Banking: Page 17

-

Stripe employee share sale may mean delayed IPO

An internal sale of stock to workers may mean the company won’t pursue a public offering anytime soon, consultants and analysts said.

By Patrick Cooley • Feb. 25, 2025 -

Will Global Payments sell its issuer business?

Some analysts are pressing the processor to consider divesting the segment that caters to financial institutions, even as its merchant segment grapples with competition.

By Lynne Marek • Feb. 24, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

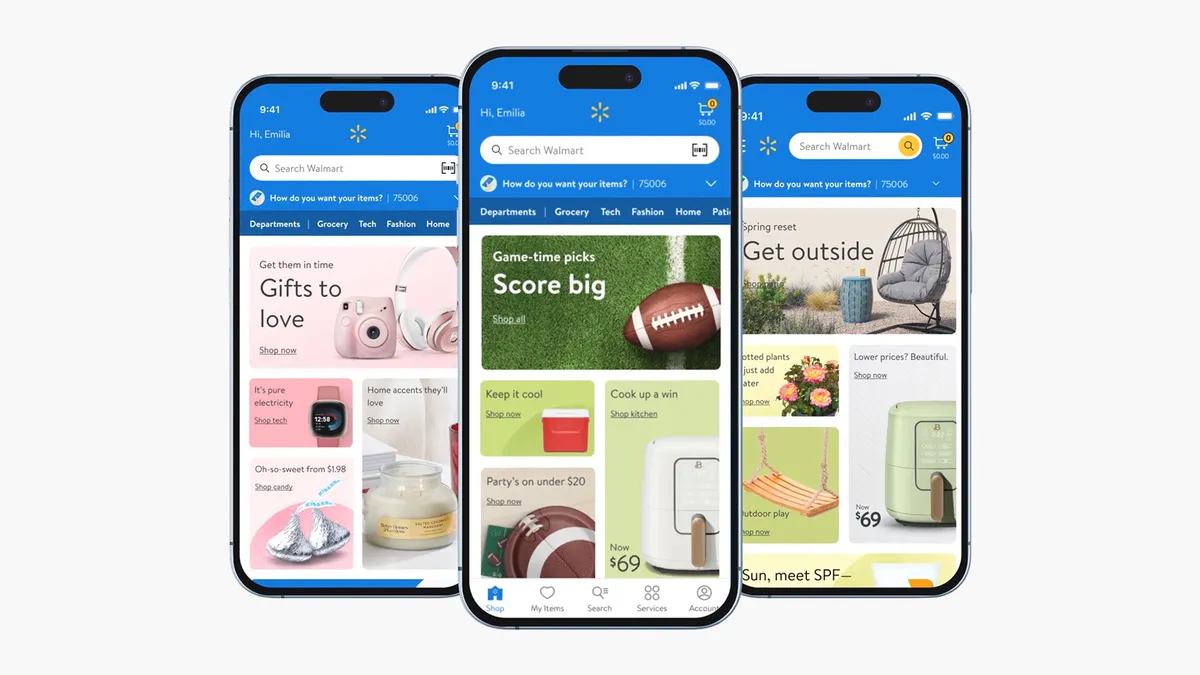

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fed’s Barr warns of weaker regulation, supervision

The Fed board, he said, should resist initiatives that impede effective supervision by discouraging examiners to flag issues early, or ones that add to the process unnecessarily, he said.

By Rajashree Chakravarty • Feb. 21, 2025 -

23 AGs line up behind Baltimore in CFPB case

Efforts to shutter the agency are against public interest, the AGs said. The CFPB’s attorneys argue it’s in the public interest to act “consistent[ly] with the philosophy of a new administration brought about by a national election."

By Dan Ennis • Feb. 21, 2025 -

Worldwide card use to jump 43% by 2029, Nilson predicts

Nonetheless, credit, debit and prepaid card transactions will expand at the slowest rate in the U.S., relative to other regions in the world, the research firm Nilson Report forecast.

By Lynne Marek • Feb. 21, 2025 -

Opinion

How stablecoins may extend US dollar supremacy

“Dollar-based stablecoins such as USDT and USDC are traded all over the world at any time of the day, regardless of holidays, time zones, and whether markets are open or closed,” writes the CEO of an embedded finance company.

By Bam Azizi • Feb. 20, 2025 -

Waller sees stablecoins advancing in retail

Stablecoins are seeping into payments at stores, but there are plenty of hurdles before they become widely used, according to Federal Reserve Governor Christopher Waller.

By Lynne Marek • Feb. 20, 2025 -

Shame drives rampant underreporting of fraud

Push-payment scams are at a "crisis level," consumer advocates at a Payments Dive virtual event said, with losses totaling perhaps more than 15 times what's reported.

By Gabrielle Saulsbery • Feb. 19, 2025 -

Cap One, Discover shareholders approve merger

Stockholders of the two companies approved the big bank's $35.3 billion acquisition in separate meetings Tuesday.

By Patrick Cooley • Feb. 19, 2025 -

Fed delays start of new Fedwire standard

The central bank postponed a deadline for banks and credit unions to move Fedwire payments to the ISO 20022 format. That may also hold up a broader industry modernization effort.

By Lynne Marek • Feb. 19, 2025 -

Payments players mull new approaches to fraud

Google, Nacha, Early Warning Services and Truist are among the companies seeking to better protect the e-commerce ecosystem from push-payment scams.

By Lynne Marek • Feb. 18, 2025 -

How payment scams start on social media

Bad actors contact consumers through social media and then persuade them to send money over payment platforms, a JPMorgan Chase payments executive said during a Payments Dive virtual event.

By Patrick Cooley • Feb. 18, 2025 -

FIS acquires Demica, Dragonfly

Fidelity National Information Services has been buying up businesses as it seeks to expand, especially in providing services to chief financial officers and in the digital arena.

By Lynne Marek • Feb. 13, 2025 -

Georgia special charter attracts another applicant

The move follows the approval of payment processing company Fiserv’s application, which was approved in October, but payments industry consultants say the path to using such a charter is a rocky one.

By Patrick Cooley • Feb. 13, 2025 -

Wise to close Tampa office, cut 300 employees

The fintech will shutter its Florida location in November, with layoffs starting in April. Wise will consolidate Americas teams in Austin, New York and São Paulo.

By Rajashree Chakravarty • Feb. 12, 2025 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

Ex-FDIC official McKernan tapped to lead CFPB

The development came on a day when the bureau terminated roughly 70 probationary employees, including enforcement division attorneys, according to Bloomberg Law.

By Dan Ennis • Feb. 12, 2025 -

Discover flags potential Cap One merger delay

Discover Financial Services said it now expects the transaction to be completed by May 19, three months later than initially expected as the companies await regulatory approvals.

By Patrick Cooley • Feb. 12, 2025 -

Opinion

Payment tools proliferate, consolidation looms

“The winners in this consolidation won't necessarily be the biggest players,” writes a checkout technology company CEO. “They'll be the ones who understand that consumers don't want more payment options — they want better ones.”

By Justin Grooms • Feb. 12, 2025 -

Klarna, JPMorgan to offer BNPL to business clients

The collaboration will let the bank’s payments division offer the buy now, pay later company’s financing options to business customers.

By Patrick Cooley • Feb. 11, 2025 -

CFPB’s future hangs in the balance after a wild weekend

Consumer Financial Protection Bureau staff were told to work remotely this week after a new acting chief halted agency supervision and enforcement. He also told the Federal Reserve the agency wouldn't take any unappropriated funding next quarter.

By Dan Ennis • Feb. 10, 2025 -

Senators reintroduce bill to bar CBDC

Republican senators revived a bill last week to block the Federal Reserve from creating a central bank digital currency.

By Lynne Marek • Feb. 10, 2025 -

Affirm to emphasize no-interest loans

The company said that offering more interest-free financing options would drive profits by bringing in more customers.

By Patrick Cooley • Feb. 10, 2025 -

Treasury responds to concerns about Musk ‘meddling’

A Treasury Department official sought to allay a senator’s concerns about DOGE staffers gaining access to the U.S. payments system, but sidestepped questions Tuesday. The issue escalated at a Wednesday hearing.

By Lynne Marek • Feb. 6, 2025 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv doubles down on embedded finance

Company executives touted a recent partnership with DoorDash and said the company has more embedded finance deals in the pipeline.

By Patrick Cooley • Feb. 6, 2025 -

NCR Voyix shifts chairman to CEO post

The C-suite change this week follows the Atlanta-based digital commerce software company’s decision to sell off parts of its business.

By Tatiana Walk-Morris • Feb. 6, 2025