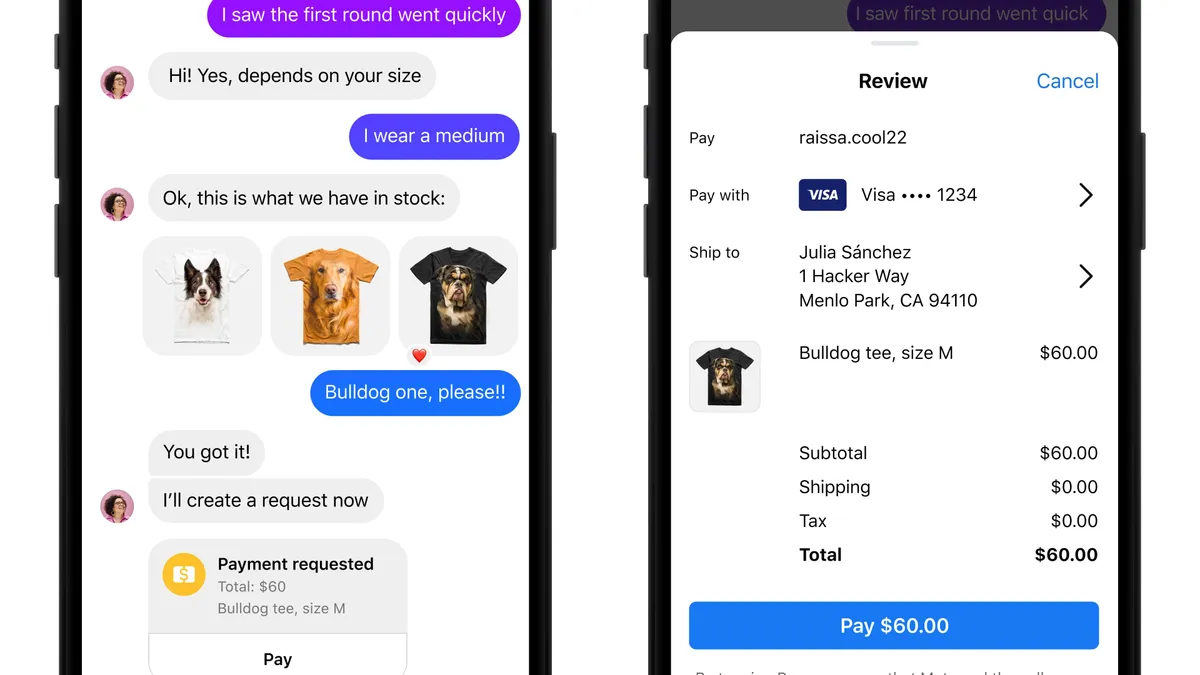

Instagram enables payments in chat

Meta-owned Instagram will allow users to make purchases from small businesses directly within messages sent in the app.

By Caitlin Mullen • July 18, 2022 -

Stake, Aliaswire target rental payment flows

The companies see millions of dollars of opportunity in offering new ways for management of rental payment flows.

By Lynne Marek • July 18, 2022 -

Modern Treasury expands on demand, readies for FedNow

The company has more than doubled its headcount over the past year to meet demand for its payments software from clients like Marqeta and Gusto. Now, it plans more expansion for real-time services.

By Jonathan Berr • July 18, 2022 -

Sponsored by Cybersource

5 essential features to look for in an omnichannel commerce partner

An experienced commerce partner can help provide the technology needed to help merchants keep up.

July 18, 2022 -

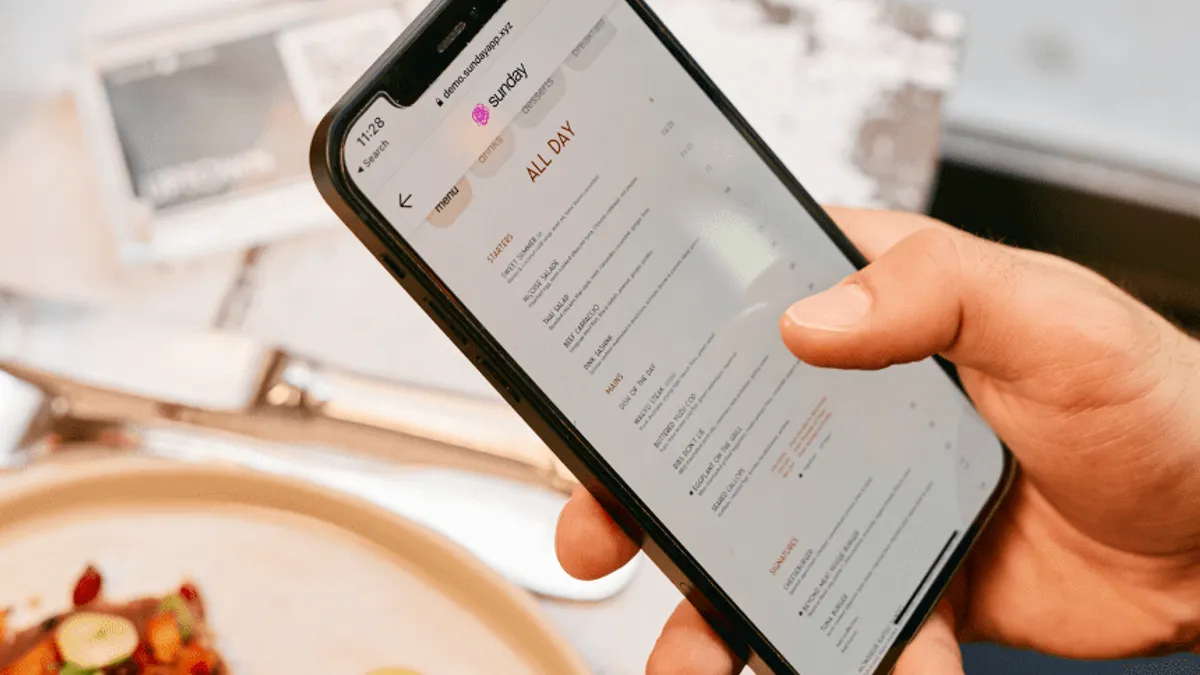

Retrieved from sunday on July 15, 2022

Retrieved from sunday on July 15, 2022

Restaurant payments app Sunday cuts staff, exits markets

The startup, which launched just 16 months ago, will pull out of four of its seven markets to focus on the U.S., U.K. and France.

By Emma Liem Beckett • July 17, 2022 -

Stripe's valuation slashed as fintech rout continues

The company told employees Friday that its internal share price had fallen 27% to $29 from $40, The Wall Street Journal reported, citing unnamed sources.

By Jonathan Berr • July 15, 2022 -

SeatGeek taps Affirm for event BNPL

As inflation threatens consumers’ discretionary spending, event ticketing companies like SeatGeek could view the buy now-pay later option as an attractive way to bolster sales.

By Caitlin Mullen • July 15, 2022 -

CFPB's Chopra reminds payments players they're in his sights

In a blog post this week, the director reiterated that payments processors, credit card issuers and debt collectors are attracting scrutiny from his agency.

By Lynne Marek • July 14, 2022 -

Deep Dive

FedNow chases real-time payments front-runners

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

By Lynne Marek • July 14, 2022 -

Relay Payments takes on incumbents in trucking

The fintech is taking on FleetCor and Wex as it seeks to take a bigger bite of a $500 billion U.S. trucking logistics market.

By Caitlin Mullen • July 13, 2022 -

Opinion

Banks and fintechs don't need to fight

“Rather than competing with one another, banks and fintechs are increasingly partnering,” writes Modern Treasury CEO Dimitri Dadiomov.

By Dimitri Dadiomov • July 12, 2022