Technology: Page 42

-

PayPal promotes Archie Deskus to CTO

The move expands the executive's oversight to include platform engineering teams, the company said Thursday.

By Roberto Torres • Nov. 2, 2023 -

Treasury Prime creates instant payment rail

The new payment rail allows fintech clients to move money between banks in milliseconds, the software company’s CEO said in an interview.

By James Pothen • Nov. 2, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

PayPal’s new CEO promises improvements

Alex Chriss, who took the top post in September, tapped a new chief financial officer this week and pledged to refocus the payment company's strategy.

By Lynne Marek • Nov. 2, 2023 -

PayPal tapping Google AI tool

Google CEO Sundar Pichai did not provide details on how PayPal used the tool, saying only that it helped “boost developer productivity.”

By James Pothen , Lynne Marek • Nov. 1, 2023 -

Global Payments delays new POS launch

The payments processor’s new point-of-sale software for retail and restaurant customers will launch in early 2024, not this year.

By Caitlin Mullen • Nov. 1, 2023 -

Western Union grapples with growth goals

The cross-border payments company plans to revamp its loyalty program early next year as part of a plan to jump-start growth.

By Lynne Marek • Nov. 1, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

Affirm sees CFPB supervision on the horizon

The buy now, pay later company expects to begin being supervised by the federal watchdog in the “immediate future.”

By Caitlin Mullen • Oct. 30, 2023 -

Consumers expect to use fewer digital wallets: report

As more merchants accept digital payments for in-store purchases, consumers are moving away from using multiple, single-use payment apps, McKinsey Senior Partner Marie-Claude Nadeau said.

By James Pothen • Oct. 30, 2023 -

Wex buys Payzer for $250M

The purchase continues a spate of payments industry acquisitions this month, and will let the fleet management services company cross-sell more software.

By Lynne Marek • Oct. 27, 2023 -

PayPal to sell Happy Returns to UPS

The digital payments pioneer is shedding the returns software business under a new CEO just two years after acquiring it.

By Alejandra Carranza • Oct. 27, 2023 -

Ingenico, Jifiti partner to offer payment options

The payments acceptance company is racking up partnerships to expand services under Apollo Funds ownership.

By Tatiana Walk-Morris • Oct. 27, 2023 -

BNPL, EWA bills surface at House hearing

The legislative proposals emerged at a Wednesday hearing during which lawmakers queried witnesses on payments and fintech issues.

By Caitlin Mullen • Oct. 26, 2023 -

Fed proposes reduction in debit fee cap

The Federal Reserve Board proposed a rule change that would slash the amount card issuers can charge merchants for processing a debit transaction. The proposal also calls for periodic updates to the fee cap in the future.

By Lynne Marek • Oct. 25, 2023 -

PayPal taps Fiserv as ‘core’ payments partner

Fiserv CEO Frank Bisignano said Tuesday that his company is now PayPal’s “core U.S. partner for payment services.”

By Caitlin Mullen • Oct. 25, 2023 -

Visa leans into CFPB proposal

The card network’s CEO on Tuesday backed a recent Consumer Financial Protection Bureau proposal on open banking, but was more circumspect about Fed moves on debit rules.

By Lynne Marek • Oct. 25, 2023 -

Three lessons in ACI’s $2.4B payments test disaster

Pay attention to how legacy vendors are integrated after an acquisition, treat internal data sharing requests as cyber risks and don’t let staff test systems using real data.

By Robert Freedman • Oct. 25, 2023 -

PayNearMe gives online gamblers more ATMs to cash out

Despite the declining use of physical currency and ATMs across the country, “cash remains an integral part of the player experience,” Atleos Chief Operating Officer Stuart Mackinnon said in a Monday press release.

By James Pothen • Oct. 24, 2023 -

Fiserv, Blackhawk Network push to expand bill-pay services

By increasing the number of retailers accepting walk-in bill payment, the two companies seek to better serve consumers who prefer to use cash.

By Caitlin Mullen • Oct. 24, 2023 -

Crypto legislation would put US ‘back in the game,’ stakeholders say

A pair of House bills would help the industry gain clarity, scale digital asset products and promote financial inclusion, cryptocurrency stakeholders said Sunday on a panel at Money20/20.

By Anna Hrushka • Oct. 24, 2023 -

BIS advances oversight structure for broader faster payments ecosystem

In the interest of faster, cheaper and more transparent cross-border payments, the Bank of International Settlements last week produced an interim report aimed at developing a governance structure for an interlinked faster payments system.

By Lynne Marek • Oct. 23, 2023 -

Opinion

Why payments to government agencies should be easier

“Increasingly, government agencies — and the people they serve — need a payments system that is connected across departments and jurisdictions,” writes one payments executive.

By Sloane Wright • Oct. 23, 2023 -

Do low-income consumers need more digital payments protection?

“Big gaps in the law” are leaving the financially vulnerable open to harms from digital payments, one law professor argues in a recent Georgetown Journal on Poverty Law & Policy paper.

By James Pothen • Oct. 23, 2023 -

Same-day payments keep climbing: Nacha

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

By Tatiana Walk-Morris • Oct. 20, 2023 -

CFPB unveils open banking proposal

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

By Anna Hrushka • Oct. 20, 2023 -

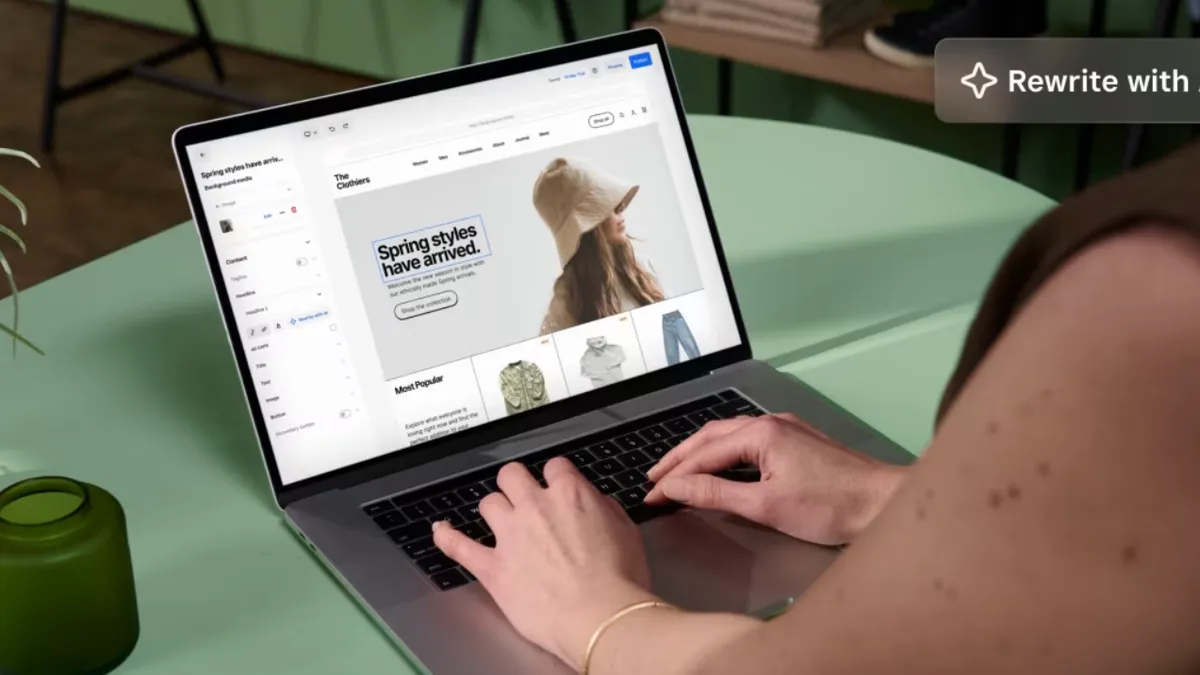

Square adds generative AI tools for sellers

The point-of-sale provider's latest features include menu and website copy generators, which are designed to automate operations and increase efficiency.

By Aneurin Canham-Clyne • Oct. 19, 2023