Regulations & Policy: Page 46

-

Shift4's Finaro purchase entangled with Russian oligarch

With its acquisition of financial services firm Finaro, Allentown, Pennsylvania-based payments company Shift4 awaits not only European regulatory approval but also a license from the U.S. Office of Foreign Assets Control due to a Russian oligarch’s minority stake in Finaro.

By Caitlin Mullen • March 25, 2022 -

Ohio's credit unions swing at BNPL

Buy now-pay later comments are due to the Consumer Financial Protection Bureau this week. And battle lines are being drawn over how to regulate a burgeoning industry.

By Jonathan Berr • March 24, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Fed's Powell lists 4 qualifications for a US CBDC

A digital dollar must ensure user privacy, be "identity verifiable," be "intermediated" and be widely accepted as a means of payment, the central bank chief said Wednesday during a panel discussion hosted by the Bank for International Settlements.

By Dan Ennis • March 24, 2022 -

Affirm CFO leans in for CFPB inquiry

A top executive at Affirm, the biggest independent U.S. buy now-pay later company, says he understands the way in which the Consumer Financial Protection Bureau is trying to get a handle on the new industry.

By Jonathan Berr • March 23, 2022 -

Retail, financial trade groups beg for coins

A U.S. coin shortage subsided for a bit early last year, but the problem is back. That led a group of trade organizations to complain to the Treasury Department this week, and to ask for help in making consumers aware of the coin crisis.

By Lynne Marek • March 22, 2022 -

ChargeAfter raises $44M as competition grows

The New York-based company is stockpiling dollars as new and old payments players arrive in the buy now-pay later arena. Consumers are predicted to increase their BNPL spending, but the service also faces regulatory scrutiny.

By Tatiana Walk-Morris • March 22, 2022 -

Payments industry makes a tempting target for hackers

The industry might not be experiencing a major uptick in cyberattacks as a result of Russia's war on Ukraine, but that doesn't mean it shouldn't be on high alert, cybersecurity professionals say.

By Jonathan Berr , Caitlin Mullen , Lynne Marek • March 18, 2022 -

Merchants lose North Dakota debit fee case

Merchant trade groups that sued the Federal Reserve Board in federal court last year over what they alleged was the central bank's failure to keep debit card fees in check had their case dismissed this week. They said they'll appeal the ruling.

By Lynne Marek • March 18, 2022 -

Wealthy BNPL consumers give Affirm a boost

A new survey from one equity analyst suggests installment financing from the buy now-pay later company Affirm has appeal for rich and poor alike. "The demand for our service is going up because consumers are trying to ration their money,” Affirm CEO Max Levchin told CNBC.

By Jonathan Berr • March 16, 2022 -

CFPB's Chopra blasts potential card hikes

In a rare TV appearance, the director of the Consumer Financial Protection Bureau said that the payments industry isn't competitive enough and that fee hikes by the big card companies would add "insult to injury" at a time of inflation. He noted new fintech tools could ultimately be a benefit if they add competition.

By Jonathan Berr • March 14, 2022 -

Russia pivots to UnionPay for payments alternative

With Russia shut out of U.S. and EU payment infrastructures, the country is pivoting to alternatives such as China's UnionPay card system and other channels that may take its trade and commerce through China.

By Jonathan Berr • March 11, 2022 -

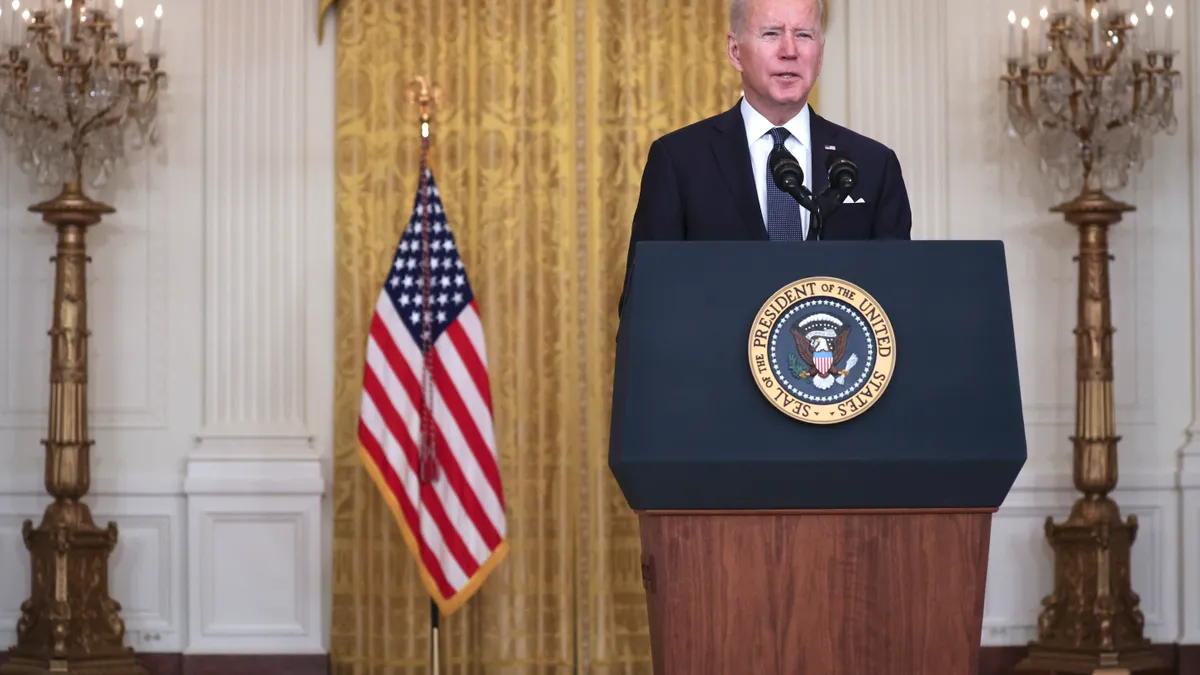

Biden's digital asset order may prompt legislation

Comprehensive cryptocurrency legislation may follow the executive order released this week, which called for a multi-agency response to exploring and regulating digital assets.

By Caitlin Mullen • March 11, 2022 -

New BNPL study raises concern about 'debt spiral'

Some consumers are charging buy now-pay later installment payments to their credit cards, and that should serve as a "warning flag" to regulators, said three economists who authored the research paper.

By Jonathan Berr • March 10, 2022 -

White House lays out digital asset priorities

The White House said Pres. Biden will deliver an executive order today explaining how the U.S. government will approach digital assets, laying out priorities for protecting U.S. consumers and businesses; ensuring a stable global financial system; and promoting American leadership in the use of the emerging technology.

By Lynne Marek • March 9, 2022 -

Visa races to rescue employees from Ukraine

When Visa CEO Al Kelly got a message at church that Ukrainian President Volodymyr Zelenskyy was trying to reach him, "that was the initial sign to me about the pressure we would feel," he said. Aside from implementing sanctions, the card giant has been in a race to move employees out of Ukraine.

By Lynne Marek • March 9, 2022 -

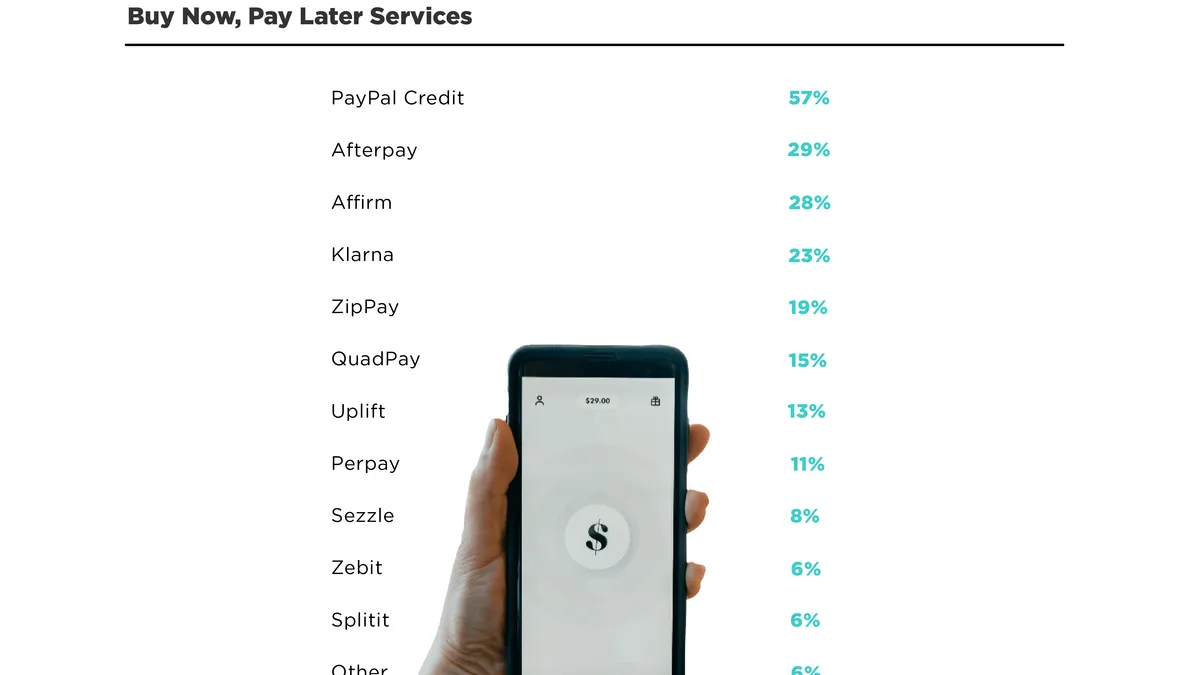

BNPL popularity shows no signs of slowing, FIS report says

The Jacksonville, Florida-based payments company expects buy now-pay later to be the fastest-growing e-commerce payment method through 2025 in the U.S. and Canada.

By Jonathan Berr • March 4, 2022 -

Retrieved from Flightradar24 on March 04, 2022

Retrieved from Flightradar24 on March 04, 2022

Card company CFOs grapple with 'fluid' sanctions environment

“Our first and most important priority remains the people we have in the region," said Sachin Mehra, CFO at Mastercard.

By Maura Webber Sadovi , Jonathan Berr , Caitlin Mullen • March 4, 2022 -

Visa reportedly plans to cut some credit card fees

The U.S. card giant plans to cut the credit card fees it charges smaller merchants, according to a report Thursday. The company didn't respond to requests for comment on previously planned April increases that could affect other merchants.

By Lynne Marek • March 4, 2022 -

EU to restrict 7 Russian banks from Swift

The sanctions reportedly won't include Sberbank, which said Wednesday it would pull out of the European market. The Single Resolution Board is liquidating the lender's Austria-based unit while units in other European countries have been sold.

By Dan Ennis • March 2, 2022 -

Visa follows Mastercard in disclosing potential impact from Russia-Ukraine conflict

Visa disclosed Wednesday that Russia and Ukraine made up 5% of its 2021 revenue. Mastercard earlier in the week called Russia and Ukraine "important contributors" to its business and said sanctions triggered by Russia's invasion of Ukraine could impact 6% of its revenue.

By Lynne Marek • March 2, 2022 -

Affirm, Klarna meet CFPB deadline, others mum

There’s plenty at stake in the Consumer Financial Protection Bureau proceedings. The buy now-pay later companies were asked for voluminous amounts of data that could lead to additional scrutiny in the future.

By Jonathan Berr • March 1, 2022 -

Visa, Mastercard block Russian banks from network

The card giants said they've disconnected Russian banks from their international payment networks to comply with the slew of sanctions being imposed on Russia after its invasion of Ukraine.

By Jonathan Berr • March 1, 2022 -

FTC report shows consumer fraud losses jumped last year

Consumers lost a whopping $5.9 billion to fraud in 2021, with bank payments and cryptocurrency transactions generating the highest losses, the government report said.

By Caitlin Mullen • March 1, 2022 -

G-7 nations impose limited Swift sanctions

Japan on Sunday joined a coalition of six nations and the European Union in imposing Swift money transfer system sanctions on a limited number of Russian banks.

By Jonathan Berr , Dan Ennis • Updated Feb. 27, 2022 -

Payment companies mainly skirt Russia-Ukraine impact

Payments industry executives likely aren't worrying too much about Russia's invasion of Ukraine, based on the amount of revenue coming from the region, at least not yet.

By Jonathan Berr • Feb. 25, 2022