Banking: Page 51

-

Citizens Bank to pay $9M to settle disputed-charge suit

The CFPB said the bank, in 2015, improperly denied customer reports of fraud and unauthorized use and, in some cases, failed to fully reimburse users.

By Dan Ennis • May 24, 2023 -

Opinion

Give EWA a chance

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

By Brian Tate • May 24, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

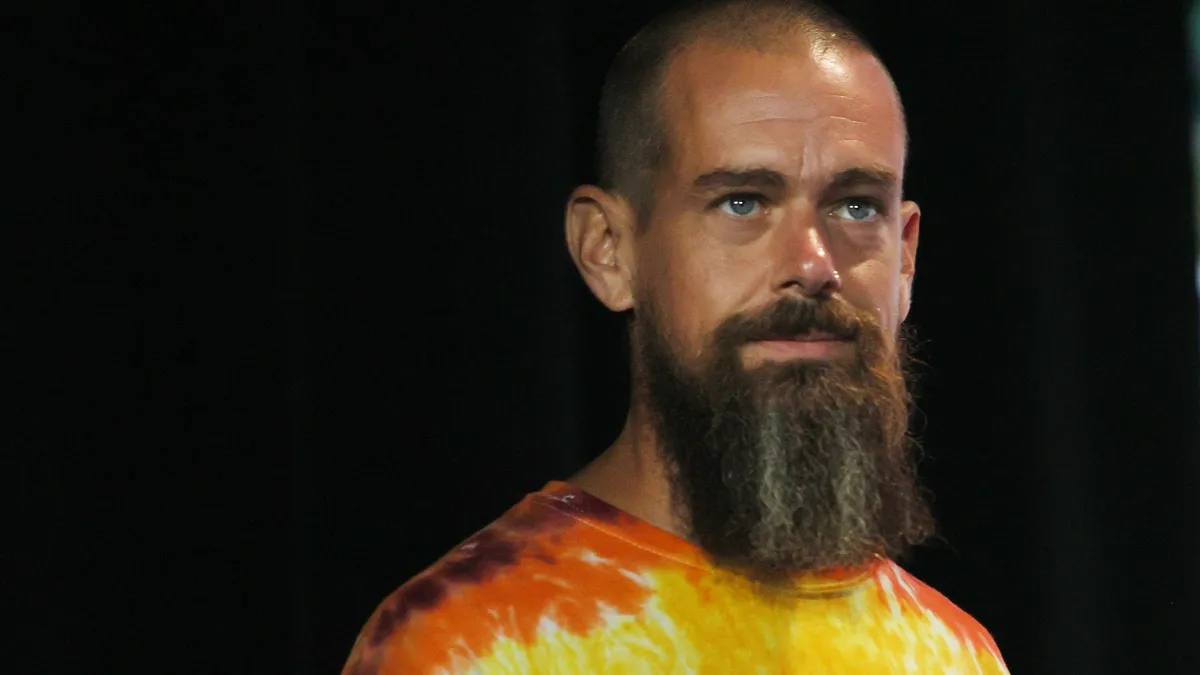

Cash App pursues older, affluent customers

The Block business is seeking older, higher-income users as it pursues diversified growth, CEO Jack Dorsey said.

By Caitlin Mullen • May 24, 2023 -

Venmo to launch teen account

The move is part of PayPal’s plan to lean on Venmo to lure more users.

By Tatiana Walk-Morris • May 23, 2023 -

Credit popularity doesn’t displace cash: Fed report

Credit cards were the most used payment method last year in the U.S., but cash demand remains stable, a Fed report showed.

By Caitlin Mullen • May 23, 2023 -

Legislators spar over stablecoin proposals

Lawmakers agree stablecoin legislation is needed to ensure the U.S. establishes itself as a leader in the space.

By Caitlin Mullen • May 22, 2023 -

NY Fed teams with Singapore on CBDC study

The two central banks tested digital ledger technology for payments across multiple currencies in less than 30 seconds.

By Lynne Marek • May 22, 2023 -

Fed official stresses importance of dollar’s standing

“For the dollar to maintain its status, it is important for U.S. elected officials and other policymakers to make decisions that instill confidence in our economy and institutions,” a New York Fed official said Thursday.

By Tatiana Walk-Morris • May 19, 2023 -

PayPal urged to accelerate CEO search

The digital payments pioneer faces pressure from investors to name CEO Dan Schulman’s successor sooner rather than later.

By Lynne Marek • May 16, 2023 -

Card debt weighs on consumers

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

By Caitlin Mullen • May 16, 2023 -

Revolut CFO leaves digital bank for ‘personal reasons’

The company’s finance head is the latest to depart the troubled fintech as it fends off regulatory and financial concerns.

By Grace Noto • May 15, 2023 -

Catch chases in-store opportunity

Currently focused on e-commerce, Catch seeks to bring its ACH payment option into stores.

By Caitlin Mullen • May 15, 2023 -

Opinion

How to advance cross-border B2B payments

“Regional regulatory bodies must work together on common financial standards that support multilateral payment systems if we are to make progress,” writes one payments professional.

By Scott Frisby • May 15, 2023 -

Paysend charges into US market

From a new U.S. headquarters in Miami, the British cross-border payments company is pitching services to U.S. businesses and consumers.

By Lynne Marek • May 12, 2023 -

Discover pursues ESG goals

The card company this week issued a new report on the environmental, social and corporate governance aspects of its business and its aspirations.

By Tatiana Walk-Morris • May 12, 2023 -

Everee takes on EWA providers

The payroll provider is angling to disrupt the earned wage access companies that have been making it easier for employers to offer workers on-demand pay.

By Lynne Marek • May 11, 2023 -

Marqeta to cut workforce by 15%

The card-issuing fintech plans to dismiss about 150 employees in an effort to become profitable. It aims to reduce annual costs by as much as $45 million.

By Lynne Marek • May 10, 2023 -

Senators call out banks on card late fees

A group of lawmakers asked the CEOs of large credit card issuers to explain their late fee practices.

By Caitlin Mullen • May 9, 2023 -

PayPal growth driven by Braintree

PayPal's Braintree unit is bolstering the company's growth, but that expansion isn't as profitable as building its legacy business.

By Lynne Marek • May 9, 2023 -

Green Dot braces for profit margin pressure

Green Dot expects profit margins to be squeezed in coming quarters after the exit of some clients last year.

By Caitlin Mullen • May 8, 2023 -

Synchrony, Wells Fargo, Bread Financial lead medical credit card market: CFPB

The medical credit card industry has expanded in recent years as healthcare providers promoted the cards to patients, the agency said in a report.

By Tatiana Walk-Morris • May 8, 2023 -

Block boosts compliance spending to $160M

Square parent Block is increasing compliance spending on personnel and software this year.

By Caitlin Mullen • May 5, 2023 -

Battle ensues over CFPB proposal to cap late fees

Supporters and opponents of the CFPB’s proposal to cap late fees at $8 clashed in comments to the agency in recent weeks.

By Lynne Marek • May 5, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry preps clients for FedNow

The financial technology provider is encouraging clients to be prepared to receive payments through FedNow.

By Caitlin Mullen • May 3, 2023 -

Andreessen Horowitz partners spy payments play

Gaming, cannabis and telehealth are some of the “high-risk” niches that would benefit from more vertical-specific payments software, two partners for the firm contend.

By Lynne Marek • May 3, 2023