Banking: Page 79

-

Binance.US hires ex-leader of California's 'mini-CFPB'

Manny Alvarez is joining Binance.US after leaving the California Department of Financial Protection and Innovation. He will oversee risk, compliance and legal developments at the company under Binance.US CEO Brian Brooks, who formerly led the Office of the Comptroller of the Currency.

By Dan Ennis • July 7, 2021 -

Fintech Karat Financial raises $26M to expand services

The company plans to move beyond credit cards and offer a suite of tools, including bank accounts and tax preparation services, for the creator economy.

By Anna Hrushka • July 6, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

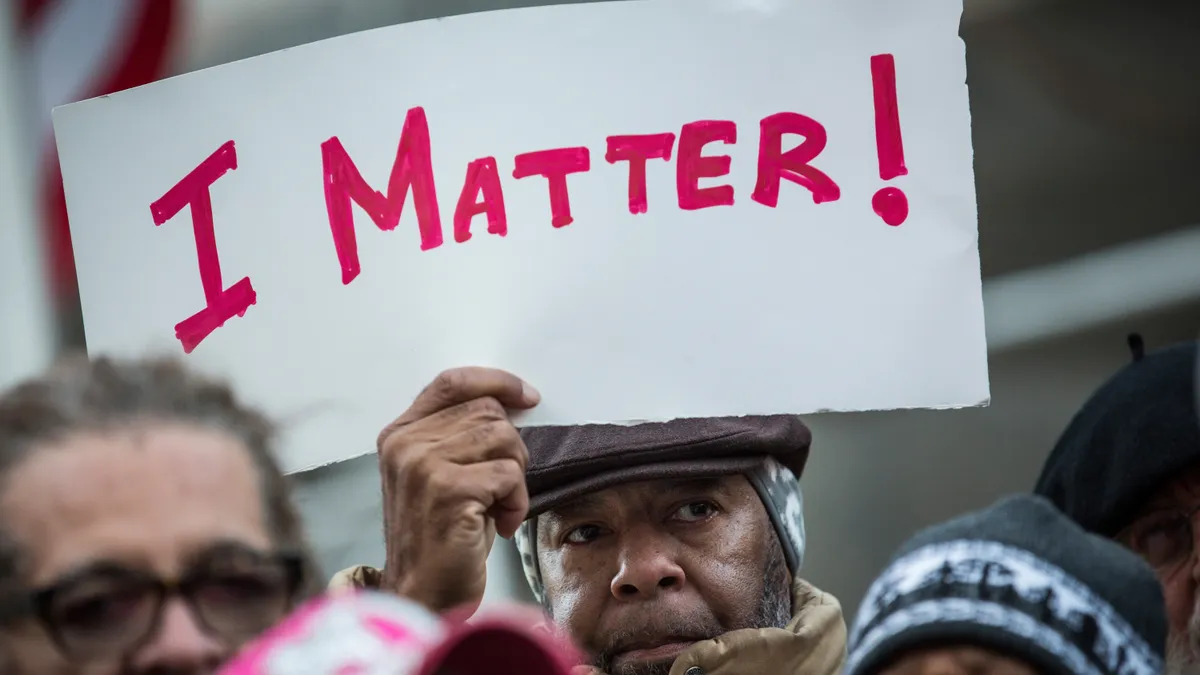

Mastercard CEO, FDIC Chair call on fintech industry to press financial inclusion

In a post-pandemic world, financial institutions and companies are putting more effort into leveraging technological advances to bring more people into the financial system, while innovating to remove digital barriers.

By Lynne Marek , Vaidik Trivedi • June 30, 2021 -

U.S. digital currency could "pose considerable risks," Fed official says

Federal Reserve Board Governor Randal Quarles also said the benefits of developing a central bank digital currency are "unclear," given the "very good" U.S. payment system.

By Dan Ennis • June 29, 2021 -

Column

Growing divide on crypto in international banking report

Central banks strike a second blow against digital assets and stablecoins. The dissonance between market and government may come down to timing, or an age-old pattern concerning risk.

By Dan Ennis • June 24, 2021 -

Payments industry deal-making mushrooms

The payments industry has accounted for the bulk of big fintech deals since the start of last year, charting eight combinations worth $23 billion, according to S&P Global Market Intelligence, which predicts the trend will march on.

By Lynne Marek • June 22, 2021 -

American Express launches business checking accounts

The card network's subsidiary, Kabbage, initiated the checking account product last summer, before it was acquired by AmEx.

By Anna Hrushka • June 15, 2021 -

Column

How payments became a magnet for money

The industry was beginning to attract record amounts of venture capital in recent years, but the pandemic's impact super-charged the trend.

By Lynne Marek • June 15, 2021 -

Citi's new 5% cash-back card signals an industry rebound

The world's top card issuer rolled out its new card last week days after Wells Fargo launched a new product, showing the card industry is ready to rebound from a relatively muted 2020.

By Anna Hrushka • June 11, 2021 -

'Super-apps' are the next evolutionary step for financial services

As transactions are increasingly digitized, financial service providers are vying to create "super-apps" that connect consumers to a bevy of financial services.

By Vaidik Trivedi • June 7, 2021 -

Goldman Sachs taps Visa for cross-border payment upgrade

The global investment bank is aiming to streamline and enhance cross-border payments for its clients by signing on for Visa's cross-border programs.

By Lynne Marek • June 7, 2021 -

Mastercard invests in fledgling fintech Synctera

San Francisco-based Synctera, only six months old, draws $33 million from a pack of investors as it takes on the role of matchmaker between small banks and fintechs.

By Lynne Marek • June 3, 2021 -

Crypto exchange Kraken launches mobile app in US

Customers can buy and sell more than 50 crypto tokens from their mobile phones with a starting investment of as little as $10. The services are not available for residents of New York or Washington state.

By Dan Ennis • June 3, 2021 -

E-commerce fraud prevention startup Forter raises $300M

The recent funding round, which the company will use to expand its global ecosystem, brings the company's valuation to $3 billion.

By Tatiana Walk-Morris • May 27, 2021 -

Visa expands reach of fintech partnership program

The card network behemoth is doing its part to help banks connect with fintechs that it believes can help bring more business to all the companies moving money through the system.

By Lynne Marek • May 26, 2021 -

Wells Fargo to offer crypto investment product for wealthy clients

The bank's decision to wade into crypto follows similar moves made by other large institutions, and comes as the nation's top bank regulator has indicated it plans to review past crypto-friendly actions.

By Anna Hrushka • May 21, 2021 -

Federal Reserve to kick off conversation on CBDC

Federal Reserve Chairman Jerome Powell said yesterday that the Fed will issue a paper this summer to begin a public discussion about the possibility of a central bank digital currency.

By Lynne Marek • May 21, 2021 -

Major payments trade group weighs in on CBDC development

The Electronic Transactions Association is touting principles on interoperability, consumer protections and risk safeguards in Washington discussions about a central bank digital currency.

By Lynne Marek • May 20, 2021 -

Payments firms draw another $275 million in venture capital

DailyPay and Amount are the latest companies in the industry to attract investors' dollars.

By Lynne Marek • May 19, 2021 -

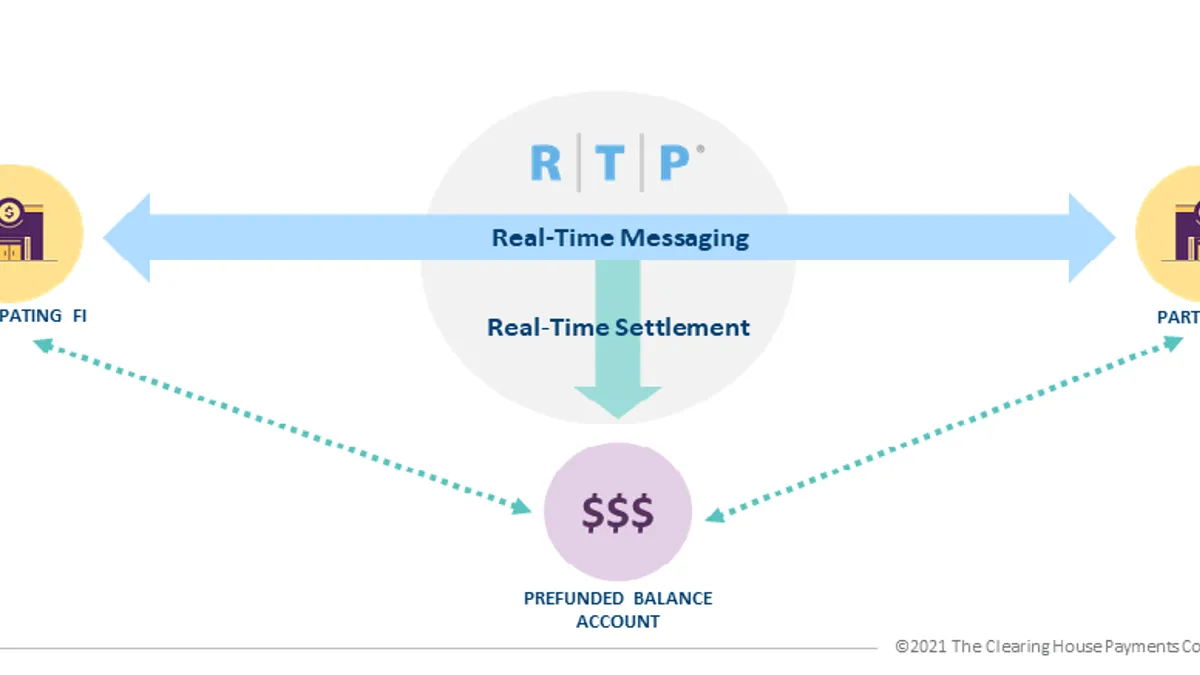

The Clearing House nudges businesses to buy into real-time system

The U.S. real-time payments system has invested $320 million in a real-time payments network, and now wants businesses to invest in their own systems to use it.

By Lynne Marek • May 14, 2021 -

Facebook-backed Diem shifts from Swiss to US jurisdiction

Diem Networks U.S. will register as a money services business with the Financial Crimes Enforcement Network, and Silvergate Bank will become the exclusive issuer of Diem's dollar-backed stablecoin.

By Anna Hrushka • May 13, 2021 -

Fed weighs debit transaction rule clarification

Fed proposes review of debit transaction routing, but leaves fee alone

The Fed will review whether a rule requiring options in routing debit transactions is being followed, but angered merchants when it kept the cost basis for a national debit fee cap unchanged.

By Lynne Marek • May 13, 2021 -

Rho Technologies taps Mastercard for new corporate credit card

Rho Technologies is partnering with Mastercard to offer a corporate credit card after teaming with Visa on prior cards.

By Vaidik Trivedi • May 13, 2021 -

Visa invests in Remitly, extends partnership

Credit card behemoth Visa bought an ownership stake in Remitly, a phone app company seeking to build a payments network for immigrants sending money to other countries.

By Lynne Marek • May 12, 2021 -

Citi considers crypto services, but isn't rushing in

"This isn't a space race," Citi's head of global foreign exchange, Itay Tuchman, told the Financial Times. "There is room for more than just one flag."

By Dan Ennis • May 11, 2021