Technology: Page 39

-

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

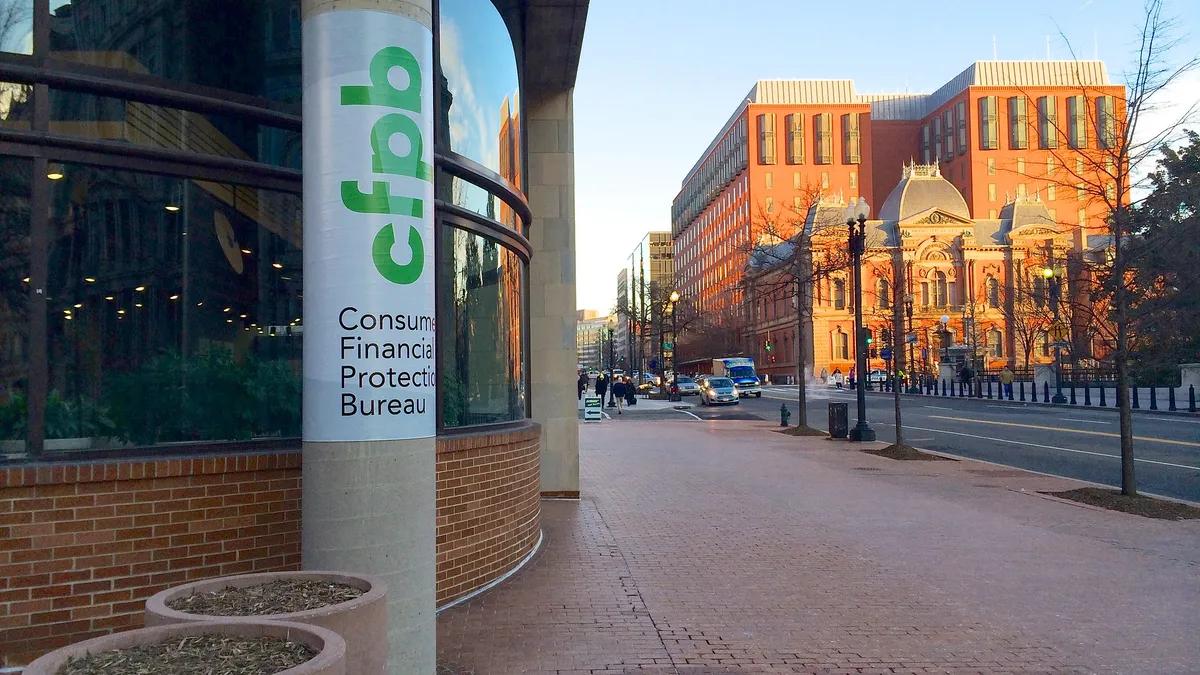

Trade groups seek to delay digital wallet oversight plan

Fintech trade groups asked the Consumer Financial Protection Bureau to extend the comment period on a proposal formalizing its oversight of big tech companies’ digital wallets.

By Caitlin Mullen • Jan. 4, 2024 -

CFPB flags impending guidance on earned wage access

The federal agency plans to weigh in on EWA services, it said in commenting on a California proposal to register and oversee the providers of such services.

By Lynne Marek • Jan. 4, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

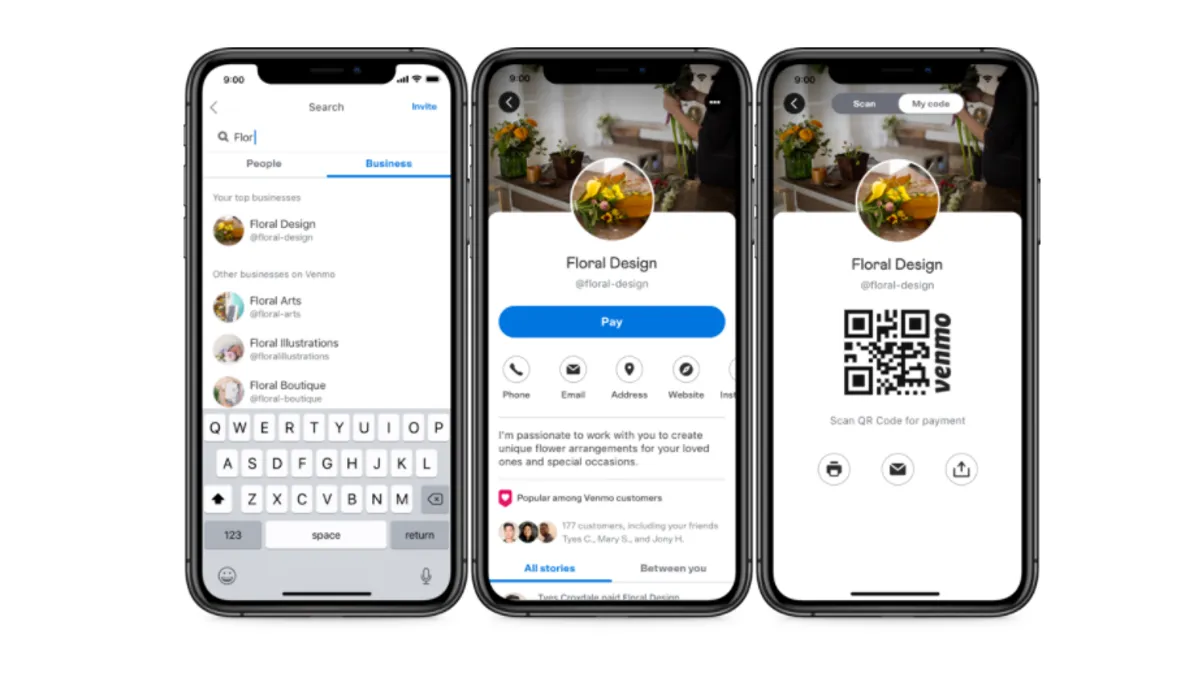

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

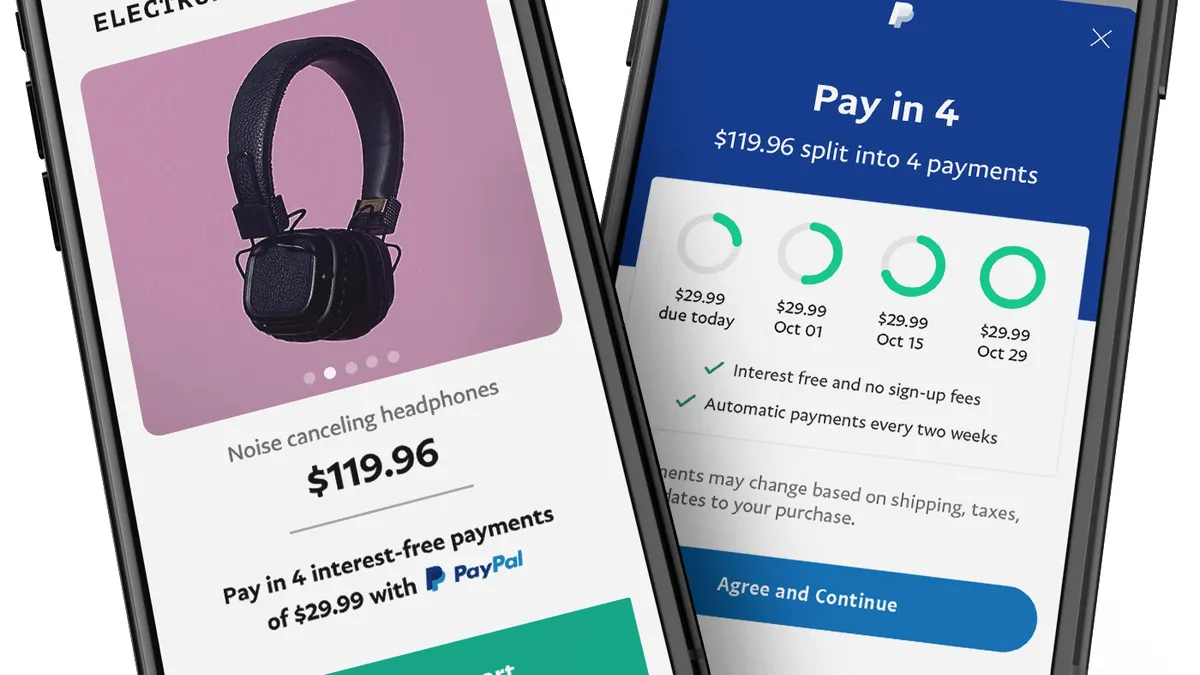

NY governor pursues BNPL regulation

New York Gov. Kathy Hochul is seeking to require buy now, pay later providers to obtain a license to operate in the state, in addition to other potential regulations for the industry.

By Caitlin Mullen • Jan. 3, 2024 -

Q&A

Endava exec talks super apps, Paze and embedded payments

The consulting firm’s global marketing head explained in an interview why a bank-backed digital wallet won’t be “the PayPal killer” and why the U.S. hasn’t seen a super app for payments.

By James Pothen • Jan. 3, 2024 -

Canadian payments firms chart US growth

Versapay and Brim Financial, both based in Toronto, have already lured U.S. customers, and are seeking to expand their clientele south of the border.

By Lynne Marek , Caitlin Mullen • Dec. 22, 2023 -

Employee feedback informs Global Payments’ RTO approach

Flexibility ranked high on the payment processor’s list of employee retention pain points, so the company turned to staffers for guidance, said Chief Human Resources Officer Andréa Carter.

By Ryan Golden • Dec. 22, 2023 -

How Google’s settlement will change in-app payments

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

By Lynne Marek • Dec. 21, 2023 -

Data startup Spade aims for larger customers

Spade is tapping its recent funding to try to lure more big U.S. banks to its services, CEO Oban MacTavish said.

By Caitlin Mullen • Dec. 21, 2023 -

Walmart adds Affirm to self-checkout kiosks

In an expanded partnership between the two companies, Walmart is adding Affirm’s buy now, pay later option at its checkout kiosks at most stores.

By Tatiana Walk-Morris • Dec. 21, 2023 -

Q&A

Visa leans on fintech partners

Teaming with emerging fintechs is “a way of staying very, very relevant,” said Jim Schinella, Visa’s global head of digital partnerships.

By Caitlin Mullen • Dec. 20, 2023 -

Don’t know what a digital wallet is? We’ve got you covered.

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

By James Pothen • Dec. 20, 2023 -

Senators prod CFPB on BNPL oversight

Three Democratic lawmakers worried about financially vulnerable consumers during the holiday shopping season urged the Consumer Financial Protection Bureau to keep an eye on buy now, pay later offerings.

By Lynne Marek • Dec. 19, 2023 -

Q&A

Amex EVP weighs in on fraud trends

Beating back fraud can feel “a bit like a vicious circle,” as the industry improves its capabilities and fraudsters pivot, said Tina Eide, an executive vice president focused on fraud at the card issuer.

By Caitlin Mullen • Dec. 19, 2023 -

SEC won’t budge on crypto regulation

In denying a petition submitted by Coinbase, the agency has concluded rulemaking isn’t needed for issuers and intermediaries to know which – and how – crypto assets fit within securities law.

By Robert Freedman • Dec. 18, 2023 -

Visa seeks majority stake in Mexico payments processor

The card network giant said it plans to purchase a controlling interest in Prosa, with banks retaining a minority stake, subject to regulatory approvals.

By Lynne Marek • Dec. 15, 2023 -

Profile

Simon Khalaf channels energy into scaling Marqeta

Serial entrepreneur and tech executive Simon Khalaf is known for his boundless enthusiasm and energy. Now, the Marqeta CEO is tasked with taking the card issuing fintech to the next level amid increased competition.

By Caitlin Mullen • Dec. 15, 2023 -

Fraud emerges as concern for FedNow users

The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system.

By Lynne Marek • Dec. 15, 2023 -

Senators keep pressure on PayPal, Block

Senate Democrats urged top executives at PayPal and Block, in another round of letters, to improve reimbursement for victims of payment scams.

By Lynne Marek • Dec. 14, 2023 -

Authorized payment scams climb in US

Such scams are expected to jump 50-plus percent to $3 billion by 2027, forcing financial institutions to address the rising threat, according to a new report.

By Tatiana Walk-Morris • Dec. 14, 2023 -

Google-Epic trial outcome undercuts app payment model

The jury verdict in favor of Epic Games challenges the Google Play app store model that forces payments through its system, with fees up to 30% on sales.

By Robert Freedman • Dec. 13, 2023 -

Google Pay taps Affirm, Zip for BNPL

The tech giant has linked with the buy now, pay later companies to develop installment payment options to be offered next year.

By Caitlin Mullen • Dec. 13, 2023 -

FedNow may have spurred RTP adoption

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

By Lynne Marek • Dec. 13, 2023 -

Q&A

ValueAct chops Fiserv stake: analyst

The activist investor has cut its ownership by about two-thirds, a sign that it might be satisfied with the payment company’s progress, Monness, Crespi, Hardt & Co. analyst Gus Galá says.

By Caitlin Mullen • Dec. 12, 2023 -

Mastercard ties growth to digital strategy

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

By Lynne Marek • Dec. 11, 2023 -

Sponsored by U.S. Bank

4 ways to “Break the Cycle” and leave manual reimbursements in the past

Manual travel reimbursements cost companies time and money yet remain common in corporate policies.

Dec. 11, 2023