Retail: Page 67

-

American Express outpaces rivals in digital satisfaction: J.D. Power study

Credit card apps experienced a rise in customer satisfaction as financial institutions innovated during the pandemic, according to the research.

By Anna Hrushka • June 14, 2021 -

Gig economy workers gravitating toward faster pay

The use of digital and mobile payments accelerated during the pandemic and gig economy workers expect to leverage them for better payments options, studies find.

By Vaidik Trivedi • June 14, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Discover reaps Marqeta IPO windfall

With its Marqeta stake now worth about $800 million, Discover Financial said it will "accelerate" increased spending on marketing in the highly competitive card market.

By Lynne Marek • June 14, 2021 -

Toast buys xtraChef for back-office payments and operations management

The acquisition will allow the point of sale (POS) company to offer insights into profitability by menu item, automation and intelligence tools to streamline tasks like accounts payable, managing inventory and tracking margins.

By Julie Littman • June 11, 2021 -

Klarna raises $639M, eyes international expansion

Klarna, now with a $45 billion market valuation, aims to expand its global market share and in-store buy now-pay later options.

By Vaidik Trivedi • June 11, 2021 -

Airbase raises $60M, aims for larger clients

Airbase plans to use the new capital to upgrade its products in a crowded expense management space.

By Vaidik Trivedi • June 9, 2021 -

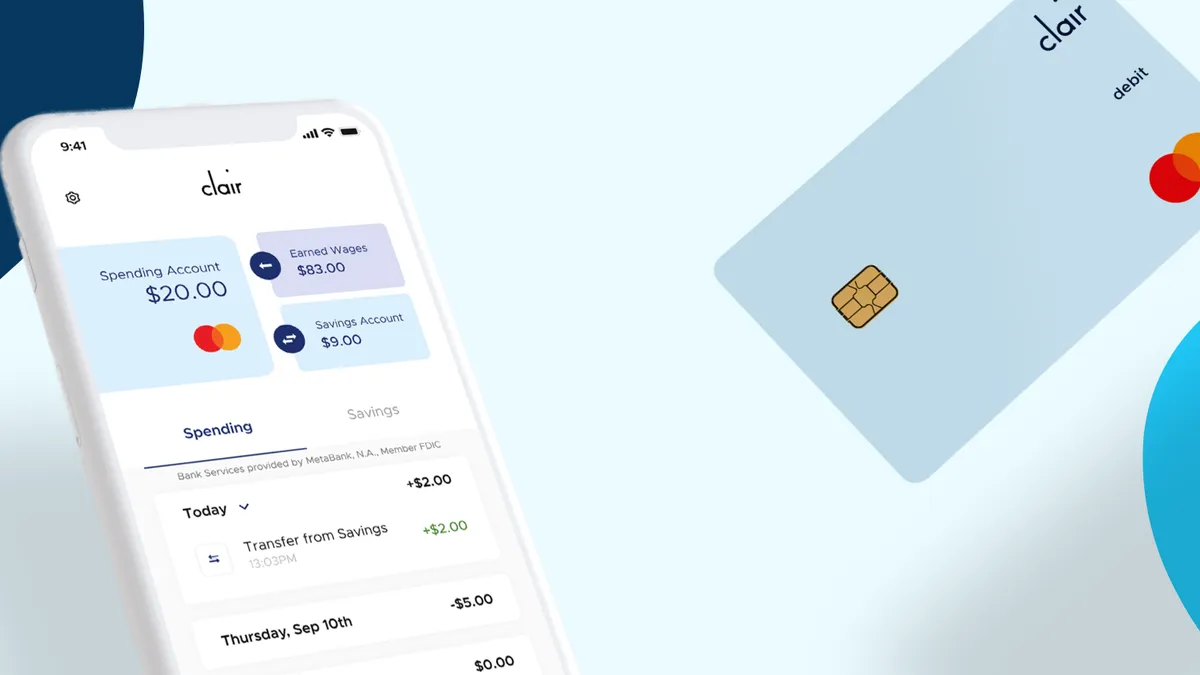

Retrieved from Clair on June 10, 2021

Retrieved from Clair on June 10, 2021

Clair attracts $15M for its on-demand pay play

Clair is bolstering its resources as competition intensifies in offering employers and employees on-demand pay options.

By Lynne Marek • June 9, 2021 -

Amazon card portfolio up for grabs with bids from AmEx, Synchrony

JPMorgan Chase, the nation's largest bank, may reportedly be ready to part with the Amazon portfolio it has worked with since 2002.

By Dan Ennis • June 9, 2021 -

Gemini acquires Shard X, seeking to bolster crypto transactions and custodian security

Cryptocurrency exchange and custodian platforms like Gemini are ramping up security measures as the digital asset class is gaining popularity among users and fraudsters alike.

By Vaidik Trivedi • June 8, 2021 -

Walmart makes cash payment options more efficient

The retailer in August will start offering a faster cash payment option at 4,000 locations to customers paying monthly bills, through its partnership with financial tech partners PayNearMe and Green Dot.

By Lynne Marek • June 8, 2021 -

'Super-apps' are the next evolutionary step for financial services

As transactions are increasingly digitized, financial service providers are vying to create "super-apps" that connect consumers to a bevy of financial services.

By Vaidik Trivedi • June 7, 2021 -

Consumer spending changes likely to stick, Visa says

For better or worse, some of the pandemic-triggered behavioral changes, like more online purchasing and digital payments, are likely to outlast COVID, a top executive for the company said.

By Lynne Marek • June 3, 2021 -

DLocal raises $75M in IPO, spearheads emerging markets

DLocal aims to expand in emerging markets because "strong cross-border business partnerships between global merchants and service providers are important and will continue to gain importance," DLocal COO Sumita Pandit told Payments Dive.

By Vaidik Trivedi • June 3, 2021 -

Certegy aims to counter rivals with white label offering

Certegy is taking aim at competing buy now-pay later market players with its new product, as customer adoption of that BNPL financing option grows.

By Vaidik Trivedi • June 2, 2021 -

Visa's results show rising consumer demand

The card giant's May performance released Tuesday underscores the economic recovery that economists have been predicting.

By Lynne Marek • June 2, 2021 -

SpotOn raises $125M to keep up battle against Toast, Square

"We're always looking for companies to partner with or acquire," said SpotOn Co-CEO Zach Hyman. "It's always a question of build versus buy."

By Lynne Marek • June 1, 2021 -

Sponsored by Splitit

How BNPL can help reduce cart abandonment

The largest barrier to cart abandonment is the simplest: shoppers are worried about being able to afford the purchase.

June 1, 2021 -

Sift acquires Chargeback to crack down on rising payments fraud

Sift is beefing up its ability to fight rising e-commerce fraud through its acquisition of software-as-a-service company Chargeback.

By Vaidik Trivedi • May 31, 2021 -

PayPal invests $50M more in Black, Latinx funds

PayPal is placing the money with 11 Black and Latinx-led venture capital funds to "expand wealth creation opportunities," doubling up on an initial investment last year.

By Vaidik Trivedi • Updated June 3, 2021 -

Paymentus raises $210M in IPO, eyes international expansion

The company aims to acquire other companies as it pursues expansion in the European, Asia-Pacific and LatAm markets.

By Vaidik Trivedi • May 26, 2021 -

Fiserv, PayMyTuition partner to ease Chinese student tuition payments

The partnership will provide services for Chinese student tuition payments to educational institutions in Australia and Singapore and expand to other parts of the world.

By Vaidik Trivedi • May 26, 2021 -

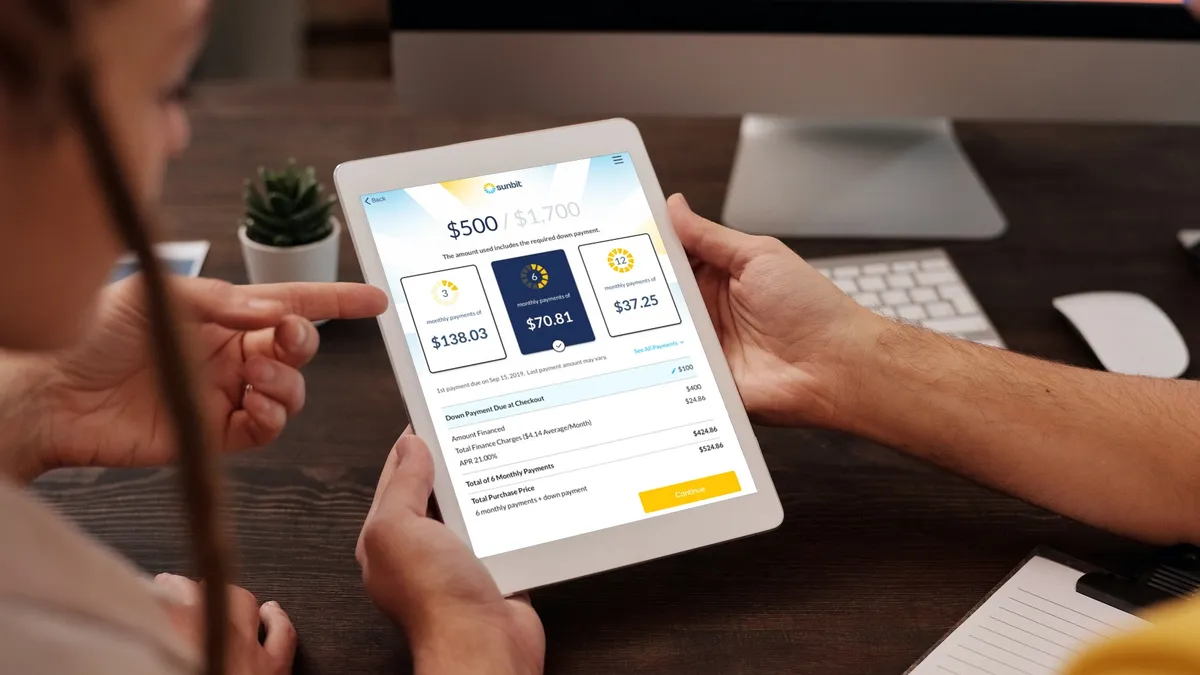

Sunbit raises $130M, doubles down on BNPL for auto-repairs, elective healthcare

Sunbit is offering buy now-pay later financing services in those categories partly because of their "stickiness" in customer relationships, Sunbit CEO Arad Levertov told Payments Dive.

By Vaidik Trivedi • May 25, 2021 -

Square may soon offer small-business checking and savings accounts, app code shows

The code indicates the company will not charge monthly service fees, minimum balance fees or overdrafts on its checking account, and will offer a 0.5% interest rate on its savings account through 2021, Bloomberg reported.

By Dan Ennis • May 25, 2021 -

ReCharge eyes European expansion, raises $227M in capital

The company, founded in 2014, provides e-commerce businesses the opportunity to add subscription-based payment options for recurring payments.

By Vaidik Trivedi • May 24, 2021 -

Payments giant FIS makes another crypto move, expanding in Europe

"We’ll be well-positioned to handle (cryptocurrencies) across the whole ecosystem in the marketplace," FIS President Bruce Lowthers said at a recent industry conference.

By Lynne Marek • May 24, 2021