Banking: Page 55

-

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry, ACI pounce on FedNow

The companies are gearing up to add U.S. real-time services for customers with the mid-year launch of the Federal Reserve instant payments system.

By Lynne Marek • March 3, 2023 -

Synchrony, Bread brace for potential late fee cap impact

If a late fee cap is imposed by the Consumer Financial Protection Bureau, the companies may curtail credit and seek other offsets, executives said this week.

By Caitlin Mullen • March 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Visa aims to lower credit surcharge

The card network plans to reduce the credit card surcharge that merchants can impose on consumers, but the proposal is facing pushback.

By Lynne Marek • March 2, 2023 -

Fiserv discloses 7% drop in workforce

As the company cut 3,000 employees, Fiserv’s employee termination costs nearly doubled to $187 million in 2022.

By Caitlin Mullen • March 2, 2023 -

CFPB’s fate at stake in Supreme Court case

The high court’s decision could set a precedent for future actions, challenging everything the CFPB has done, said Scott Pearson, a partner in Manatt's consumer financial services practice.

By Anna Hrushka • March 1, 2023 -

Mastercard embraces nationalism

The card company isn’t shying away from countries in which the governments are taking a more insular approach to building their payments systems.

By Lynne Marek • March 1, 2023 -

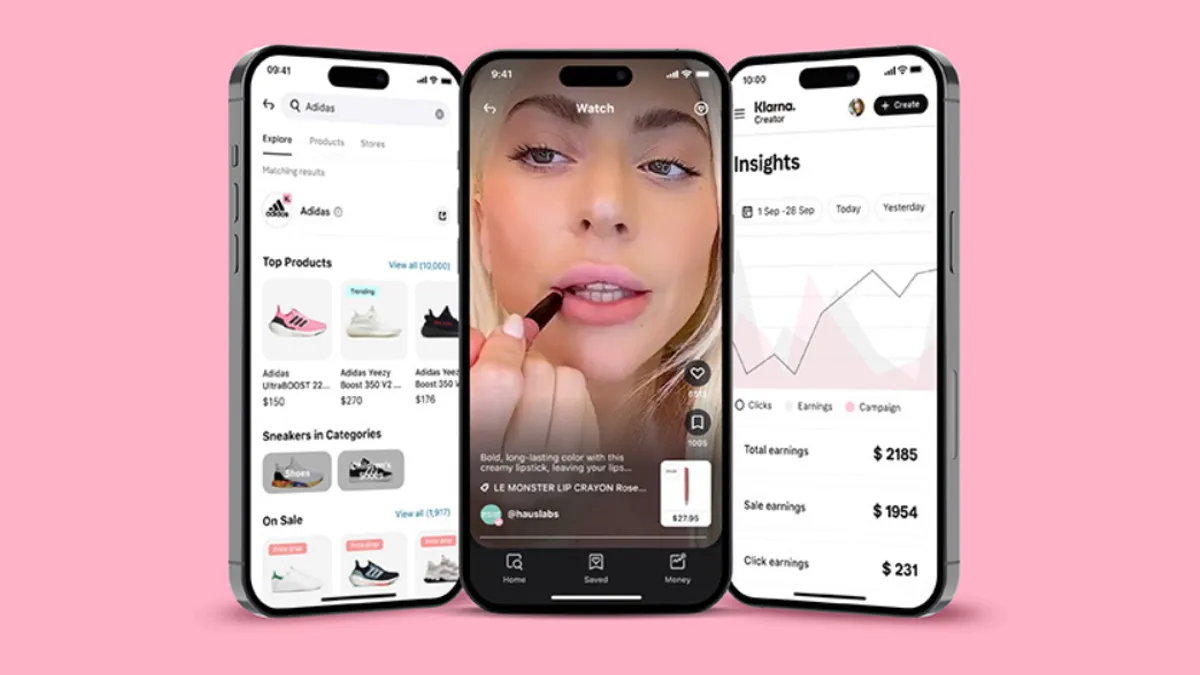

Klarna’s growth comes at a cost

The buy now, pay later pioneer kept up growth despite employee cuts last year. The credit loss rate edged up too.

By Lynne Marek • Feb. 28, 2023 -

Battle over expected Durbin bill ensues

A credit union trade group railed against expected credit card processing legislation aimed at Visa and Mastercard before a bill has even been introduced in Congress this year.

By Lynne Marek • Feb. 27, 2023 -

Remitly to shutter digital banking platform Passbook

The Seattle-based remittance fintech launched Passbook in 2020. The product, however, hasn’t garnered significant overlap with existing customers, Remitly CEO Matt Oppenheimer said.

By Anna Hrushka • Feb. 27, 2023 -

Transparency key to crypto’s next phase: Circle CFO

USDC issuer Circle is moving to become a public company, its CFO said, even as regulatory attention on the space sharpens.

By Grace Noto • Feb. 24, 2023 -

Green Dot juggles customer changes

The banking-as-a-service company posted profits in the final quarter of last year even as it recovered from the loss of clients.

By Lynne Marek • Feb. 24, 2023 -

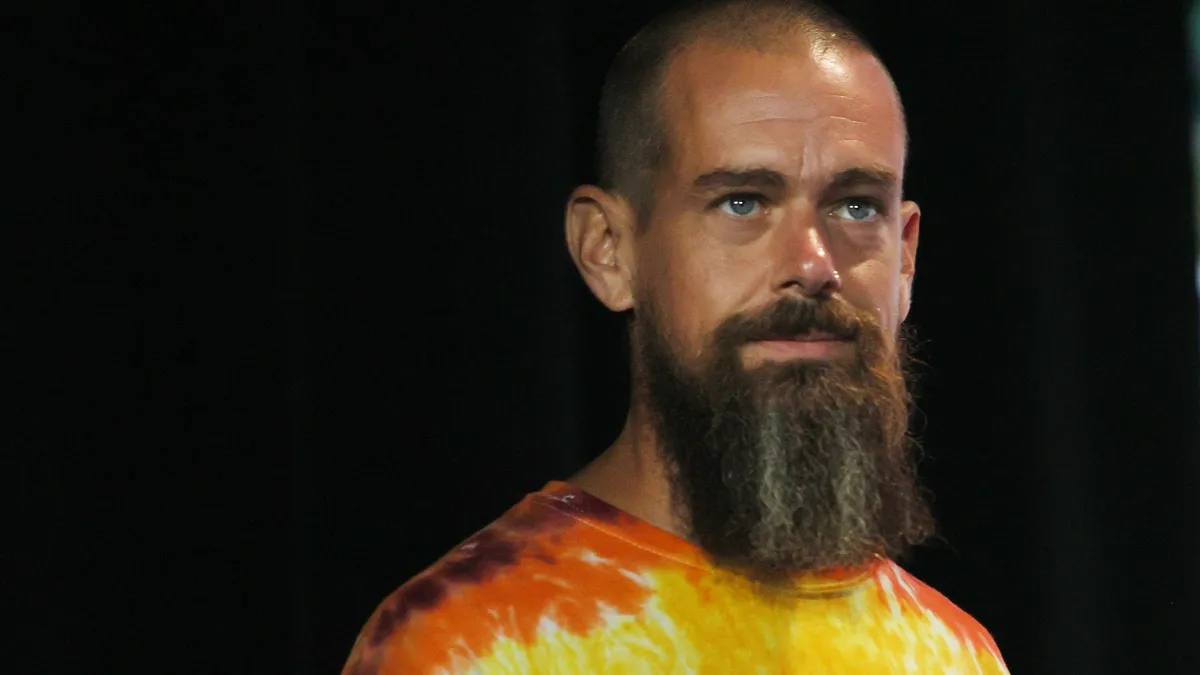

Block boosts Ahuja’s responsibilities

Pledging to be more efficient with a revamp of the company’s leadership structure, Block has combined the CFO and COO roles under Amrita Ahuja.

By Caitlin Mullen • Feb. 24, 2023 -

GoDaddy launches payable domain service

GoDaddy now offers its business owner clients a digital payment tool that is customizable to their company branding.

By Tatiana Walk-Morris • Feb. 24, 2023 -

FedNow aims to avoid Zelle-type fraud

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

By Lynne Marek • Feb. 23, 2023 -

Same-day, B2B payments fuel ACH growth

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

By Tatiana Walk-Morris • Feb. 23, 2023 -

Discover launches tech website

The card company joined the Linux Foundation and Fintech Open Source Foundation as part of a broader investment into its developer ecosphere.

By Matt Ashare • Feb. 23, 2023 -

Discover debit reboot gets marketing assist

The card company is betting its soon-to-be relaunched debit account services will help it better compete with fintech and neobank rivals.

By Caitlin Mullen • Feb. 22, 2023 -

Klarna touts US as largest market

The Swedish buy now, pay later provider aims to keep growing in the U.S. with new services despite the intense competition.

By Lynne Marek • Feb. 22, 2023 -

Discover to implement gun code in April: report

The newly published code will be part of Discover’s policy and product update for merchants and payment partners in April, a spokesperson told Reuters.

By Caitlin Mullen • Feb. 21, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB warns card issuers on credit reports

The Consumer Financial Protection Bureau has threatened action over card issuers not reporting full consumer payment data for tracking credit histories.

By Lynne Marek • Feb. 21, 2023 -

Credit card debt surpasses pre-pandemic levels: Fed

Despite a pause in payments required for federal student loans, younger borrowers particularly are showing higher credit card delinquencies.

By Tatiana Walk-Morris • Feb. 17, 2023 -

Paymentus hands interim CFO severance benefits

The company called the severance benefits’ approval a formality. But one expert said it is likely a retention strategy designed to encourage the interim CFO to “stick around.”

By Maura Webber Sadovi • Feb. 16, 2023 -

Column

Debit routing rule tables turned on regulators

Bank card issuers say there isn’t enough network competition to meet the July debit card routing rule deadline, adopting regulators’ argument to push back.

By Lynne Marek • Feb. 16, 2023 -

Branch draws Uber, others into fold

After landing Uber as a client, the worker payment services company has recently attracted other logistics and delivery clients with help from that big name.

By Caitlin Mullen • Feb. 16, 2023 -

Retailers oppose banks seeking more time on debit routing rule

Banks requested a delay in implementing a debit routing rule, but a retail and merchant trade group argued it’s high time the card issuers comply.

By Lynne Marek • Feb. 15, 2023