Banking: Page 72

-

Ramp raises $750M to fuel growth

New York-based corporate spend management platform Ramp said today it's raised $200 million in equity and $550 million in debt financing, bringing its valuation to $8.1 billion.

By Caitlin Mullen • March 21, 2022 -

Payments industry makes a tempting target for hackers

The industry might not be experiencing a major uptick in cyberattacks as a result of Russia's war on Ukraine, but that doesn't mean it shouldn't be on high alert, cybersecurity professionals say.

By Jonathan Berr , Caitlin Mullen , Lynne Marek • March 18, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Merchants lose North Dakota debit fee case

Merchant trade groups that sued the Federal Reserve Board in federal court last year over what they alleged was the central bank's failure to keep debit card fees in check had their case dismissed this week. They said they'll appeal the ruling.

By Lynne Marek • March 18, 2022 -

Fewer taxpayers plan to pay the IRS by check

The share of consumers planning to use mobile phones to pay their taxes increased over last year, while the portion preferring to pay by check declined, according to a survey from payments firm ACI Worldwide.

By Caitlin Mullen • March 17, 2022 -

Deep Dive

How does Gen Z feel about credit cards? It's complicated.

Each generation has approached credit differently; Gen Z is no exception. As they turn toward credit cards, industry analysts say these consumers are likely to keep card companies on their toes.

By Caitlin Mullen • March 16, 2022 -

Moving big money is about to get faster

In the next few weeks, the two U.S. automated payments systems are set to increase the speed with which $1 million can be sent between two parties.

By Lynne Marek • March 16, 2022 -

Russia pivots to UnionPay for payments alternative

With Russia shut out of U.S. and EU payment infrastructures, the country is pivoting to alternatives such as China's UnionPay card system and other channels that may take its trade and commerce through China.

By Jonathan Berr • March 11, 2022 -

Walgreens joins PayNearMe bill pay network

Consumers seeking another nearby location to make bill payments in cash can now turn to about 9,000 Walgreens store locations as a result of the new tie-up.

By Lynne Marek • March 10, 2022 -

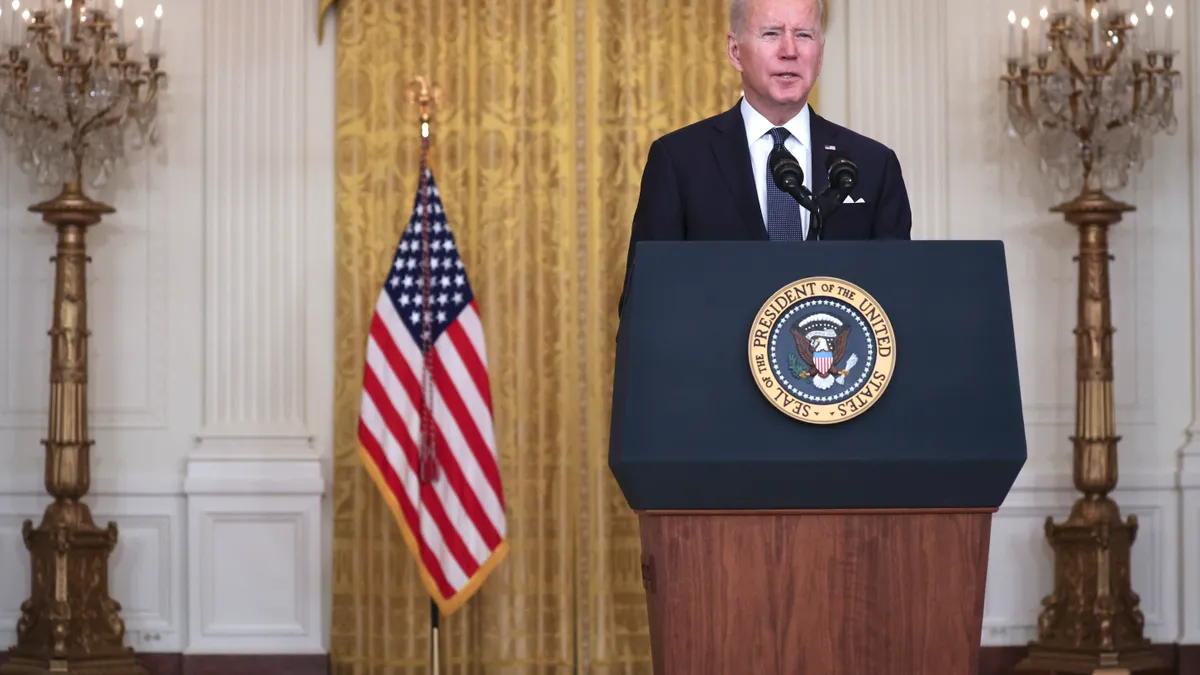

White House lays out digital asset priorities

The White House said Pres. Biden will deliver an executive order today explaining how the U.S. government will approach digital assets, laying out priorities for protecting U.S. consumers and businesses; ensuring a stable global financial system; and promoting American leadership in the use of the emerging technology.

By Lynne Marek • March 9, 2022 -

Visa races to rescue employees from Ukraine

When Visa CEO Al Kelly got a message at church that Ukrainian President Volodymyr Zelenskyy was trying to reach him, "that was the initial sign to me about the pressure we would feel," he said. Aside from implementing sanctions, the card giant has been in a race to move employees out of Ukraine.

By Lynne Marek • March 9, 2022 -

Visa, Mastercard and PayPal suspend operations in Russia

The payments giants all separately cut off use of their services in Russia, citing that country's invasion of Ukraine. "This war and the ongoing threat to peace and stability demand we respond in line with our values," Visa CEO Al Kelly said in a Saturday statement.

By Lynne Marek • March 7, 2022 -

Visa reportedly plans to cut some credit card fees

The U.S. card giant plans to cut the credit card fees it charges smaller merchants, according to a report Thursday. The company didn't respond to requests for comment on previously planned April increases that could affect other merchants.

By Lynne Marek • March 4, 2022 -

EU to restrict 7 Russian banks from Swift

The sanctions reportedly won't include Sberbank, which said Wednesday it would pull out of the European market. The Single Resolution Board is liquidating the lender's Austria-based unit while units in other European countries have been sold.

By Dan Ennis • March 2, 2022 -

Visa follows Mastercard in disclosing potential impact from Russia-Ukraine conflict

Visa disclosed Wednesday that Russia and Ukraine made up 5% of its 2021 revenue. Mastercard earlier in the week called Russia and Ukraine "important contributors" to its business and said sanctions triggered by Russia's invasion of Ukraine could impact 6% of its revenue.

By Lynne Marek • March 2, 2022 -

Visa, Mastercard block Russian banks from network

The card giants said they've disconnected Russian banks from their international payment networks to comply with the slew of sanctions being imposed on Russia after its invasion of Ukraine.

By Jonathan Berr • March 1, 2022 -

FTC report shows consumer fraud losses jumped last year

Consumers lost a whopping $5.9 billion to fraud in 2021, with bank payments and cryptocurrency transactions generating the highest losses, the government report said.

By Caitlin Mullen • March 1, 2022 -

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Zip to buy Sezzle in bid for US expansion

The Australian buy now-pay later company agreed to buy Minneapolis-based Sezzle as it seeks scale in the U.S. and positions itself to take on larger competitors such as Block's Afterpay.

By Lynne Marek • Feb. 28, 2022 -

G-7 nations impose limited Swift sanctions

Japan on Sunday joined a coalition of six nations and the European Union in imposing Swift money transfer system sanctions on a limited number of Russian banks.

By Jonathan Berr , Dan Ennis • Updated Feb. 27, 2022 -

Block defends higher marketing spending

Having added products focused on taxes and families, Cash App’s rising profitability “is what we’re investing behind here," Block CFO Amrita Ahuja said during a company earnings call last week.

By Caitlin Mullen • Feb. 25, 2022 -

Deep Dive

US banks brace for stricter sanctions against Russia

The Russian banks the U.S. targeted Tuesday account for only 5% of the country's total bank assets. But penalties aimed at larger banks of greater systemic importance may be in the offing.

By Robin Bradley • Feb. 25, 2022 -

Payment companies mainly skirt Russia-Ukraine impact

Payments industry executives likely aren't worrying too much about Russia's invasion of Ukraine, based on the amount of revenue coming from the region, at least not yet.

By Jonathan Berr • Feb. 25, 2022 -

FlexWage wins favorable California ruling

The on-demand pay company secured a statement from a California regulatory agency that said it doesn't need to hold two state licenses that are required for some companies providing financial services in the state.

By Lynne Marek • Feb. 24, 2022 -

Washington policymakers spout off on CBDC

With rising individual and institutional interest in digital assets, policymakers in Washington are cranking up their public discussion of the possibility of a digital dollar. Federal Reserve Gov. Lael Brainard weighed in last week and the Congressional Research Service did earlier this month.

By Lynne Marek • Feb. 22, 2022 -

Klarna puts BNPL on a card

After a U.K. rollout last month, the Swedish buy now-pay later firm is bringing its physical Visa card to the U.S. – but not before making prospective cardholders wait.

By Caitlin Mullen • Feb. 17, 2022 -

Payments, crypto executives do C-suite shuffle

Another wave of payments and crypto executives are making a move as the demand for C-suite talent rises in a realm that's experiencing significant expansion and intense competition.

By Lynne Marek • Feb. 17, 2022