Retail: Page 42

-

ConnexPay takes aim at bigger rivals

The payments gateway startup, which handles acquiring and issuing, is positioning itself as a nimbler competitor to the likes of Stripe and Wex.

By Caitlin Mullen • April 4, 2023 -

Deep Dive

EWS readies Paze to help banks take on digital wallet market

Even with the backing of the nation’s largest banks, the platform, set for a June launch, will have adoption and security hurdles to overcome to grab a slice of the digital wallet market, industry experts say.

By Anna Hrushka • April 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Q&A

Index Ventures partner talks fintech fundraising

An investor at a VC firm that’s backed payments players Adyen, Plaid and Wise says it’s the right environment “to craft interesting deals.”

By Caitlin Mullen • March 31, 2023 -

Synchrony mulls creating a digital wallet

The private label card company behind many retailers’ credit options may develop its own digital wallet, but for now it’s deferring to others’ wallets.

By Lynne Marek • March 29, 2023 -

Apple rolls out initial BNPL service

The tech giant delivered an initial version of its long-awaited buy now, pay later service for select U.S. users, with plans for a broader launch later this year.

By Lynne Marek • March 29, 2023 -

Senators urge BNPL crackdown

Three Democratic U.S. senators pressed the Consumer Financial Protection Bureau to bring big buy now, pay later providers under federal oversight.

By Caitlin Mullen • March 28, 2023 -

DoorDash to offer SNAP online purchasing for grocery orders

Offering the payment option will reduce accessibility barriers to getting groceries, as well as boost convenience for SNAP users, DoorDash said.

By Catherine Douglas Moran • March 28, 2023 -

Credit card spending topped $13T last year: FIS report

Global credit card transaction value rose both online and in stores last year, despite an earlier FIS projection of a decline.

By Tatiana Walk-Morris • March 28, 2023 -

BNPL remains mainly absent from consumer credit histories

The lack of BNPL data being furnished to credit bureaus more than a year after inclusion efforts were announced points to the complexity involved with fitting the burgeoning payment method into the traditional credit scoring framework.

By Caitlin Mullen • March 27, 2023 -

Tandym adds retailers for rewards programs

The private label digital credit card company is stacking up online retail customers, with plans to add debit options and in-store clients this year.

By Lynne Marek • March 27, 2023 -

CFPB seeks to improve credit card transparency

The agency wants to give consumers more information from credit card issuers so that it’s easier to compare the cards’ offers, especially their interest rates.

By Tatiana Walk-Morris • March 24, 2023 -

Buy now, pay later explodes in grocery

The percentage of online transactions involving groceries where shoppers opted to delay payment grew 40% during the first two months of 2023, according to Adobe data.

By Sam Silverstein • March 23, 2023 -

Panera tests Amazon One palm payments at 2 cafes

Panera plans to expand the palm payments technology to as many as 20 cafes in the second stage of the test, depending on the outcome of the initial test.

By Aneurin Canham-Clyne • March 22, 2023 -

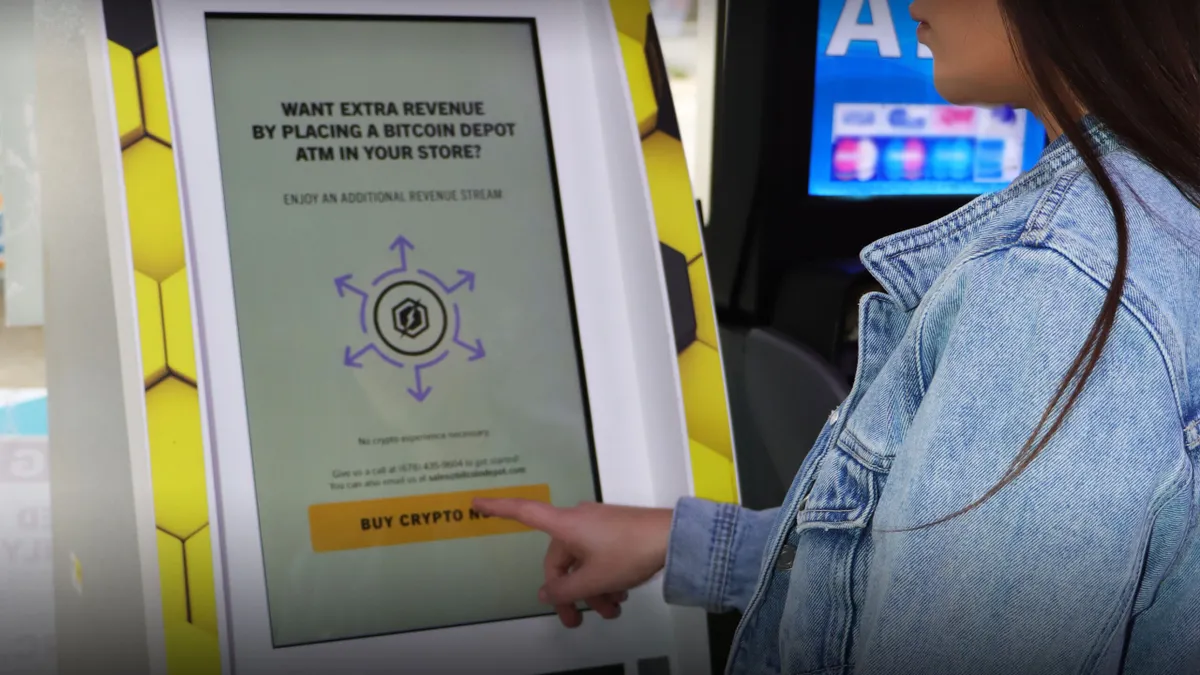

Convenience chain to install bitcoin ATMs

GetGo joins a growing list of convenience store operators adding bitcoin ATMs, as retailers seek new ways to bring customers inside their stores.

By Brett Dworski • March 22, 2023 -

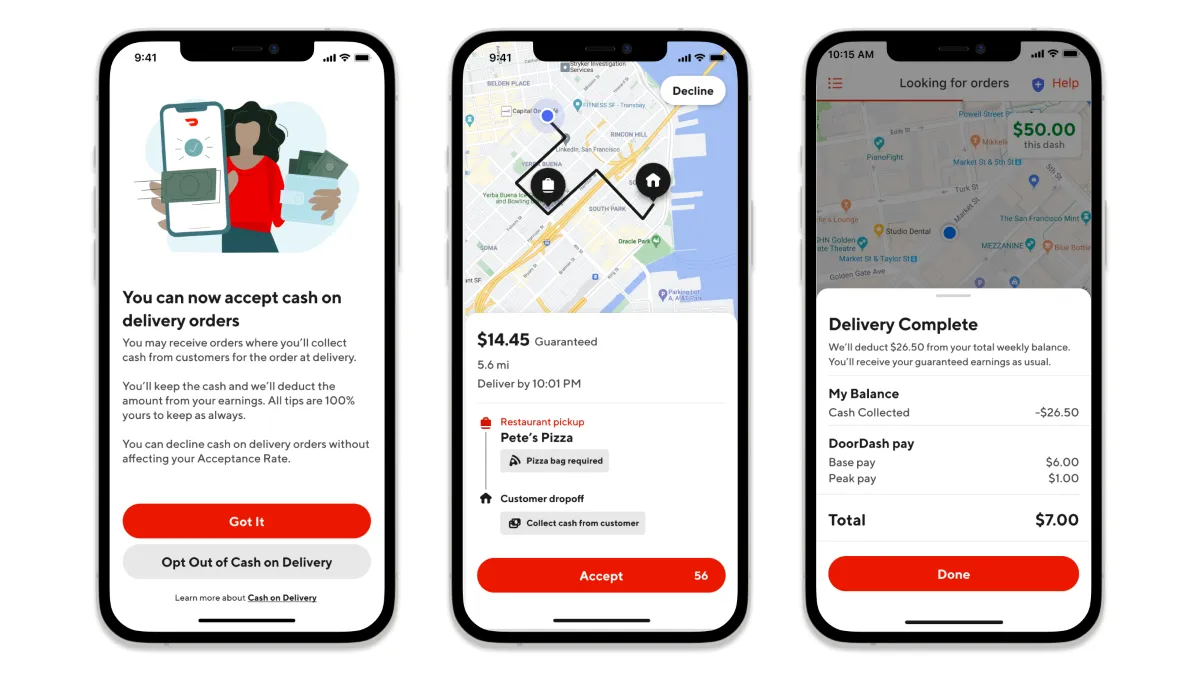

DoorDash adds cash payment option

The company’s white label delivery service can now accept cash payments, which drivers would collect as part of their pay.

By Julie Littman • March 21, 2023 -

Mastercard buys Baffin Bay Networks

The card network company said it bought the cybersecurity business to better combat cyber-attacks in an increasingly threatening environment.

By Lynne Marek • March 20, 2023 -

Western Union CEO gives rivals respect

The legacy money transfer company has lost the advantage of scale over younger fintechs like Remitly and Wise, but it’s discounting digital services to claw back customers.

By Lynne Marek • March 20, 2023 -

BNPL firms snag consumers at checkout: J.D. Power

As buy now, pay later use rises, consumers are learning about the payment option at checkout, more so than from social media or family and friends.

By Tatiana Walk-Morris • March 17, 2023 -

Democrats slam card CEOs on gun code

A group of attorneys general took card company CEOs to task for pulling an about-face on implementing the gun merchant category code.

By Caitlin Mullen • March 16, 2023 -

Payments execs detail SVB impact

The Silicon Valley Bank downfall that sent shockwaves through the financial industry forced fintechs, such as Affirm and Marqeta, to react fast.

By Caitlin Mullen , Lynne Marek • March 16, 2023 -

Retrieved from Meijer.

Retrieved from Meijer.

Meijer, Flashfood expand tie-up to include SNAP payments

The Midwestern grocer is the first of the food waste solution company’s partners to make the payment method accessible on the company’s app.

By Peyton Bigora • March 16, 2023 -

Visa, Mastercard depict bank failure impact

As bank card issuers faltered this past weekend, the card networks monitored payments closely, Visa and Mastercard executives said at a conference.

By Lynne Marek • March 15, 2023 -

Fiserv, Jack Henry CEOs react to bank crisis

Payments processors’ CEOs this week described how their companies were affected by the recent bank industry turmoil, downplaying the impact.

By Caitlin Mullen , Lynne Marek • March 15, 2023 -

Amex bets on millennials, Gen Z for growth

As it pursues younger consumers, the company is angling to ensure its high-fee cards offer enough value for millennials and Gen Zers.

By Caitlin Mullen • March 14, 2023 -

Tilia C-suite gets overhaul

The payments startup has a new team of top executives to spearhead payments for gaming, social media and other next-generation marketplaces.

By Lynne Marek • March 14, 2023