Banking: Page 47

-

PayPal closes in on new CEO

Digital payments titan PayPal is nearing a decision on who will be its next CEO, with the company circling a short list of candidates.

By Lynne Marek • Aug. 3, 2023 -

Senate ‘making good progress’ on pot banking bill, Schumer says

There may be bipartisan agreement on SAFE Banking’s goal to help the cannabis industry enter the banking fold, but lawmakers are reportedly haggling over some of the bill’s details.

By Anna Hrushka • Aug. 2, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

FIS, Fiserv revenue growth slows in banking

For both mega-processors, sluggish revenue in their banking segment is causing a drag on overall revenue growth.

By Lynne Marek • Aug. 2, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

RTP takes on FedNow

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

By Lynne Marek • July 31, 2023 -

Fiserv racks up merchants for pay-by-bank services

The Federal Reserve’s new instant payments system is driving more merchant interest in pay-by-bank capabilities for consumers, a Fiserv executive said.

By Caitlin Mullen • July 31, 2023 -

Opinion

It’s time for a new payday approach

“It's time to question whether this traditional approach to paying employees is still the most efficient and equitable,” writes one earned wage access CEO.

By Kevin Coop • July 28, 2023 -

Wex acquires Ascensus unit for $180M

In addition to the Ascensus health and benefits unit purchase, Wex said it will invest up to $100 million in a new venture arm.

By Lynne Marek • July 28, 2023 -

Mastercard waits on FedNow

While Mastercard participates in real-time payment systems in other countries, it’s holding back for now on the new U.S. instant payments network.

By Lynne Marek • July 27, 2023 -

Photo by Bia Santana from Pexels.

Fiserv bets on Latin America

“Latin America has been a standout grower in recent quarters, and we believe it can remain so for the long term,” Fiserv CEO Frank Bisignano said Wednesday during an earnings call.

By James Pothen • July 27, 2023 -

PayPal deepens Microsoft partnership

In an expansion of a prior tie, software colossus Microsoft will increase the ways customers can use PayPal tools to purchase goods and services.

By Lynne Marek • July 26, 2023 -

Visa CEO bashes surcharges

“It’s not a great customer experience,” Visa CEO Ryan McInerney said of merchant surcharges, while speaking on an earnings webcast Tuesday.

By Lynne Marek • July 26, 2023 -

Apple Pay Later makes gains: survey

Apple Pay Later is gaining traction with consumers after a rollout earlier this year, according to a survey from JD Power.

By James Pothen • July 25, 2023 -

How FedNow may affect businesses

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

By Suman Bhattacharyya • July 25, 2023 -

Payments venture funding skids

Venture capital interest in payments startups plunged in the second quarter, according to a CB Insights report.

By Lynne Marek • July 24, 2023 -

Will payments M&A pick up after slow start?

Despite a flurry of payments acquisitions recently, deal activity was slow in the first half of the year and some factors are still suppressing M&A.

By Caitlin Mullen • July 24, 2023 -

Amex corporate client growth ebbs

U.S. commercial card services volume grew 2% in the second quarter, relative to the year-ago period, American Express said in a Friday earnings report.

By Caitlin Mullen • July 21, 2023 -

Opinion

FedNow’s launch ‘is just the start’

Direct access to the Fed’s payments system for nonbanks — specifically payments companies — will push the U.S. more fully into payments modernization, writes an executive from cross-border payments company Wise.

By Brigit Carroll • July 21, 2023 -

Apple pursues global payments, pushing into Morocco

The tech giant also launched the app in South Korea in March, and in four Latin American countries in May.

By James Pothen • July 20, 2023 -

Whole Foods to deploy Amazon One chainwide

The chain plans to offer the palm recognition and payment system at all of its more than 500 stores by the end of 2023, Amazon announced Thursday.

By Sam Silverstein • July 20, 2023 -

Photo by Tima Miroshnichenko from Pexels

Q&A

Q&AClair CEO welcomes on-demand pay regulation

Clair CEO Nico Simko weighed in on whether EWA is a payday loan and how the company offers fee-free wage access.

By James Pothen • July 20, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover facing FDIC probe

The company also disclosed during its 2Q earnings report that a pricing issue affected merchants and merchant acquirers, some of whom will get refunds.

By Caitlin Mullen • July 20, 2023 -

FedNow goes live for banks, credit unions

The Fed’s long-awaited instant payments system arrived right on time, giving consumers and businesses a new route for speedier transactions.

By Lynne Marek • July 20, 2023 -

CCCA opponents brace for defense bill move

Opponents of the Credit Card Competition Act proposal are gearing up to fight the bill as an attachment to the National Defense Authorization Act.

By Lynne Marek • July 19, 2023 -

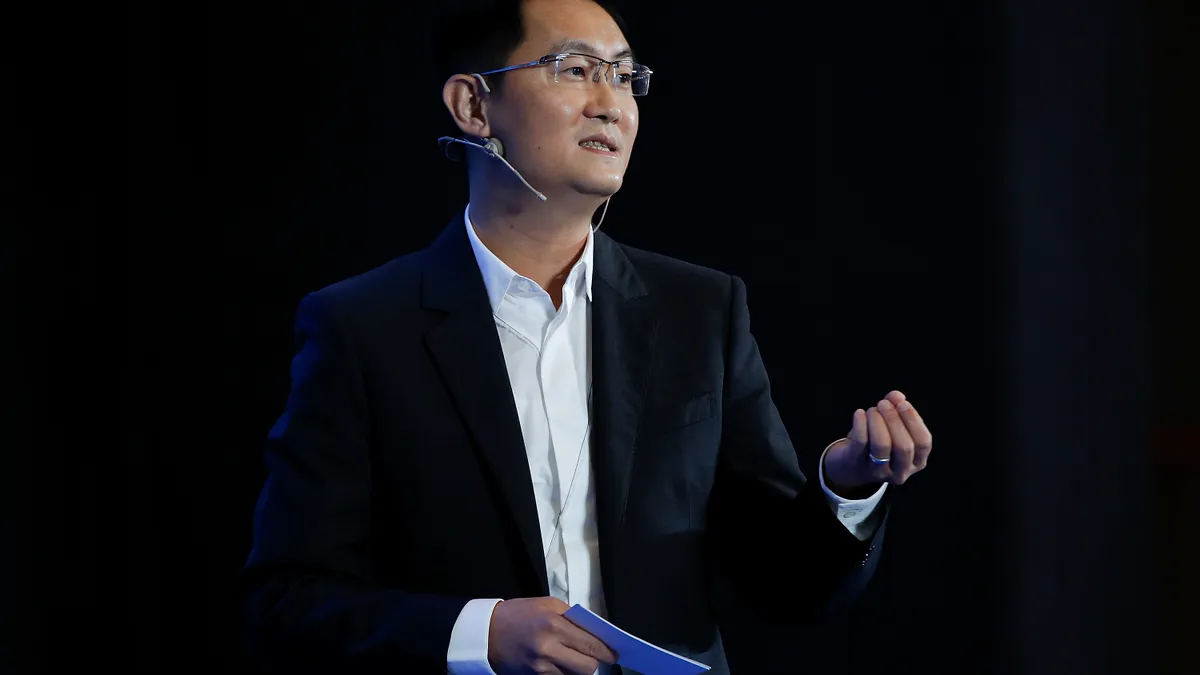

Flywire, Tencent partner on cross-border education payments

The international payments software firm aims to give Chinese students abroad a tool for paying tuition using their home country’s most popular digital wallet.

By James Pothen • July 19, 2023 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB, European regulator open a dialogue on digital rules

Buy now, pay later platforms, artificial intelligence and other developments “if left unchecked, could increase consumers’ exposure to fraud and manipulation,” the regulators said Monday.

By Rajashree Chakravarty • July 18, 2023