Retail: Page 72

-

7-Eleven unveils mobile wallet to enable contactless payments

The retailer aims to bring cash users into the digital wallet space and make its rewards program more accessible.

By Tatiana Walk-Morris • Dec. 8, 2020 -

Capital One halts buy-now-pay-later credit card transactions

The move stands in contrast to fellow credit-card issuers Citi and JPMorgan Chase, which last year launched fixed-payoff options. PayPal and Ally Financial this year announced they were rolling out installment loans.

By Dan Ennis • Dec. 7, 2020 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Teen-aimed banking app Step gets celebrity boost

The platform said it raised $50 million in a Series B funding round that included investment from singer Justin Timberlake, music group The Chainsmokers and retired athlete Eli Manning.

By Anna Hrushka • Dec. 3, 2020 -

How COVID-19 could disrupt store credit cards

Despite a pandemic-induced recession and uncertainty over another federal stimulus bill, store cards remain a channel for customer engagement.

By Tatiana Walk-Morris • Dec. 2, 2020 -

Deep Dive

Is cashierless tech ready for prime time?

The pandemic has juiced demand for automated checkout systems, and retailers are having positive experiences with them, but the technology still has to prove itself over the long term.

By Sam Silverstein • Nov. 30, 2020 -

Google revamps Google Pay, adds 3 new partner banks

With a redesigned app and an expanded network of banks that have signed on to offer co-branded accounts, the tech giant continues its push into the consumer financial services space.

By Anna Hrushka • Nov. 19, 2020 -

GameStop, Klarna team up on installment payments

The partnership is part of the gaming retailer's ongoing efforts to modernize its digital operations.

By Tatiana Walk-Morris • Nov. 3, 2020 -

PayPal launches crypto payment platform

The payments company will convert consumers' Bitcoin, Ethereum, Bitcoin Cash and Litecoin holdings into fiat currencies when they check out. That cuts the risk merchants assume from any volatility in cryptos' value.

By Dan Ennis • Updated March 30, 2021 -

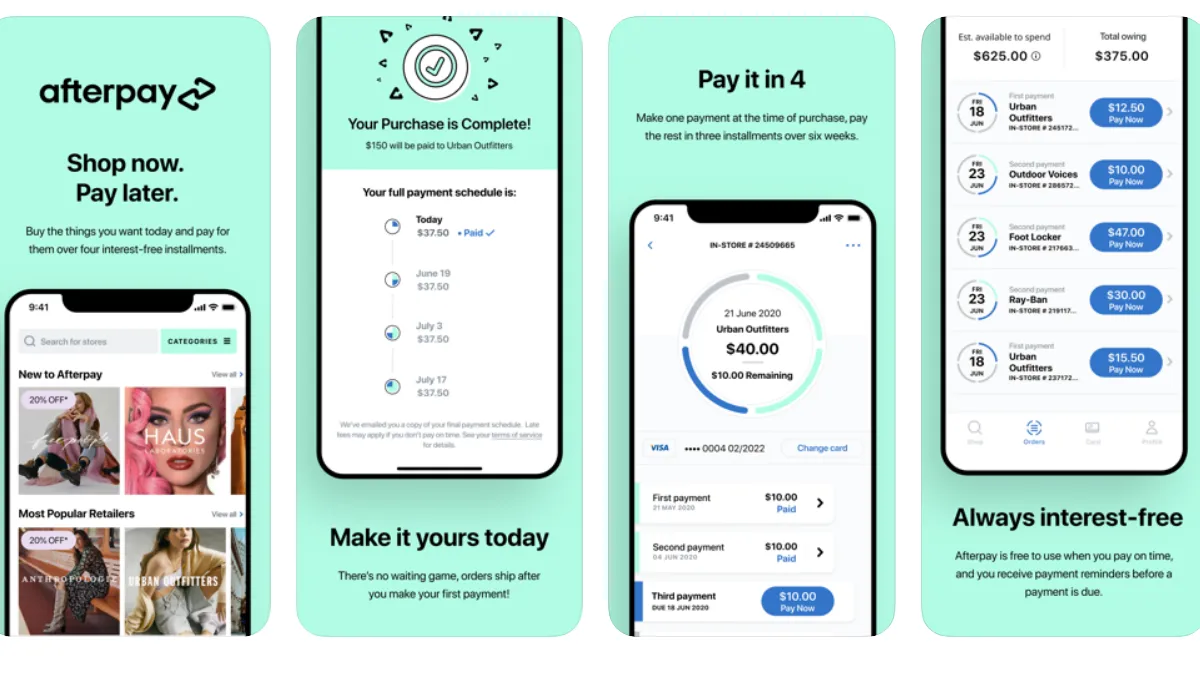

Afterpay partners with retailers for in-store payments

Shoppers nationwide can use a virtual, contactless card stored in their digital wallet to pay for in-store purchases in installments.

By Tatiana Walk-Morris • Oct. 19, 2020 -

Bank of America enters the small-dollar loan fray

Balance Assist, which will launch in January, will offer loans of up to $500 — to be repaid in three installments over 90 days — for a flat $5 fee to customers who have held Bank of America checking accounts for a year or more.

By Dan Ennis • Oct. 9, 2020 -

Venmo launches its first credit card

After teasing it last October, the payment platform this week unveiled the card, which is integrated with the existing Venmo app.

By Tatiana Walk-Morris • Oct. 6, 2020 -

PayPal introduces 'Pay in 4' installment payment service

The payments behemoth joins a growing list of pay-over-time competitors.

By Tatiana Walk-Morris • Sept. 3, 2020 -

PayPal expands its point-of-sale arsenal

The payments company is looking to wrest part of a burgeoning buy-now-pay-later market from the likes of Afterpay, Affirm and Klarna with a six-week installment plan for purchases between $30 and $600.

By Dan Ennis • Sept. 1, 2020 -

Ally partners with Mastercard's Vyze to enter retail point-of-sale lending

The bank will offer installment loans on retail purchases between $500 and $40,000 with interest rates ranging from 9.99% to 26.99%. Monthly fixed-rate installment loans will range from six to 60 months, the company said.

By Dan Ennis • Aug. 26, 2020 -

Retrieved from Facebook on June 02, 2020

Retrieved from Facebook on June 02, 2020

Facebook unveils payments umbrella

Facebook Financial, the social network's latest effort to lend brand consistency among its payment and commerce plans, will be overseen by Libra co-creator David Marcus.

By Dan Ennis • Aug. 11, 2020 -

CVS to offer Venmo, PayPal QR codes in stores

Other platforms, like WhatsApp and Amazon, have introduced QR codes for merchants, too.

By Tatiana Walk-Morris • Aug. 3, 2020 -

Will COVID-19 push contactless payments into the mainstream?

Multiple barriers have curtailed retailers' contactless payment integration. But a pandemic may be the catalyst to widespread adoption.

By Tatiana Walk-Morris • June 9, 2020 -

Samsung to launch US debit card this summer with SoFi

The South Korean company joins competitors Apple and Google, as more tech giants announce plans to offer banklike products.

By Anna Hrushka • May 11, 2020 -

More than half of US consumers paying contactless, Mastercard finds

Banks such as HSBC, JPMorgan Chase and Bank of America have ramped up their efforts to push consumers toward tap-and-go technology. The coronavirus may prove the catalyst for behavioral shift.

By Dan Ennis • April 30, 2020 -

Consumers aren't adopting mobile wallets, even during the pandemic

A PYMNTS.com study conducted in March found that mobile wallets accounted for a small portion of eligible transactions, despite the coronavirus outbreak.

By Tatiana Walk-Morris • April 7, 2020 -

Banks mostly fear payments and money transfer fintechs, survey finds

Less of a concern among banks is competition from online investment and crowdfunding upstarts.

By Robert Freedman • March 3, 2020 -

Abercrombie & Fitch, Hollister launch Instagram Checkout

The in-app checkout feature adds to the retailer's growing slate of diverse payment methods.

By Lisa Rowan • Oct. 10, 2019 -

J.C. Penney pulls the plug on contactless payments

The move comes as other major retailers roll out Apple Pay to consumers and Amazon Pay positions itself as a potential competitor.

By Tatiana Walk-Morris • April 24, 2019 -

Sephora launches store-branded credit card program

Cardholders will receive rewards in addition to those they already get from the retailer's popular Beauty Insider program.

By Cara Salpini • March 15, 2019 -

Deep Dive

Pay it down: How millennials' relationships with credit cards will change retail

The 2008 recession is just one reason the demographic rejects plastic payments. Brands are now being pushed to fill the void with convenient, frictionless solutions.

By Kaarin Moore • Feb. 21, 2019