Regulations & Policy: Page 29

-

Fraud emerges as concern for FedNow users

The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system.

By Lynne Marek • Dec. 15, 2023 -

Senators keep pressure on PayPal, Block

Senate Democrats urged top executives at PayPal and Block, in another round of letters, to improve reimbursement for victims of payment scams.

By Lynne Marek • Dec. 14, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Synchrony, Bread plan offsets to late fee cap

“I want that shoe to drop so we can start mitigating that issue,” Bread CEO Ralph Andretta said last week, as the industry awaits the CFPB’s final rule.

By Caitlin Mullen • Dec. 14, 2023 -

FedNow may have spurred RTP adoption

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

By Lynne Marek • Dec. 13, 2023 -

Retrieved from Discover Financial Services on December 11, 2023

Retrieved from Discover Financial Services on December 11, 2023

Discover’s new CEO brings bank experience

Michael G. Rhodes, previously the group head for Canadian personal banking at TD Bank Group, will take the helm at Discover in March.

By Caitlin Mullen • Updated Dec. 12, 2023 -

Discover to spend at least $500M on compliance next year

“We’re going to continue to invest whatever we have to invest in order to get the compliance issues behind us,” CFO John Greene said last week.

By Caitlin Mullen • Dec. 11, 2023 -

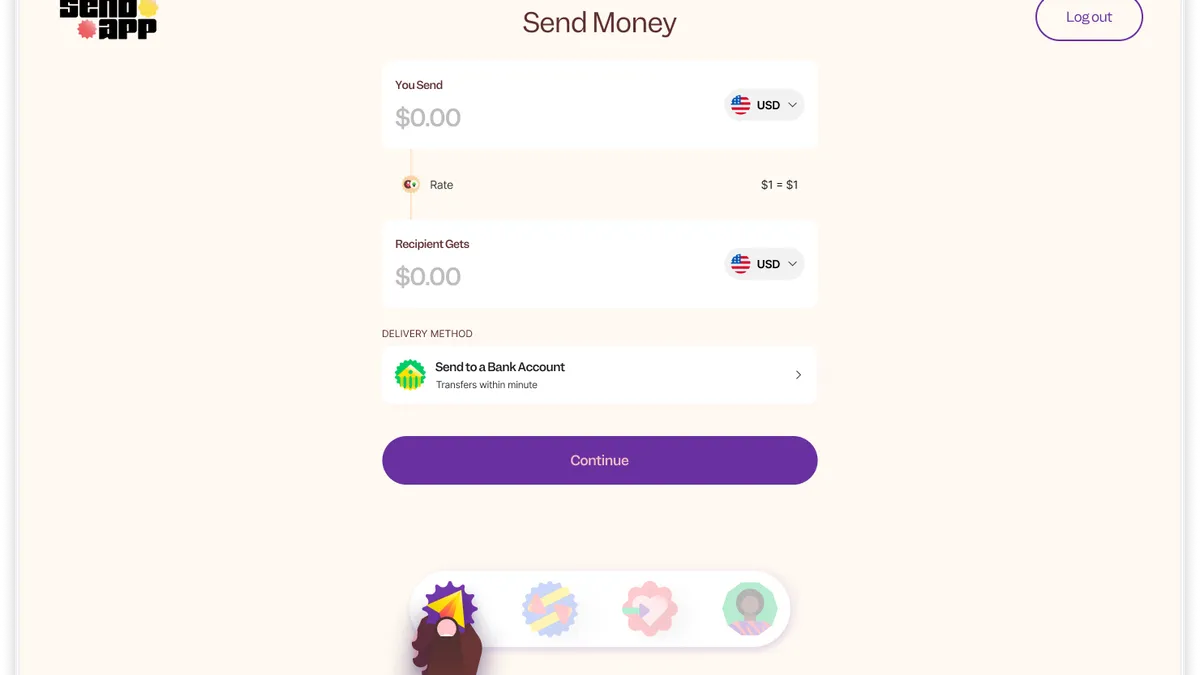

Retrieved from Flutterwave on Dec. 8, 2023.

Flutterwave lands state money licenses

The African payments company launched its remittance app in August as part of a push to facilitate more payments between the U.S. and Africa.

By James Pothen • Dec. 8, 2023 -

Durbin bashes United Airlines in CCCA fight

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

By Lynne Marek • Dec. 8, 2023 -

Lawmakers call for action on gun code

Sen. Elizabeth Warren and 48 other congressional Democrats called on the card networks to provide answers to a dozen questions related to the gun merchant category code.

By Caitlin Mullen • Dec. 7, 2023 -

BNPL growth decelerates: Bank of America

The growth rate in the number of shoppers downloading buy now, pay later apps shrunk for this year's Thanksgiving shopping weekend compared to 2022.

By Tatiana Walk-Morris • Dec. 5, 2023 -

FTC to hold January hearing on ‘click to cancel’ rule

The Federal Trade Commission is scheduled to hear from six industry organizations concerned about a proposed rule that would crack down on automatically renewing subscriptions.

By James Pothen • Dec. 5, 2023 -

Warren urges CFPB to act on card late fee rule

“I urge the CFPB to finalize this as quickly as possible,” Sen. Elizabeth Warren said during a Senate hearing with the agency’s director, Rohit Chopra.

By James Pothen • Dec. 4, 2023 -

X picks up two more state money licenses

South Dakota and Kansas are the first states to grant X money transmitter licenses since September, inching the social media platform closer to adding a payments feature.

By James Pothen • Nov. 30, 2023 -

Discover pursues sale of student loan business

The card issuer said it’s seeking to offload its $10.4 billion student loan portfolio.

By Caitlin Mullen • Nov. 30, 2023 -

Credit card bill battle may slide into 2024

Prospects for passing the Credit Card Competition Act this year are dimming, but supporters and opponents remain locked in battle over the legislation.

By Lynne Marek • Nov. 27, 2023 -

Plaid poaches Adyen executive for European expansion

Brian Dammeir sees opportunities for Plaid’s payments business to grow in Europe, particularly in account-to-account payments, he said in a Wednesday interview.

By James Pothen • Nov. 22, 2023 -

Will China be a boon or bust for card networks?

U.S. card companies have gained a foothold in China’s market, but they must still win over banks and battle behemoth China UnionPay.

By Lynne Marek • Nov. 21, 2023 -

Mastercard joint venture approved for China card processing

The No. 2 U.S. card company now has a means of processing card payments inside China, after years of waiting on Chinese government approvals.

By Lynne Marek • Nov. 20, 2023 -

Q&A

BNPL regulation could contribute to consolidation: Moody’s analysts

Adapting to regulation could be a costly endeavor for BNPL companies already facing losses and more expensive funding costs, Moody’s analysts said.

By Caitlin Mullen • Nov. 20, 2023 -

5 takeaways from Michael Barr’s remarks at The Clearing House conference

The Fed's vice chair for supervision expressed optimism about FedNow’s benefits and said he expects it to co-exist with the privately owned RTP network.

By Suman Bhattacharyya • Nov. 20, 2023 -

EU digital identity wallet to stir paytech market

The EU would require big tech companies, like Apple and Google, to offer their customers payment services through the new digital identity wallet if the regulation is approved.

By James Pothen • Nov. 13, 2023 -

BNPL companies face grim outlook, Moody’s says

Fierce competition, persistent losses and regulatory constraints are likely to push some players out of the buy now, pay later market, Moody’s predicted.

By Lynne Marek • Nov. 13, 2023 -

Bitcoin Depot CEO weighs in on new California law

Bitcoin Depot CEO Brandon Mintz contends a new California law will “create economic challenges” for his company and other crypto ATM operators.

By James Pothen • Nov. 10, 2023 -

FIS forms board committee to review litigant demands

Fidelity National Information Services disclosed that its board has formed a committee and hired an independent counsel to review demands tied to a stockholder lawsuit.

By Lynne Marek • Nov. 9, 2023 -

Affirm CEO welcomes CFPB oversight

Consumer Financial Protection Bureau supervision “levels the playing field” in buy now, pay later, Affirm’s CEO Max Levchin said Wednesday.

By Caitlin Mullen • Nov. 9, 2023