Regulations & Policy: Page 50

-

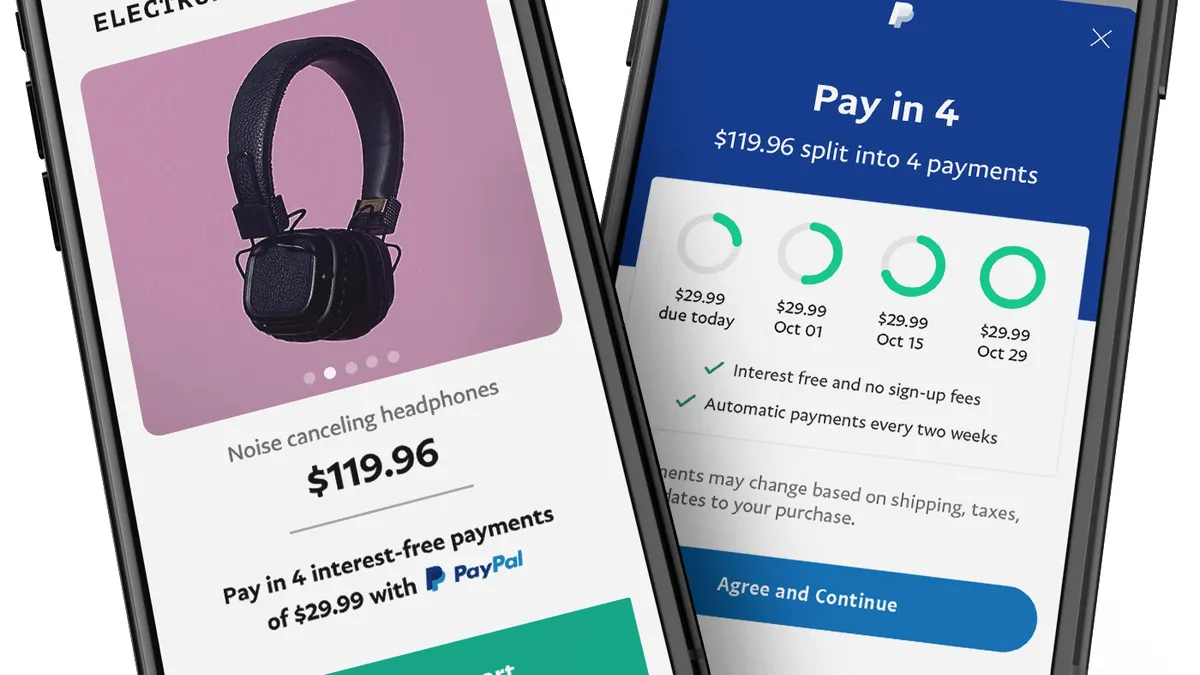

PayPal drops BNPL late fees worldwide

The payments giant will soon get rid of the late fees on buy now-pay later transactions in the U.S., the United Kingdom and France, catching those regions up with other parts of the world where it didn't have them.

By Lynne Marek • Aug. 18, 2021 -

Fed weighs debit transaction rule clarification

Big bank, merchant groups weigh in on Fed rule clarification

Bank and merchant trade groups weighed in on the Fed's debit rule clarification at the 11th hour, digging in their heels in a long-time battle over whether to ease merchant access to increased debit transaction networks.

By Lynne Marek • Aug. 12, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Binance.US CEO resigns

Former regulator Brian Brooks is leaving the crypto exchange as the company faces scrutiny from the CFTC, Justice Department and IRS.

By Robin Bradley • Aug. 10, 2021 -

Fed weighs debit transaction rule clarification

Debit rule battle dumps 500-plus comments on Fed

The Federal Reserve asked for public comment on a proposal to clarify rules regarding the processing of debit card transactions and it's getting an earful.

By Lynne Marek • Aug. 9, 2021 -

Retrieved from Senate Banking Committee.

Retrieved from Senate Banking Committee.

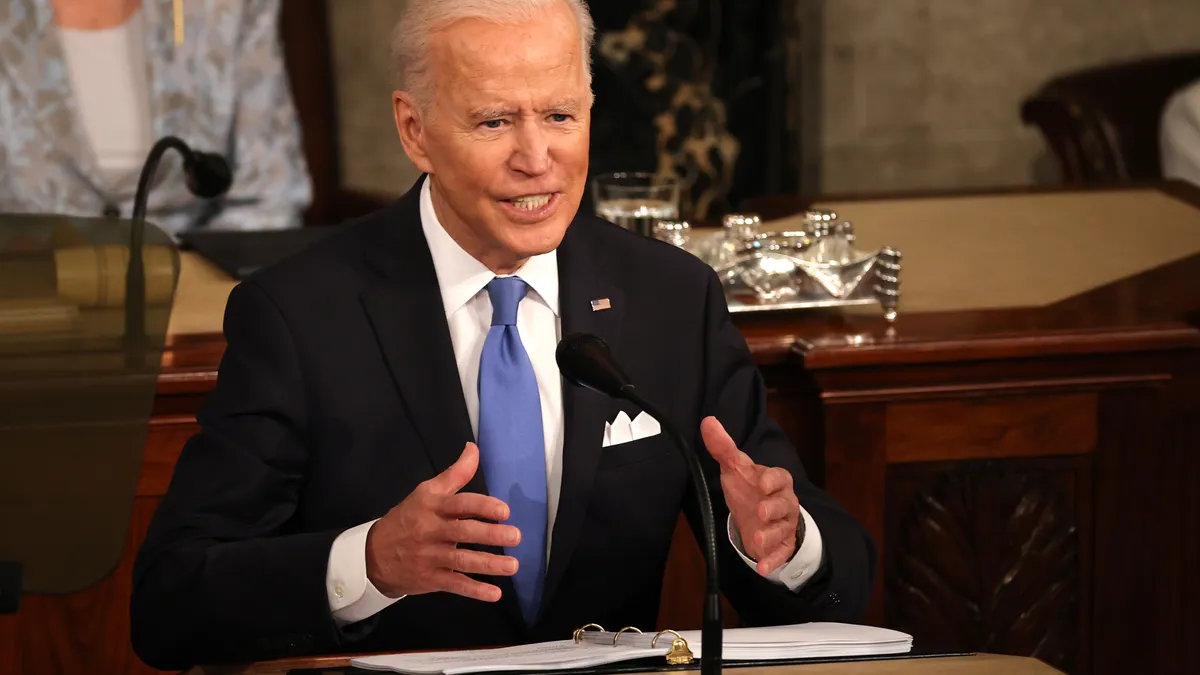

OCC conducting review of overdraft policies, acting comptroller says

Acting Comptroller Michael Hsu's remarks come as more banks are revamping their overdraft policies and as Democrats are calling for legislation that would rein in the practice.

By Anna Hrushka • Aug. 5, 2021 -

Mastercard CEO pushes back against regulatory zeal

Mastercard CEO Michael Miebach tucked a warning for Washington into a recent discussion with analysts.

By Lynne Marek • Aug. 5, 2021 -

Clearing House urges caution on CBDCs

A Federal Reserve-backed digital currency could "destabilize both the domestic and foreign banking and financial services sectors," the payments system operator said.

By Lynne Marek • July 30, 2021 -

Payments M&A is hot, but deals could face antitrust scrutiny

The fintech industry faces “a wave of consolidation” for the remainder of 2021 and 2022, according to an industry report.

By Vaidik Trivedi • July 26, 2021 -

Card companies go green, but hurdles remain

Card issuers, networks and manufacturers are working to shrink their carbon footprint as consumers become more environmentally conscious and global carbon emissions climb.

By Vaidik Trivedi • July 22, 2021 -

Opinion

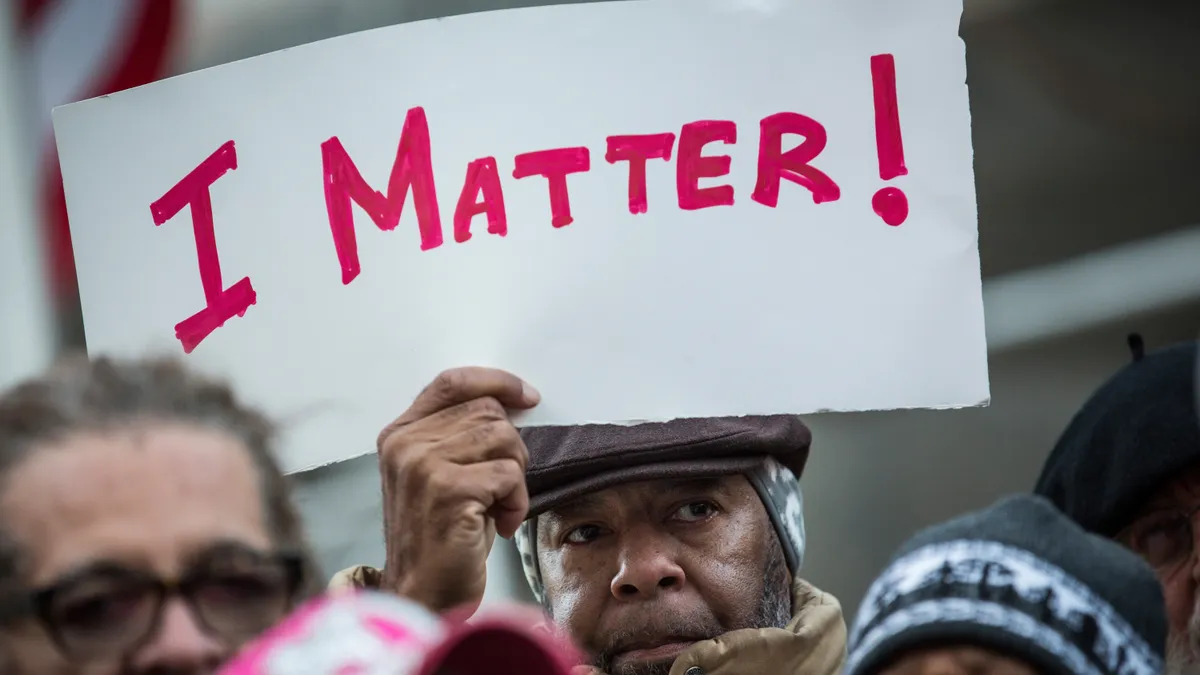

Creating financial inclusion in banking and payments

"A bank account opens up a consumer’s access to not only their own money and a lack of fees, but it is essential to creating long-term financial health," argues one Washington advocate attuned to unbanked issues.

By Devina Khanna • July 21, 2021 -

Why cybersecurity keeps payments executives up at night

Payments are a critical part of the nation's infrastructure, so executives in the industry are under pressure to understand the evolving threat landscape.

By Mercedes Cardona • July 19, 2021 -

Powell clarifies timeline on Fed CBDC paper

In two congressional hearings this week, lawmakers grilled the central bank chair on digital dollar development and pressed for his second term — or a change in leadership.

By Dan Ennis • July 16, 2021 -

Fed seeks to dismiss or move retailers' North Dakota lawsuit

Retail associations' case against the Fed's setting of debit fee caps is resurfacing familiar arguments from a prior battle over the issue.

By Lynne Marek • July 16, 2021 -

It's CardX versus AmEx at state capitols nationwide

The startup CardX is fighting American Express from coast to coast as states reassess whether merchants should be able to slap surcharges on credit card purchases.

By Lynne Marek • July 15, 2021 -

CBDCs could give 'clean slate' for cross-border payments, BIS report says

Global coordination for central bank digital currency "designs could lead to more efficient cross-currency and cross-border payments,” the Bank for International Settlements report this week said.

By Vaidik Trivedi • July 13, 2021 -

Trade group seeks Biden antitrust focus on payments

The Merchants Payments Coalition kept up its crusade to draw federal attention to what it calls "anti-competitive" swipe fees.

By Lynne Marek • July 13, 2021 -

Colorado scraps ban on credit card surcharges

Colorado is the latest state to allow surcharges on credit card transactions, leaving only two with bans amid a nationwide move away from them.

By Lynne Marek • July 9, 2021 -

Fed weighs debit transaction rule clarification

Clash over debit card routing persists in comments to Fed

A battle running for decades regarding the fees that card processors can charge on debit transactions is showing up again in comments regarding a Federal Reserve proposal to clarify rules on the issue.

By Lynne Marek • July 8, 2021 -

Retrieved from ATPC on July 07, 2021

Retrieved from ATPC on July 07, 2021

Payments industry trade group taps new chair

The American Transaction Processors Coalition picked a new board leader as it maps out new initiatives, including expanding its activities at the state level.

By Lynne Marek • July 7, 2021 -

Binance.US hires ex-leader of California's 'mini-CFPB'

Manny Alvarez is joining Binance.US after leaving the California Department of Financial Protection and Innovation. He will oversee risk, compliance and legal developments at the company under Binance.US CEO Brian Brooks, who formerly led the Office of the Comptroller of the Currency.

By Dan Ennis • July 7, 2021 -

Crypto exchange Binance responds to Barclays move to halt payments

The crypto exchange said Barclay's decision to block U.K. consumers' credit and debit card payments to Binance is based on a misunderstanding regarding a U.K. regulatory action. Binance is facing increased regulatory scrutiny elsewhere too.

By Vaidik Trivedi • July 7, 2021 -

Fintechs' letter, panel hearing put CFPB's lending, credit stances in spotlight

Lawmakers are debating putting CFPB in charge of credit reporting as fintechs like Varo and Square seek clarity from the agency on its disparate impact.

By Dan Ennis • June 30, 2021 -

Mastercard CEO, FDIC Chair call on fintech industry to press financial inclusion

In a post-pandemic world, financial institutions and companies are putting more effort into leveraging technological advances to bring more people into the financial system, while innovating to remove digital barriers.

By Lynne Marek , Vaidik Trivedi • June 30, 2021 -

U.S. digital currency could "pose considerable risks," Fed official says

Federal Reserve Board Governor Randal Quarles also said the benefits of developing a central bank digital currency are "unclear," given the "very good" U.S. payment system.

By Dan Ennis • June 29, 2021 -

On-demand pay catches on, but scrutiny persists

Employers are gravitating to new ways to pay workers more quickly, thanks to fintechs providing payroll innovations, but state lawmakers are scrutinizing the new approaches too.

By Lynne Marek • June 28, 2021