Regulations & Policy

-

Senator spars with JPM’s Dimon

Sen. Elizabeth Warren says a bill she’s backing emulates a proposal by JPMorgan Chase CEO Jamie Dimon to let states determine their own card interest rate caps.

By Justin Bachman • Feb. 18, 2026 -

Stripe’s Bridge wins OCC conditional approval

The nod for a national trust bank charter comes after digital-asset firms Circle, Ripple and Paxos received a similar green light.

By Dan Ennis • Feb. 18, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

GAO details CFPB’s downsizing

The scope of the CFPB’s downsizing were explored in two reports released Monday, one of which concludes that the changes cost consumers $19 billion.

By Gabrielle Saulsbery • Feb. 11, 2026 -

Merchants seek hearing on card pact

Large retailers opposing a swipe-fee settlement with Visa and Mastercard want a judge to hear oral arguments before he rules on the proposal.

By Justin Bachman • Feb. 11, 2026 -

Judge backs Illinois law on card fees

A U.S. judge ruled that federal bank law doesn’t preempt an Illinois effort to ban card interchange fees on sales tax and tips. Bank groups vowed to appeal.

By Justin Bachman • Feb. 11, 2026 -

EWA products aren’t loans: fintechs

Trade groups representing fintechs filed briefs urging a U.S. appeals court to reverse two district court rulings against earned wage access providers.

By Justin Bachman • Feb. 10, 2026 -

Block to chop up to 10% of employees

The company is reducing its workforce to trim overhead costs and stay below a 12,000 employee cap, analysts said.

By Patrick Cooley • Feb. 9, 2026 -

Fed ‘skinny’ account idea draws criticism

A prototype payment account carries undue restrictions, fintech groups said in response to a Fed proposal that offers expanded real-time payments access.

By Justin Bachman • Feb. 9, 2026 -

Arizona mulls card rate cap

A state senator has introduced a bill that follows President Donald Trump’s lead in seeking to cap credit card interest rates.

By Lynne Marek • Feb. 5, 2026 -

Visa pushes real-time payments into China

The company is partnering with UnionPay International to bring direct payments to debit cardholders in one of the largest remittance markets.

By Justin Bachman • Feb. 3, 2026 -

Why some payments companies want to be banks

Banking charters let those companies streamline their services and save money by not partnering with banks.

By Patrick Cooley • Feb. 3, 2026 -

Maine, DC weigh EWA regulations

Supporters of earned wage access are seeking to shape regulation being considered in Maine and the District of Columbia.

By Lynne Marek • Feb. 2, 2026 -

Charting 2026 payments trends

Here are 4 stories that round up our deep dive outlook for this year, including coverage of agentic payments, fraud and personalization.

By Lynne Marek • Jan. 30, 2026 -

Block opens Dublin office

The location, announced Thursday, will include a demonstration lab to show off products to potential European customers.

By Patrick Cooley • Jan. 30, 2026 -

Mastercard reworks Cap One pact

The card network's CEO said the company signed a new agreement with Capital One, reaffirming ties despite the bank’s purchase of rival Discover.

By Lynne Marek • Jan. 29, 2026 -

Fiserv sued over alleged lax security

A Tampa credit union alleged that the processor failed to protect customers from cyber hacks, but charged extra fees for a security upgrade.

By Patrick Cooley • Jan. 29, 2026 -

Deep Dive

Bot payments lag in agentic commerce

Within the emerging world of agentic commerce, a broad gap exists between bot shopping and autonomous payments.

By Justin Bachman • Jan. 29, 2026 -

State legislatures mull remittance restrictions

Battle lines are being drawn in Florida and Missouri over legislation that would bar money transfer firms from servicing “unauthorized aliens.”

By Lynne Marek • Jan. 28, 2026 -

DailyPay seeks to dismiss NY lawsuit

The earned wage access provider and MoneyLion cited a federal agency opinion last month in asking judges Friday to dismiss the New York AG’s complaints.

By Justin Bachman • Jan. 27, 2026 -

Credit card delinquencies drop, says Fed bank

The decline happened even as U.S. consumers spent more on their credit cards, data from the Federal Reserve Bank of Philadelphia shows.

By Patrick Cooley • Jan. 27, 2026 -

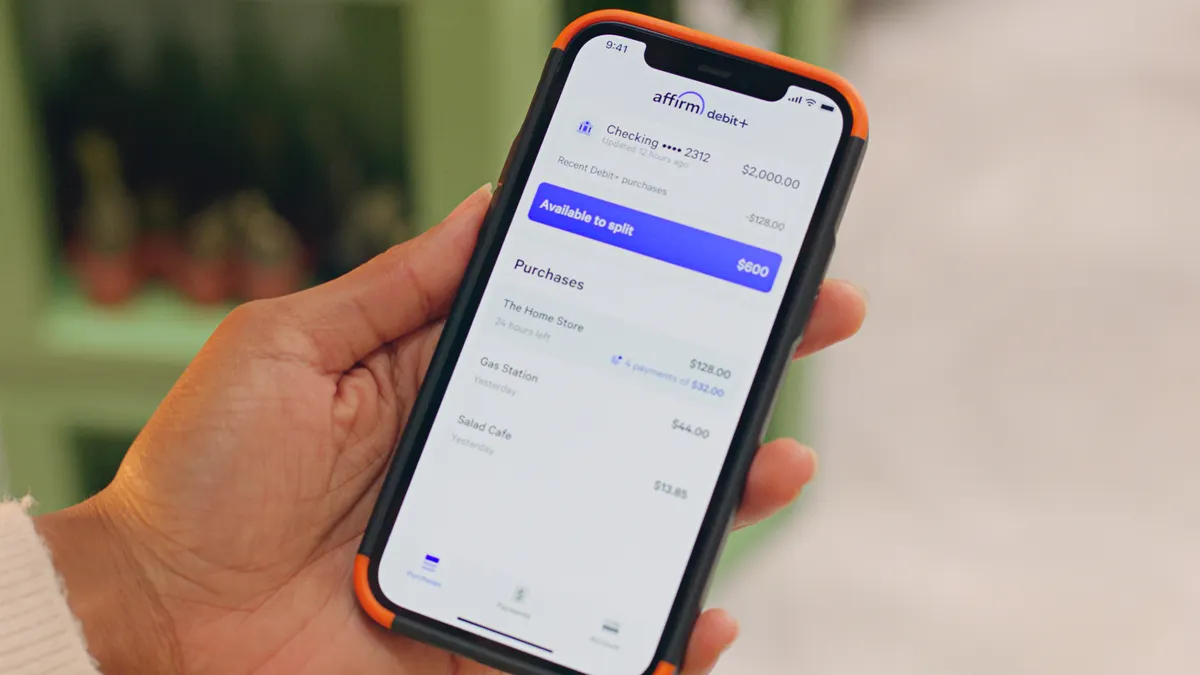

Affirm seeks Nevada bank charter

The company said Friday that it submitted applications to state and federal regulators to start Affirm Bank.

By Patrick Cooley • Jan. 23, 2026 -

JPMorgan CEO mocks card rate cap idea

The government should impose a 10% credit card interest rate freeze in Massachusetts and Vermont as an experiment, CEO Jamie Dimon said.

By Justin Bachman • Jan. 22, 2026 -

Klarna to offer after-purchase BNPL

Shoppers will be able to convert purchases into installment loans after the transaction, the company said Tuesday.

By Patrick Cooley • Jan. 21, 2026 -

Deep Dive

Payments fraud risks burgeon with AI

The artificial intelligence threats are mounting, but so are the defenses, as new industry trends take hold, from agentic commerce to passkey adoption.

By Lynne Marek • Jan. 21, 2026 -

Wyoming has big plans for stablecoin

The first state-issued stable token is being deployed to reduce card interchange costs and simplify payments to vendors.

By Justin Bachman • Jan. 21, 2026