Retail: Page 44

-

Discover to implement gun code in April: report

The newly published code will be part of Discover’s policy and product update for merchants and payment partners in April, a spokesperson told Reuters.

By Caitlin Mullen • Feb. 21, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB warns card issuers on credit reports

The Consumer Financial Protection Bureau has threatened action over card issuers not reporting full consumer payment data for tracking credit histories.

By Lynne Marek • Feb. 21, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

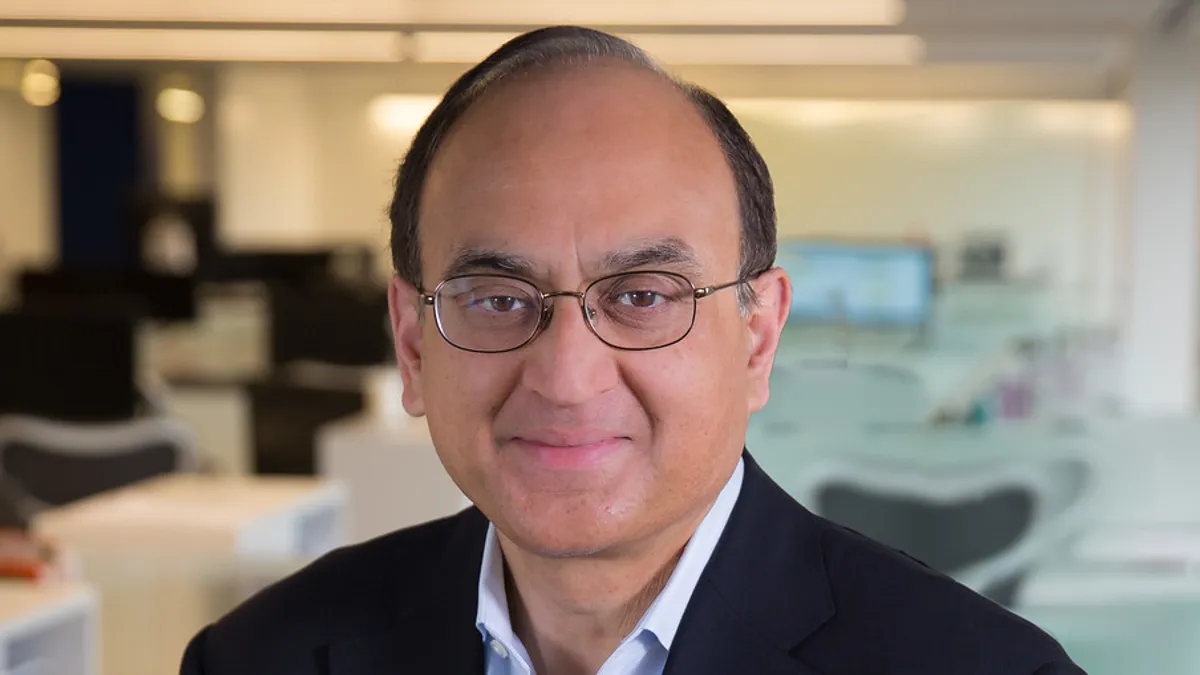

Visa CFO to exit

Vasant Prabhu, the company’s chief financial officer since 2015, will leave Visa in September, the company said Thursday.

By Caitlin Mullen • Feb. 16, 2023 -

Paymentus hands interim CFO severance benefits

The company called the severance benefits’ approval a formality. But one expert said it is likely a retention strategy designed to encourage the interim CFO to “stick around.”

By Maura Webber Sadovi • Feb. 16, 2023 -

Retailers oppose banks seeking more time on debit routing rule

Banks requested a delay in implementing a debit routing rule, but a retail and merchant trade group argued it’s high time the card issuers comply.

By Lynne Marek • Feb. 15, 2023 -

Credit metrics creep toward prepandemic levels

Delinquency rates for Discover, Synchrony and Bread all rose in January relative to December levels.

By Caitlin Mullen • Feb. 15, 2023 -

Coen stores add Grabango checkout technology

As the frictionless locations go into service, Grabango’s CEO Will Glaser sees the technology gaining traction in coming years.

By Jessica Loder • Feb. 15, 2023 -

Back to the future with Worldpay

FIS CEO Stephanie Ferris and her Worldpay sidekick Charles Drucker, reclaiming a role at the business, will be under pressure to avoid “dis-synergies.”

By Lynne Marek • Feb. 14, 2023 -

P97, Visa partner on payment security

The agreement aims to reduce friction for connected-car payments and enhance mobile payment acceptance at 60,000 convenience stores.

By Jessica Loder • Feb. 13, 2023 -

Gun merchant code to be published this month

Once it’s published, use of the new code “is eventually left up to the users in the industry,” an ISO spokesperson said.

By Caitlin Mullen • Feb. 13, 2023 -

FIS plans to spin off merchant unit

The payments processor plans to spin off its merchant business, which will reclaim its Worldpay name, and appointed its former CEO, Charles Drucker, to lead the unit.

By Lynne Marek • Feb. 13, 2023 -

EBay lays off 500 workers

The retailer and one-time parent of PayPal cited economic uncertainty in cutting jobs to invest in new technologies and innovation.

By Tatiana Walk-Morris • Feb. 10, 2023 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments sells gaming unit for $415M

Like the company’s $1 billion sale of its Netspend consumer unit, the divestiture reflects efforts to refine its portfolio, said Global Payments CEO Jeff Sloan.

By Caitlin Mullen • Feb. 10, 2023 -

Fiserv’s new HQ approved for state tax credits

The company is set to receive up to $7 million from the Wisconsin Economic Development Corporation for its new Milwaukee headquarters.

By Caitlin Mullen • Feb. 10, 2023 -

PayPal CEO will retire at the end of 2023

Dan Schulman said he plans to exit then, but will be flexible in the timing. He called 2023 a potentially “transformational year” for the digital payments company.

By Lynne Marek • Feb. 9, 2023 -

Euronet lands HSBC as Dandelion client

Euronet attracted the United Kingdom bank HSBC as one of the first financial institution clients for its Dandelion cross-border payments service.

By Lynne Marek • Feb. 9, 2023 -

Ingenico aims to make acquirers more competitive

Ingenico is adding an in-store payments software service, and hinted that a large U.S.-based merchant acquirer will start using it soon.

By Caitlin Mullen • Feb. 9, 2023 -

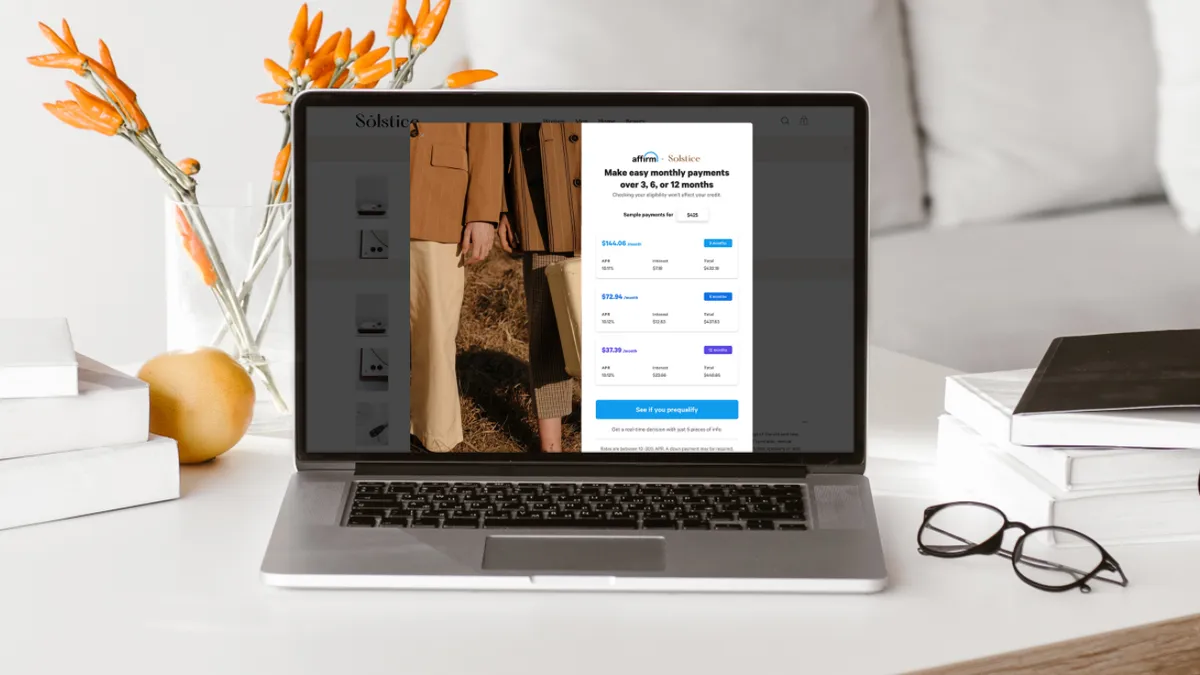

Affirm cuts 500 employees

The buy now, pay later provider is eliminating jobs after its loss for the fourth quarter of last year ballooned over the same period in 2021.

By Lynne Marek • Feb. 9, 2023 -

New Visa CEO snags 27% salary increase

The new top executive, Ryan McInerney, and other executives at the card network company also received multi-million-dollar stock awards.

By Lynne Marek • Feb. 8, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry touts FedNow launch

In July, the company expects to become the first payments processor to launch the Federal Reserve’s new real-time service.

By Caitlin Mullen • Feb. 8, 2023 -

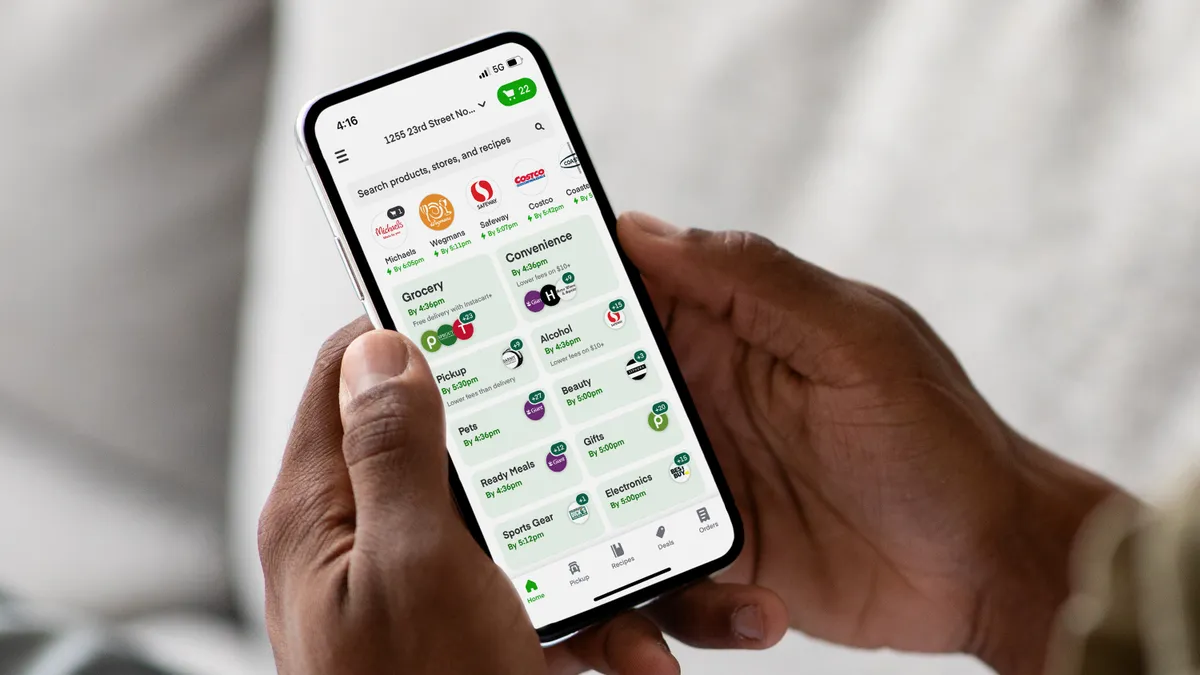

Instacart debuts Scan & Pay with NYC grocer

This marks the retail debut of the Instacart technology, which is part of the company’s suite of in-store solutions for retailers.

By Catherine Douglas Moran • Feb. 7, 2023 -

Google, Amex roll out anti-fraud tool

Amex is the latest card company to tap a Google virtual card service aimed at increasing the security of online payments.

By Lynne Marek • Feb. 7, 2023 -

Klarna jumps back to Y2K with Paris Hilton

An ad campaign developed with the fashion icon turned marketing pro reinvents her “That’s hot” catchphrase for the BNPL provider.

By Peter Adams • Feb. 7, 2023 -

Fiserv discloses acquisitions

Even as the payments and fintech giant cut employees and sold off business units, the company spent $1 billion on acquisitions last year.

By Caitlin Mullen • Feb. 7, 2023 -

Opinion

Eliminating costly false declines online

“False declines are especially problematic in an environment where demanding customers with high expectations are not afraid to take their business elsewhere,” writes an Experian executive.

By Chris Ryan • Feb. 6, 2023