Banking: Page 39

-

Senators prod CFPB on BNPL oversight

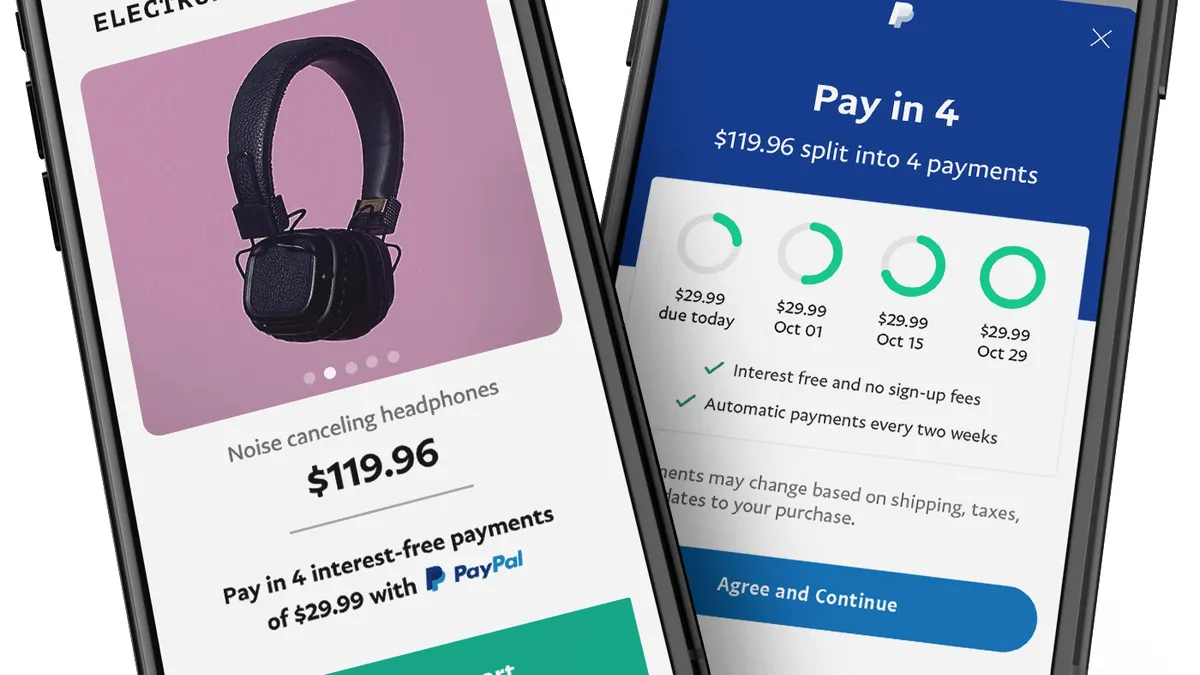

Three Democratic lawmakers worried about financially vulnerable consumers during the holiday shopping season urged the Consumer Financial Protection Bureau to keep an eye on buy now, pay later offerings.

By Lynne Marek • Dec. 19, 2023 -

Q&A

Amex EVP weighs in on fraud trends

Beating back fraud can feel “a bit like a vicious circle,” as the industry improves its capabilities and fraudsters pivot, said Tina Eide, an executive vice president focused on fraud at the card issuer.

By Caitlin Mullen • Dec. 19, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

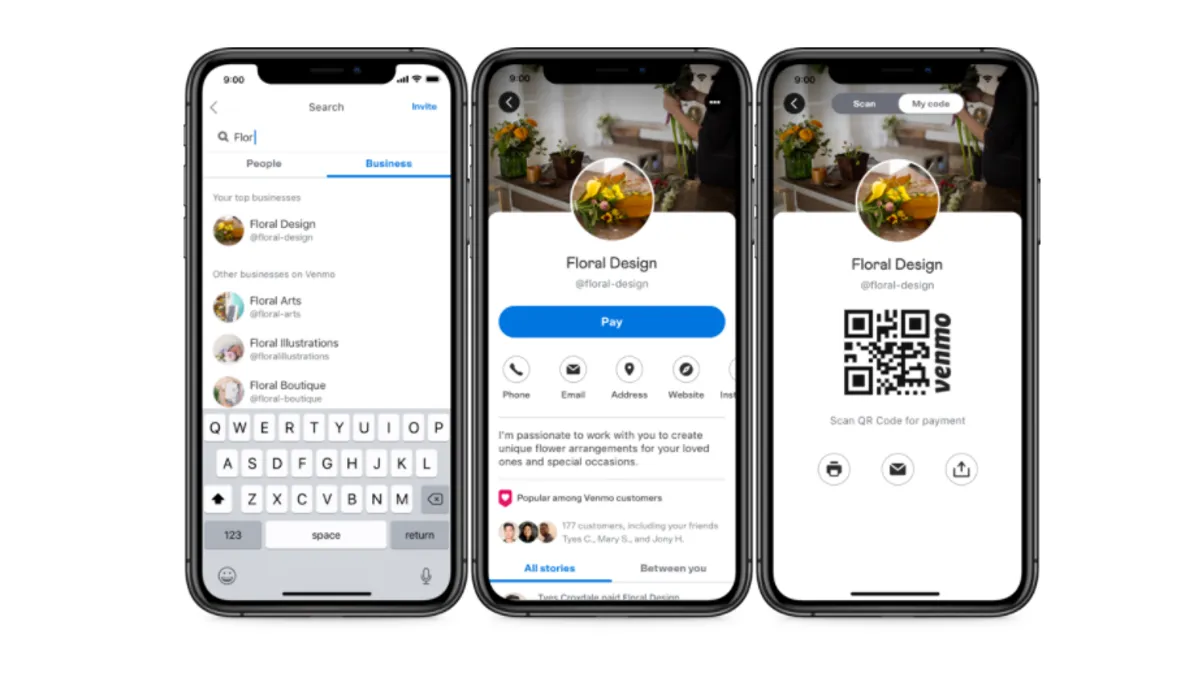

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

SEC won’t budge on crypto regulation

In denying a petition submitted by Coinbase, the agency has concluded rulemaking isn’t needed for issuers and intermediaries to know which – and how – crypto assets fit within securities law.

By Robert Freedman • Dec. 18, 2023 -

Visa seeks majority stake in Mexico payments processor

The card network giant said it plans to purchase a controlling interest in Prosa, with banks retaining a minority stake, subject to regulatory approvals.

By Lynne Marek • Dec. 15, 2023 -

Profile

Simon Khalaf channels energy into scaling Marqeta

Serial entrepreneur and tech executive Simon Khalaf is known for his boundless enthusiasm and energy. Now, the Marqeta CEO is tasked with taking the card issuing fintech to the next level amid increased competition.

By Caitlin Mullen • Dec. 15, 2023 -

Marshall keeps up CCCA crusade

Sen. Roger Marshall acknowledged the Credit Card Competition Act bill may not get a vote this year, but he intends to keep pushing for passage in 2024.

By Lynne Marek • Dec. 15, 2023 -

Fraud emerges as concern for FedNow users

The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system.

By Lynne Marek • Dec. 15, 2023 -

Senators keep pressure on PayPal, Block

Senate Democrats urged top executives at PayPal and Block, in another round of letters, to improve reimbursement for victims of payment scams.

By Lynne Marek • Dec. 14, 2023 -

Authorized payment scams climb in US

Such scams are expected to jump 50-plus percent to $3 billion by 2027, forcing financial institutions to address the rising threat, according to a new report.

By Tatiana Walk-Morris • Dec. 14, 2023 -

Synchrony, Bread plan offsets to late fee cap

“I want that shoe to drop so we can start mitigating that issue,” Bread CEO Ralph Andretta said last week, as the industry awaits the CFPB’s final rule.

By Caitlin Mullen • Dec. 14, 2023 -

Google-Epic trial outcome undercuts app payment model

The jury verdict in favor of Epic Games challenges the Google Play app store model that forces payments through its system, with fees up to 30% on sales.

By Robert Freedman • Dec. 13, 2023 -

FedNow may have spurred RTP adoption

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

By Lynne Marek • Dec. 13, 2023 -

The Clearing House revamps leadership

Since his arrival in February, The Clearing House CEO David Watson has been remaking the company’s executive suite, with another appointment this week.

By Lynne Marek • Dec. 12, 2023 -

Retrieved from Discover Financial Services on December 11, 2023

Retrieved from Discover Financial Services on December 11, 2023

Discover’s new CEO brings bank experience

Michael G. Rhodes, previously the group head for Canadian personal banking at TD Bank Group, will take the helm at Discover in March.

By Caitlin Mullen • Updated Dec. 12, 2023 -

Mastercard ties growth to digital strategy

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

By Lynne Marek • Dec. 11, 2023 -

Discover to spend at least $500M on compliance next year

“We’re going to continue to invest whatever we have to invest in order to get the compliance issues behind us,” CFO John Greene said last week.

By Caitlin Mullen • Dec. 11, 2023 -

Durbin bashes United Airlines in CCCA fight

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

By Lynne Marek • Dec. 8, 2023 -

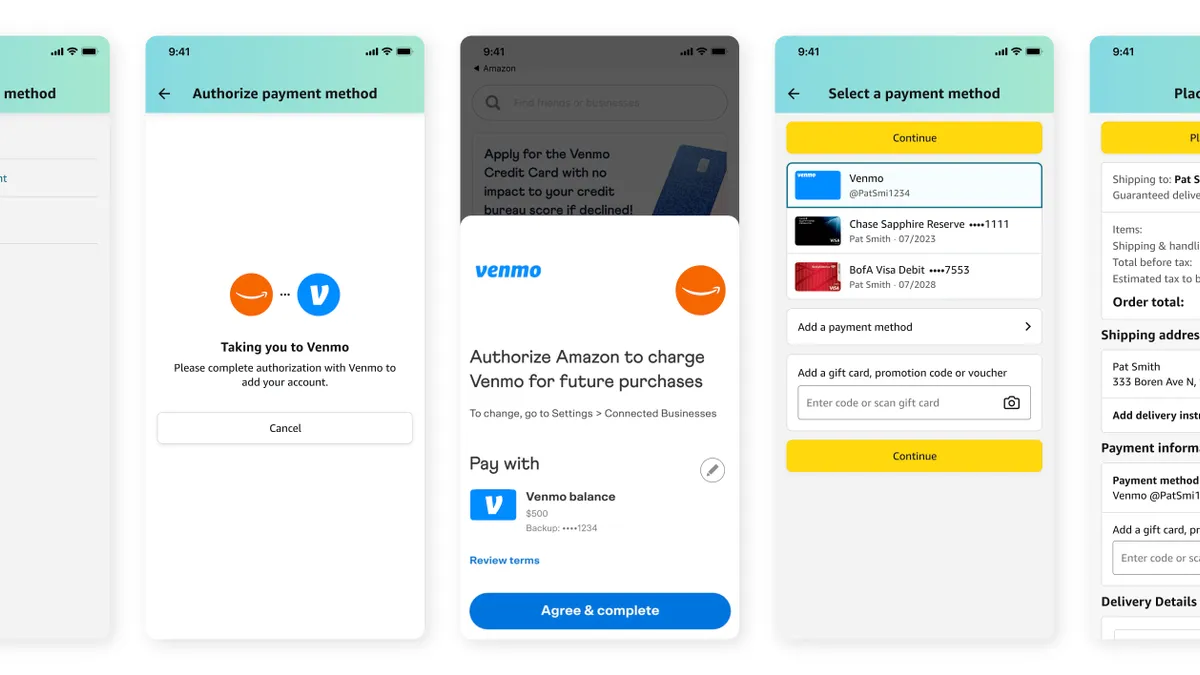

Amazon drops Venmo users

Jettisoning Venmo from the retail juggernaut’s marketplace is another strike against PayPal’s recent growth efforts.

By Lynne Marek • Dec. 7, 2023 -

Fiserv resurrects growth officer role for M&A focus

The payments processor has hired an enterprise growth officer who will zero in on M&A, strategy and ventures for the company.

By Caitlin Mullen • Dec. 7, 2023 -

PayPal taps Fiserv exec for top post

PayPal’s new CEO is making executive suite changes, creating a president of global markets post and tapping a payments industry veteran for the role.

By Lynne Marek • Dec. 6, 2023 -

Amex CEO talks co-brand partnerships after Apple reports

The card issuer’s premium designation isn’t compatible with all potential card issuing partners, Amex CEO Steve Squeri said Tuesday.

By Caitlin Mullen • Dec. 6, 2023 -

Banked builds a US presence

The fintech, founded in the U.K. and now building up operations in the U.S., expects its pay-by-bank services for bank clients will eventually lure retailers.

By Lynne Marek • Dec. 4, 2023 -

Sponsored by U.S. Bank

4 questions to ask when considering a new corporate card program

From increased expense visibility and control to added efficiencies and rebates, a commercial card is more than a card—it’s a strategic component of your financial strategy.

Dec. 4, 2023 -

FIS eyes small acquisitions

Fidelity National Information Services is on the hunt for smaller acquisitions in one of its divisions, and it’s benefitting from other companies’ deals in another.

By Lynne Marek • Dec. 1, 2023 -

Who wants Apple’s credit card? Analysts weigh in.

Synchrony, American Express and Capital One have all been floated by analysts as potential successors to Goldman Sachs for Apple’s credit card.

By James Pothen • Dec. 1, 2023