Banking: Page 12

-

Visa picks value-added services head

The global card network is shuffling its executive leadership as it bolsters efforts to sell ancillary software and advisory services.

By Tatiana Walk-Morris • June 5, 2025 -

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.

By Lynne Marek • June 4, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Airlines decry proposed card amendment

Airline and aviation industry stakeholders argue the Marshall-Durbin amendment to the GENIUS Act bill would harm consumers and workers by undercutting credit card revenue.

By Tatiana Walk-Morris • June 3, 2025 -

CFPB seeks to end open banking case

The Consumer Financial Protection Bureau and its former court foes are now in agreement: an open banking rule shouldn't be considered lawful.

By Lynne Marek • June 2, 2025 -

Illinois delays interchange law

Over the weekend, the state’s legislature voted to delay implementation of a law that would ban card interchange fees on tips and taxes.

By Lynne Marek • June 2, 2025 -

Baltimore drops lawsuit over CFPB’s move to return funds

Bureau leadership found there was no mechanism to transfer money the Federal Reserve had given the agency. Consumer advocates warned they could sue again if the CFPB tries again to defund itself.

By Dan Ennis • May 30, 2025 -

Conduit, Palla raise cross-border capital

The startups, which both offer cross-border payments, each closed on major capital-raising efforts this week.

By Tatiana Walk-Morris and Lynne Marek • May 30, 2025 -

Maryland passes EWA law

The state’s governor allowed an earned wage access bill to become law, over the objections of some consumer groups, including AARP.

By Lynne Marek • May 29, 2025 -

Remittance tax draws fintech pushback

The budget bill proposal moving through Congress would levy a tax on cross-border money transfers. That has prompted “strong concern” from one fintech organization.

By Lynne Marek • May 29, 2025 -

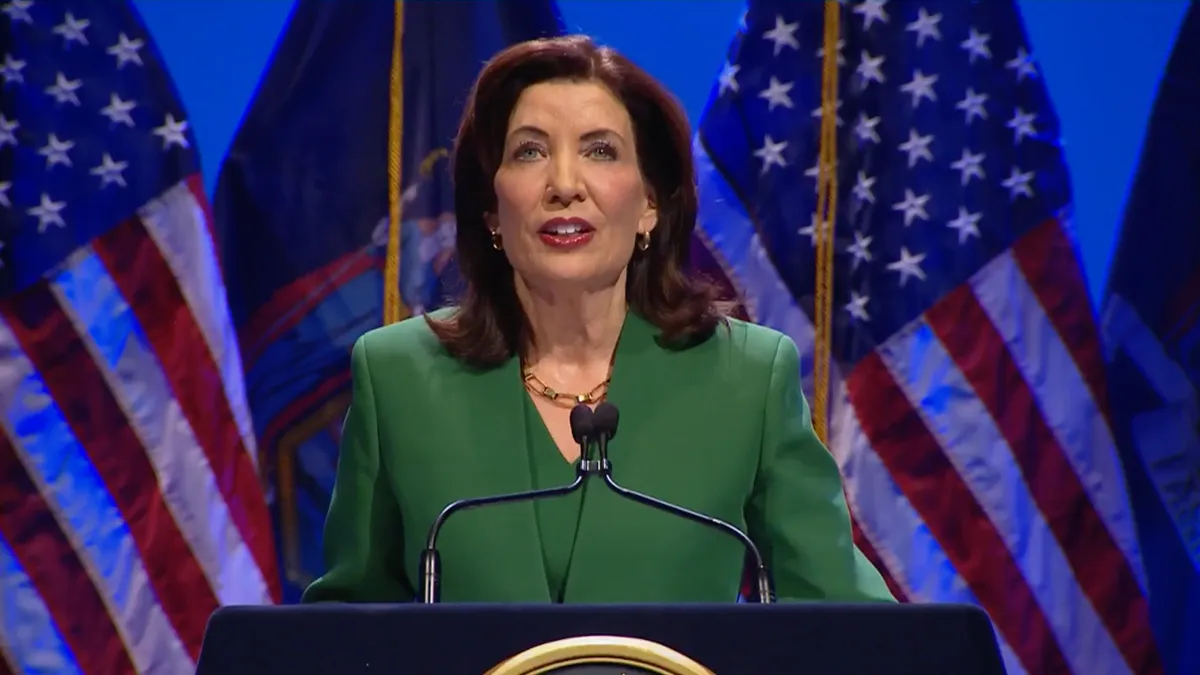

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York's rules treat buy now, pay later purchases too much like credit card transactions.

By Patrick Cooley • May 28, 2025 -

Credit card cap amendment stokes opposition

Industry trade groups for financial institutions have united to rail against legislation that could cap credit card interest rates.

By Lynne Marek • May 28, 2025 -

CFPB to yank ‘unlawful’ open banking rule

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

By Justin Bachman • May 27, 2025 -

Cash use declines as cards rise: Atlanta Fed

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

By Tatiana Walk-Morris • May 22, 2025 -

Durbin, Marshall push credit card amendment

Sens. Roger Marshall and Dick Durbin aim to add their Credit Card Competition Act legislation to the GENIUS stablecoin bill advancing in Congress.

By Lynne Marek • May 21, 2025 -

FIS quizzed on profit margins

The company’s chief financial officer was in the hot seat last week, explaining at an investor conference how he’ll bolster the bottom line.

By Lynne Marek • May 21, 2025 -

Capital One closes Discover deal

Completion of the combination results in the richest banking deal of the past six years and creates the nation’s largest credit card issuer.

By Dan Ennis • May 19, 2025 -

Why Mastercard invested in Corpay

The $300 million infusion in a cross-border partner creates a complementary tie, the network’s CFO said. It also comes as headwinds rise on that front.

By Lynne Marek • May 19, 2025 -

Amex offers virtual card to small businesses

The company has long provided the service to corporate clients, but this month started letting small business owners pay suppliers who accept Amex without a physical card.

By Patrick Cooley • May 19, 2025 -

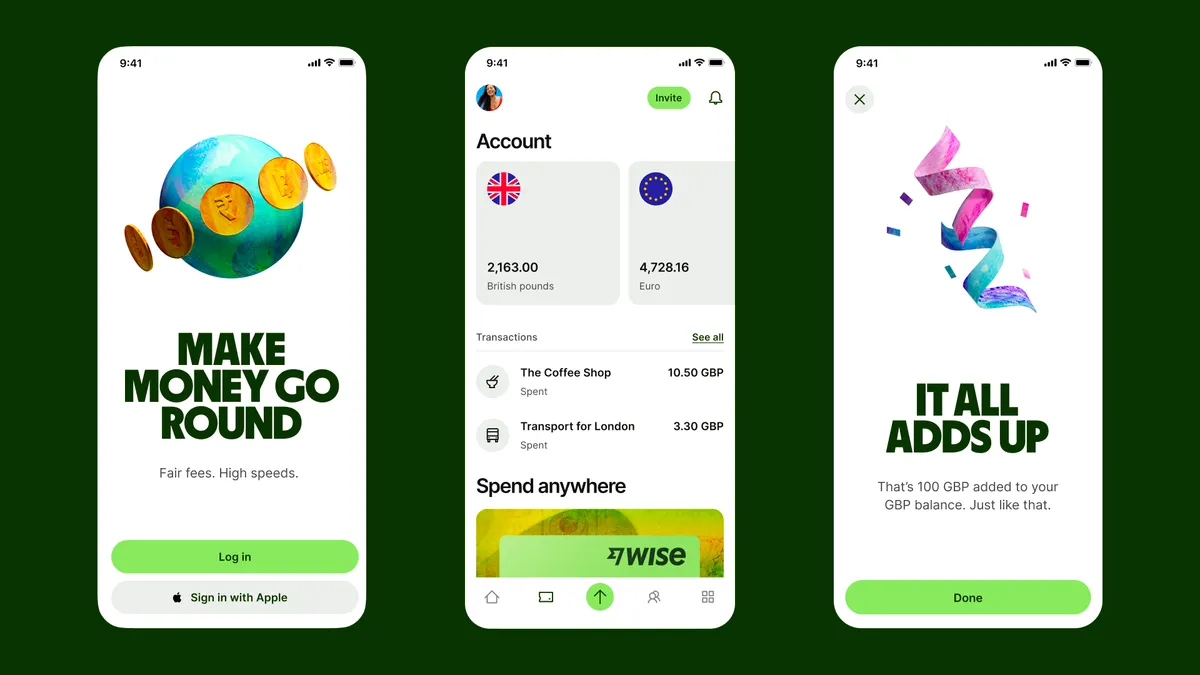

CFPB slashes Wise penalty

The U.S. unit of fintech Wise must pay the bureau $45,000 and roughly $450,000 in redress to affected customers – a far cry from the $2.5 million penalty issued in January.

By Rajashree Chakravarty • May 18, 2025 -

Opinion

Let’s scrap paper checks

If the federal government can ditch paper checks, so can the private sector, one industry CEO contends.

By Chase Gilbert • May 16, 2025 -

FTA to defend open banking in court

The Financial Technology Association will seek to protect a Consumer Financial Protection Bureau open banking rule after receiving a federal judge’s permission to intervene.

By Justin Bachman • May 15, 2025 -

Banks struggle to talk about fraud

Financial institutions battling an increase in fraud, particularly push-payment scams, have been stymied in sharing information that might help them better protect customers.

By Lynne Marek • May 15, 2025 -

Credit card delinquencies rise: NY Fed

Meanwhile, U.S. credit card balances declined and credit card aggregate limits inched up from the prior quarter, the New York Fed said.

By Tatiana Walk-Morris • May 15, 2025 -

Warren prods DOJ to block Capital One-Discover deal

The senator urged the Justice Department’s new antitrust czar, who's expressed concern over the creation of too-big-to-fail firms, to take action.

By Dan Ennis • May 14, 2025 -

Q&A

JPMorgan Chase taps payments tech head

The bank’s payments arm named Sri Shivananda to head up its technology operations this year. Now, he’s overseeing decisions on stablecoins, real-time transactions and other advances.

By Lynne Marek • May 14, 2025