Regulations & Policy: Page 24

-

CFPB notes ‘growing financialization’ of medical, rental payments

The bureau has received about 15,000 complaints in the last two years concerning medical debt collectors, according to General Counsel Seth Frotman.

By James Pothen • April 16, 2024 -

Opinion

CFPB’s new late fee cap charts ‘a better way,’ says Sunbit CEO

“The credit card industry should take a page from innovators, instead of relying on yesterday’s fee models,” argues the CEO of the payment tools provider.

By Arad Levertov • April 16, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

FlexWage wins Vermont EWA carve-out

Earned wage access provider FlexWage has received leeway from the Vermont Department of Financial Regulation to operate in the state without a lender or money transmitter license.

By Lynne Marek • April 15, 2024 -

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

EWA providers seek to steer state legislation

Payactiv, DailyPay and other earned wage access providers teamed up in calling on the governor of Kansas to pass legislation similar to laws recently enacted in three other states.

By Lynne Marek • April 11, 2024 -

Capital One’s Discover bid tops biggest Q1 tech-related deals

The proposed Capital One-Discover merger made the list because of fintech issues that are at stake in the $35.3 billion deal.

By Alexei Alexis • April 10, 2024 -

CFPB, DOJ boost teamwork on cases

The bureau will refer “potentially criminal conduct,” including “anti-competitive mischief,” to the DOJ for action, CFPB Director Rohit Chopra said Monday.

By James Pothen • April 9, 2024 -

Visa, Mastercard CEOs throw hearing off track

Senate Judiciary Committee Chairman Dick Durbin postponed a plan to call credit card chieftains on the capitol carpet at a Tuesday hearing, but he’s still aiming to get them to Washington.

By Lynne Marek • April 9, 2024 -

Virtual marketplaces risk real losses: CFPB

Virtual worlds “can become a haven for scams, fraud, financial losses, and unanticipated purchases that can deplete a family’s real-world financial assets,” CFPB Director Rohit Chopra said.

By James Pothen • April 5, 2024 -

Opinion

EWA shouldn’t be regulated like loans

“Attempts to regulate EWA as credit threaten worker access to this innovative and consumer-friendly financial tool,” writes one earned wage access industry CEO.

By Darcy Tuer • April 5, 2024 -

NY Fed enters cross-border tokenization effort

The central bank will join six other central banks in exploring blockchain technology to speed up international payments.

By James Pothen • April 4, 2024 -

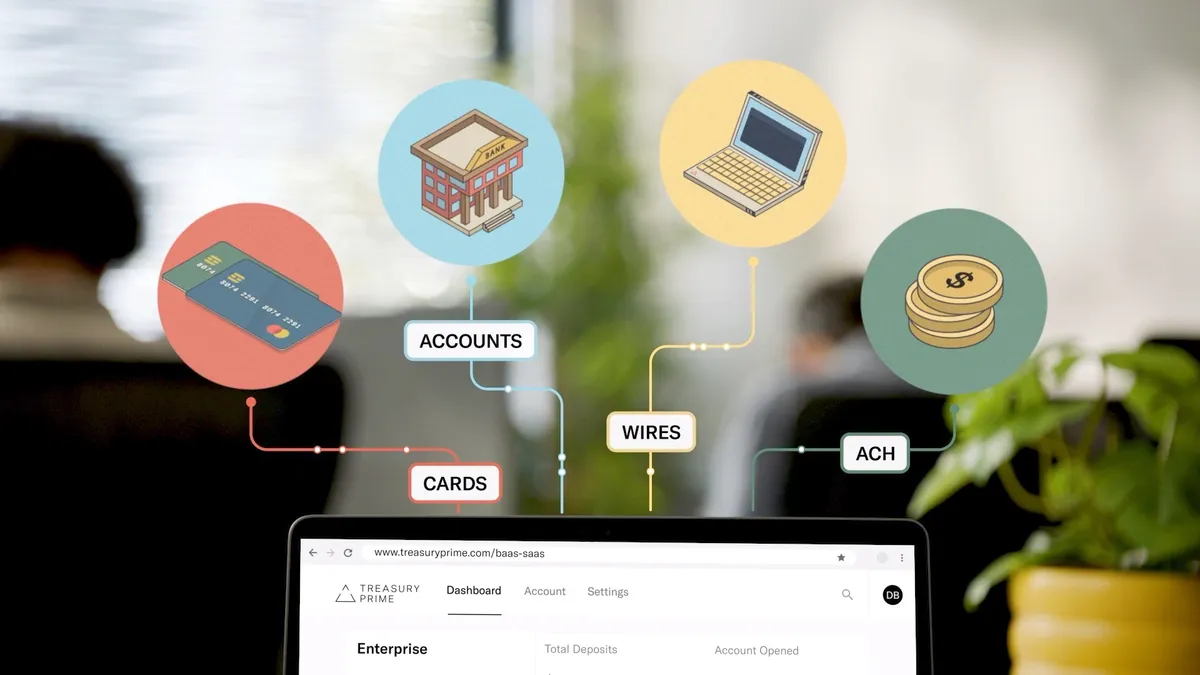

Treasury Prime, Narmi partner to offer FedNow service

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

By Rajashree Chakravarty • April 3, 2024 -

Credit card complaints jumped 38% last year: CFPB

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

By James Pothen • April 3, 2024 -

How Amex is entangled in the Visa-Mastercard settlement

The settlement gives merchants the ability to surcharge for nearly all Visa and Mastercard credit card transactions, and puts pressure on American Express to allow the same.

By Lynne Marek • April 1, 2024 -

Warren reiterates call for gun MCC guidance

The Massachusetts senator and 32 other Democrats stressed the need for federal guidance on the gun merchant category code as states diverge.

By Caitlin Mullen • March 29, 2024 -

CFPB targets ‘bait-and-switch’ card reward programs

Major credit card providers saddle rewards programs with fees and interest, burdening consumers who carry balances, CFPB Director Rohit Chopra said.

By James Pothen • March 27, 2024 -

Private plaintiffs follow DOJ’s Apple antitrust case

The follow-on class actions are substantively similar to the federal government’s case, making them dependent on the agency’s lead in breaking the company’s smartphone stranglehold.

By Robert Freedman • March 27, 2024 -

X lands money licenses in Illinois, New Mexico

The social media platform is now nearly halfway to securing the state licenses needed to fulfill owner Elon Musk’s vision of a nationwide payments app.

By James Pothen • March 27, 2024 -

NY Assembly bill counters governor on BNPL

A New York assemblymember has introduced a buy now, pay later bill, countering one introduced in the governor’s budget bill.

By Lynne Marek • March 27, 2024 -

Capital One pledges to give Discover’s network a boost

Dominated by Visa and Mastercard, card network markets “sorely need an injection of competitive rivalry,” Capital One argued in its application to regulators to purchase Discover.

By Caitlin Mullen • March 26, 2024 -

DOJ calls Apple card fees ‘significant expense’ for banks

The tech giant’s fees for credit card transactions “cut into funding for features and benefits that banks might otherwise offer smartphone users,” the Department of Justice said in suing the company earlier this month.

By James Pothen • March 26, 2024 -

Visa, Mastercard reach landmark credit card settlement

The two biggest U.S. card networks agreed to cap interchange fees for five years, among other terms, to settle merchant litigation that has lasted nearly two decades.

By Lynne Marek • March 26, 2024 -

Crypto fraud losses rose to $3.9B in 2023, a 53% yoy increase: FBI

SEC enforcement actions against cryptocurrency players were up last year, but the commission is under attack for not issuing new rules for the industry.

By Vincent Ryan • March 25, 2024 -

Advocates urge transparency in Capital One-Discover review

More than 30 organizations demanded the deal not be subject to expedited federal review and that public hearings be held in the largest lending markets for both Capital One and Discover.

By Caitlin Mullen • March 22, 2024 -

Wisconsin passes EWA law as states’ paths diverge

Wisconsin became the third state to pass a law requiring that earned wage access providers be licensed, and leaving the payments unregulated under lending laws.

By Lynne Marek • March 22, 2024