Risk: Page 14

-

Apple begins sharing BNPL data with Experian

The development may spur rival BNPL providers to follow suit, according to Ed deHaan, a professor at the Stanford Graduate School of Business.

By James Pothen • Feb. 29, 2024 -

Capital One tackles Discover compliance issues

Capital One is betting the resolution of Discover’s compliance issues will take longer and cost more than expected, Capital One CEO Richard Fairbank said.

By Caitlin Mullen • Feb. 28, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Q&A

Capital One-Discover deal may spur payments M&A

The blockbuster deal is set “to trigger a bunch of rethinking across the industry,” said Erin McCune, a partner at consulting firm Bain & Company.

By Caitlin Mullen • Feb. 27, 2024 -

CFPB may take legal action against Block

The bureau has informed the digital payment company it’s weighing legal action related to a Cash App probe.

By Caitlin Mullen • Feb. 23, 2024 -

BNPL popularity rises among ‘financially fragile’ consumers

About 60% of that group has used BNPL five or more times in the past year, compared to just over 20% of financially stable consumers, the New York Fed said.

By Caitlin Mullen • Feb. 15, 2024 -

Amex gears up for bigger bank category

Given its asset growth, the card issuer anticipates facing more stringent regulatory requirements and more frequent stress tests.

By Caitlin Mullen • Feb. 13, 2024 -

More than half of P2P fraud victims lose money: AARP

“When it comes to addressing instances of financial exploitation, consumers are less likely to trust P2P platforms than banks and credit unions,” an AARP survey reported.

By Tatiana Walk-Morris • Feb. 12, 2024 -

Affirm takes cautious approach to six-month outlook

The buy now, pay later company’s forecast for the rest of the fiscal year was conservative, analysts said, even though revenue and merchandise volume jumped over the prior year during the holiday season.

By Caitlin Mullen • Feb. 12, 2024 -

Q&A

Banks should step up scam response: fraud expert

With regulators gearing up to take a stronger stance against digital payments fraud, banks must focus on how they handle scams, says one executive.

By Caitlin Mullen • Feb. 9, 2024 -

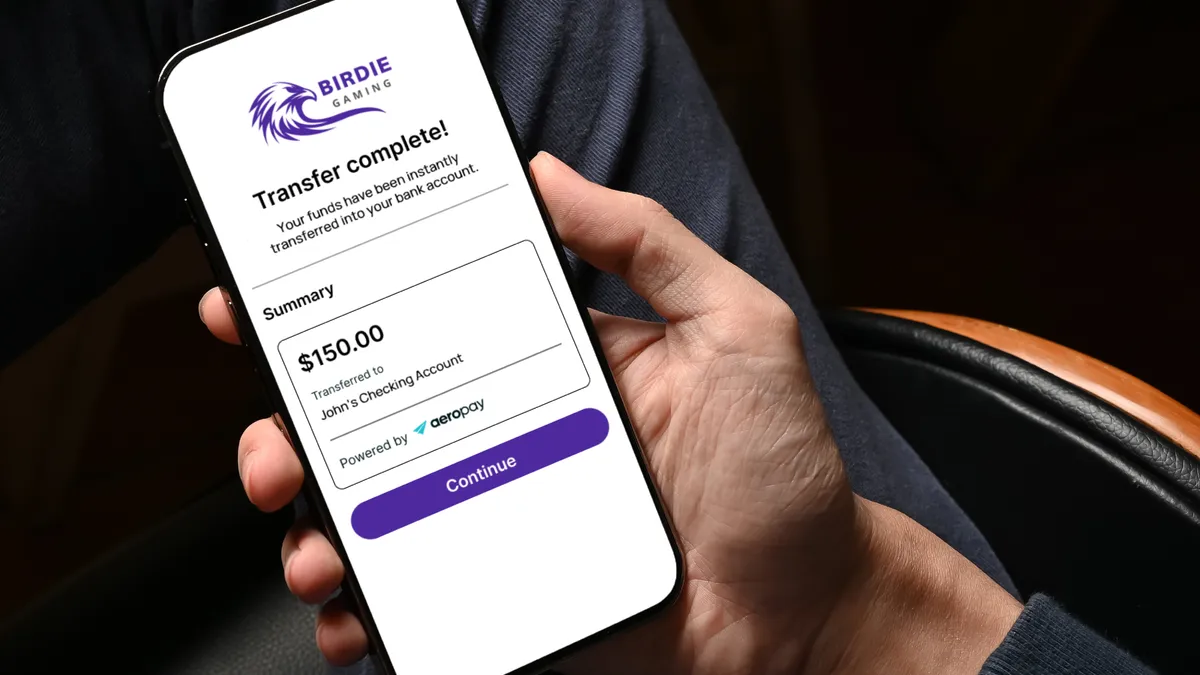

Aeropay partners with Cross River, UBank on sports gaming payouts

Digital payments provider Aeropay has lined up bank partners in an effort to facilitate faster access to winnings.

By Gabrielle Saulsbery • Feb. 8, 2024 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Card debt climbs to record $1.13 trillion

Consumers’ credit card debt rose nearly 5% in the fourth quarter, compared to the third quarter, adding to delinquencies as well.

By Lynne Marek • Feb. 7, 2024 -

Payments companies’ job cuts may not be done

PayPal, Block and Brex all started cutting employees in January in pursuit of efficiency and profits.

By James Pothen • Feb. 2, 2024 -

NY AG sues Citi over denied fraud claims

“If a bank cannot secure its customers’ accounts, they are failing in their most basic duty,” New York Attorney General Letitia James said in a statement Tuesday.

By Dan Ennis • Jan. 31, 2024 -

NY may drive out BNPL firms: attorneys

If the state’s buy now, pay later legislation passes, new requirements piling on additional compliance burdens may lead some providers to pull their operations in New York, attorneys said.

By Caitlin Mullen • Jan. 30, 2024 -

Payments regulation and legislation abound in 2024

Payments players can expect this year to be heavy with regulatory and legislative moves, both at the federal and state levels.

By Lynne Marek • Jan. 30, 2024 -

Rivals may chase Fiserv special bank charter lead

If the payments giant receives a special Georgia charter and gains access to the card networks, it could open the floodgates for other merchant acquirers, attorneys said.

By Caitlin Mullen • Jan. 25, 2024 -

Payments startups face pivotal year

Many venture-dependent startups that put off fundraising will be forced to do so this year or find an exit plan.

By Caitlin Mullen • Jan. 23, 2024 -

Discover lands servicer for student loan portfolio

Student loan servicer Nelnet will handle servicing of Discover’s portfolio while the card issuer markets it for sale, said CFO John Greene.

By Caitlin Mullen • Jan. 18, 2024 -

Amex to sell fraud prevention firm Accertify

The card issuer is selling the business, which offers online fraud monitoring services to merchants, to the tech investment firm Accel-KKR.

By Caitlin Mullen • Jan. 16, 2024 -

Fiserv seeks special purpose bank charter

The designation would allow the payment processor to own transactions from end-to-end, removing the need for a bank partner.

By Caitlin Mullen • Jan. 12, 2024 -

Stablecoin issuer Circle files for IPO

Circle, which issues the USDC stablecoin, has filed confidential paperwork with the Securities and Exchange Commission — one day after the SEC's approval of 11 spot bitcoin exchange-traded funds.

By Gabrielle Saulsbery • Jan. 12, 2024 -

6 payments trends to watch in 2024

Swipe fee battles, real-time payments, fraud prevention and acquisition plans will be among the hot topics pulsing through the industry this year.

By Lynne Marek , Caitlin Mullen , James Pothen • Jan. 9, 2024 -

Q&A

Regulator’s BNPL guidance may go beyond banks

The Office of the Comptroller of the Currency directed its advice at national banks, but a Venable attorney expects others to use it to inform their approaches.

By Caitlin Mullen • Jan. 9, 2024 -

Q&A

Tyler Technologies eyes growth in digital disbursements

The company, which provides payment and software services to the public sector, is seeing increased client interest in digital disbursements such as prepaid debit cards, said Sloane Wright, Tyler’s senior VP of payments.

By Caitlin Mullen • Jan. 8, 2024 -

Bank groups voice concerns with CFPB’s open banking proposal

The Bank Policy Institute and The Clearing House want the Consumer Financial Protection Bureau to take a tougher stance on screen scraping, and allow banks to charge fees to cover the cost of enabling data sharing.

By Anna Hrushka • Jan. 5, 2024