Regulations & Policy: Page 14

-

Amex, Alipay target fast-growing China market

The card company has locked arms with the local digital payments player to accelerate its growth in China, the world’s second most populous nation.

By Patrick Cooley • Feb. 26, 2025 -

Durbin to reintroduce credit card competition bill

The senate minority whip from Illinois plans to reintroduce the Credit Card Competition Act proposal in a bid to increase competition for Visa and Mastercard.

By Lynne Marek • Feb. 25, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Stripe employee share sale may mean delayed IPO

An internal sale of stock to workers may mean the company won’t pursue a public offering anytime soon, consultants and analysts said.

By Patrick Cooley • Feb. 25, 2025 -

CFPB drops case against SoLo Funds

The bureau’s lawsuit against the online lending platform – filed during Rohit Chopra’s tenure – “was wrong” and “the weaponization of ‘consumer protection’ must end,” the CFPB’s Acting Director Russ Vought said.

By Caitlin Mullen • Feb. 24, 2025 -

Block begins rollout of Afterpay on Cash App debit card

The buy now, pay later product Afterpay became available to eligible cardholders in 20 states Tuesday.

By Patrick Cooley • Feb. 21, 2025 -

Fed’s Barr warns of weaker regulation, supervision

The Fed board, he said, should resist initiatives that impede effective supervision by discouraging examiners to flag issues early, or ones that add to the process unnecessarily, he said.

By Rajashree Chakravarty • Feb. 21, 2025 -

23 AGs line up behind Baltimore in CFPB case

Efforts to shutter the agency are against public interest, the AGs said. The CFPB’s attorneys argue it’s in the public interest to act “consistent[ly] with the philosophy of a new administration brought about by a national election."

By Dan Ennis • Feb. 21, 2025 -

Opinion

How stablecoins may extend US dollar supremacy

“Dollar-based stablecoins such as USDT and USDC are traded all over the world at any time of the day, regardless of holidays, time zones, and whether markets are open or closed,” writes the CEO of an embedded finance company.

By Bam Azizi • Feb. 20, 2025 -

Waller sees stablecoins advancing in retail

Stablecoins are seeping into payments at stores, but there are plenty of hurdles before they become widely used, according to Federal Reserve Governor Christopher Waller.

By Lynne Marek • Feb. 20, 2025 -

Cap One, Discover shareholders approve merger

Stockholders of the two companies approved the big bank's $35.3 billion acquisition in separate meetings Tuesday.

By Patrick Cooley • Feb. 19, 2025 -

Fed delays start of new Fedwire standard

The central bank postponed a deadline for banks and credit unions to move Fedwire payments to the ISO 20022 format. That may also hold up a broader industry modernization effort.

By Lynne Marek • Feb. 19, 2025 -

Payments players mull new approaches to fraud

Google, Nacha, Early Warning Services and Truist are among the companies seeking to better protect the e-commerce ecosystem from push-payment scams.

By Lynne Marek • Feb. 18, 2025 -

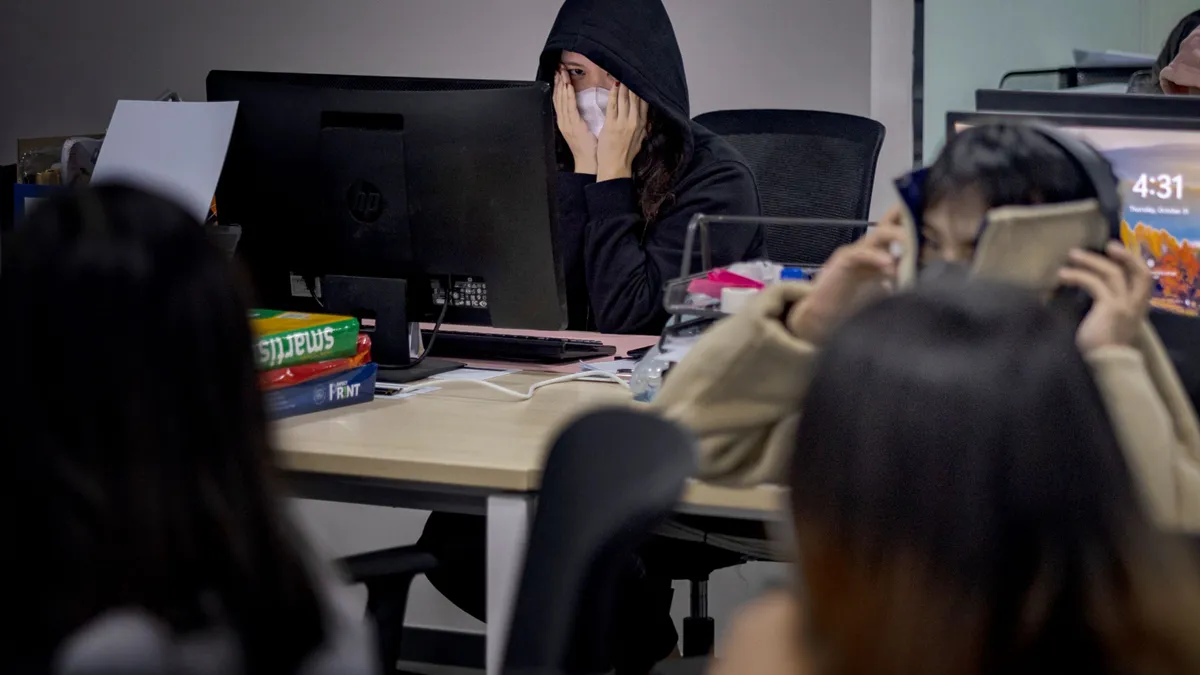

How payment scams start on social media

Bad actors contact consumers through social media and then persuade them to send money over payment platforms, a JPMorgan Chase payments executive said during a Payments Dive virtual event.

By Patrick Cooley • Feb. 18, 2025 -

Georgia special charter attracts another applicant

The move follows the approval of payment processing company Fiserv’s application, which was approved in October, but payments industry consultants say the path to using such a charter is a rocky one.

By Patrick Cooley • Feb. 13, 2025 -

Wise to close Tampa office, cut 300 employees

The fintech will shutter its Florida location in November, with layoffs starting in April. Wise will consolidate Americas teams in Austin, New York and São Paulo.

By Rajashree Chakravarty • Feb. 12, 2025 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

Ex-FDIC official McKernan tapped to lead CFPB

The development came on a day when the bureau terminated roughly 70 probationary employees, including enforcement division attorneys, according to Bloomberg Law.

By Dan Ennis • Feb. 12, 2025 -

Discover flags potential Cap One merger delay

Discover Financial Services said it now expects the transaction to be completed by May 19, three months later than initially expected as the companies await regulatory approvals.

By Patrick Cooley • Feb. 12, 2025 -

CFPB’s future hangs in the balance after a wild weekend

Consumer Financial Protection Bureau staff were told to work remotely this week after a new acting chief halted agency supervision and enforcement. He also told the Federal Reserve the agency wouldn't take any unappropriated funding next quarter.

By Dan Ennis • Feb. 10, 2025 -

Senators reintroduce bill to bar CBDC

Republican senators revived a bill last week to block the Federal Reserve from creating a central bank digital currency.

By Lynne Marek • Feb. 10, 2025 -

Treasury responds to concerns about Musk ‘meddling’

A Treasury Department official sought to allay a senator’s concerns about DOGE staffers gaining access to the U.S. payments system, but sidestepped questions Tuesday. The issue escalated at a Wednesday hearing.

By Lynne Marek • Feb. 6, 2025 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv doubles down on embedded finance

Company executives touted a recent partnership with DoorDash and said the company has more embedded finance deals in the pipeline.

By Patrick Cooley • Feb. 6, 2025 -

Sanders, Hawley introduce credit card interest rate cap bill

In an unlikely union, Republican Sen. Josh Hawley and independent Sen. Bernie Sanders have locked arms to introduce legislation that would cap credit card interest rates at 10% over five years.

By Lynne Marek • Feb. 5, 2025 -

Cash App, Venmo app downloads decline

Consumer downloads of apps like Cash App and Venmo dropped in the fourth quarter compared to the year-ago period, data from Wolfe Research shows.

By Patrick Cooley • Feb. 5, 2025 -

Democrats decry Trump payments policy upheaval

Congressional Democrats criticized Trump administration moves at the Treasury Department and Consumer Financial Protection Bureau that suggest changes to federal government payments and policies.

By Lynne Marek • Feb. 4, 2025 -

Gamers support CFPB video game payments rule

Video game players and their parents submitted comments to the Consumer Financial Protection Bureau saying they overspent, or lost their accounts to hackers.

By Patrick Cooley • Feb. 4, 2025