The geography of online payments is changing – and fast.

Based on millions of processed transactions across 2023–2025, NOWPayments’ internal data reveals a decisive shift in how global consumers use crypto payment rails. While the United States remains the single largest market by volume, the growth patterns tell a far more complex story: demand is no longer concentrated in one region. Instead, crypto payments are expanding across multiple economic centers, each shaped by its own motivations, regulatory environments, and structural inefficiencies.

This emerging polycentric model is reshaping how merchants design their payment stacks and where they choose to expand.

And one conclusion is clear: payment leaders can no longer build for a single market at a time.

A New Pattern Emerges: A Distributed Global Demand Curve

According to NOWPayments data, the global demand for crypto payments is no longer dominated by one region. Instead, activity is now distributed across the U.S., Europe, and the Global South – each driving growth for different reasons.

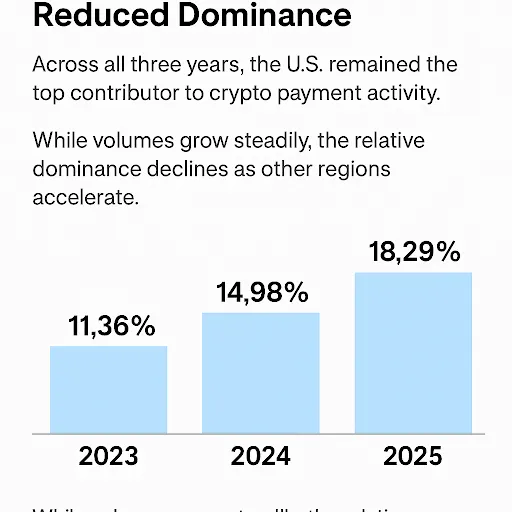

United States: Stable Leadership, Reduced Dominance

Across all three years of NOWPayments transaction data, the U.S. remains the top contributor:

- 2023: 11.36%

- 2024: 14.98%

- 2025: 18.29%

While volumes grow steadily, the relative dominance declines as other regions accelerate. Merchants now view the U.S. as an important market – but no longer the engine of global crypto adoption.

Global South: Volatile, Dynamic, and Increasingly Influential

Few trends illustrate the global shift as clearly as the rise of India and Nigeria in NOWPayments’ dataset.

India

- 2023: 31.08% (explosive surge)

- 2024: 5.53%

- 2025: 6.22%

Nigeria

- 2023: 10.99%

- 2024: 9.36%

- 2025: slightly below top-5 but maintaining strong engagement

Although numbers fluctuate year-to-year, the underlying pattern remains stable: Consumers in emerging markets increasingly rely on crypto rails to overcome traditional-payment friction.

Across NOWPayments merchants, crypto is often used as:

- a workaround for high acquiring fees,

- a solution for restrictive local banks,

- a faster route for cross-border commerce.

In these economies, crypto functions less as a speculative asset and more as a practical payment tool in places where cards and wires frequently fail.

Europe: Slow, Steady, and Regulatory-Driven

Europe shows a different trajectory.

According to NOWPayments internal insights, adoption grows gradually and consistently:

France

- 2023: 3.68%

- 2024: 5.7%

- 2025: 5.15%

Germany

-

2023: 2.84%

- 2024: 4.06%

- 2025: 3.96%

Unlike the Global South, Europe’s growth is shaped by:

- cross-border commerce norms,

- predictable consumer behavior,

- and – increasingly – regulatory clarity.

Regulation also influences stablecoin preferences.

Many European merchants show growing interest in USD-denominated stablecoins that align with emerging EU compliance frameworks. As a result, leading providers – including NOWPayments – support not only USDT but also USDC, which often serves as the preferred regulated option for businesses operating across the EU.

For merchants, Europe provides the most stable long-term demand curve for crypto payments.

Where Traditional Rails Face Friction, Alternative Rails Rise

NOWPayments’ data for 2025 shows Russia reentering the top-five (3.92%), reinforcing a broader trend: When traditional rails are restrictive or unreliable, consumers adopt alternative rails at scale.

Across multiple markets, crypto usage spiked immediately after high-profile disruptions in banking, cards, or local settlement infrastructure – especially in regions with high digital penetration but limited financial interoperability.

Fiat → Crypto: The Emerging Gateway to Crypto Payments

Another notable trend across NOWPayments merchants is the rapid growth of fiat-to-crypto on-ramps.

For many businesses entering the crypto space, hybrid payment flows become the first step:

- customers pay using familiar local fiat methods,

- settlement occurs via crypto rails,

- cross-border approval rates improve,

- decline rates fall,

- and operational costs drop.

This model is particularly effective in markets where card acceptance is inconsistent or expensive.

In 2025, fiat→crypto functionality is becoming a strategic requirement rather than an optional add-on.

What This Means for Merchants in 2025 and Beyond

Across industries and geographies, NOWPayments’ 2023–2025 data highlights three strategic imperatives:

1. Build Payment Stacks That Reflect Regional Differences

Different markets use crypto rails for different reasons:

- U.S.: convenience, privacy, digital-native services

- India/Nigeria: bypassing banking limitations and high transaction costs

- Europe: stable cross-border efficiency, regulatory-aligned assets

- Russia/Emerging Markets: reliable access when traditional rails fail

Merchants who attempt a “one-size-fits-all” global approach lose up to 15–20% of potential conversions.

2. Prepare for Volatility – and Opportunity – in the Global South

Fluctuations in India and Nigeria indicate:

- rapid digital adoption,

- seasonal economic cycles,

- currency instability,

- shifting regulation.

These markets may be unpredictable – but they are powerful drivers of global crypto payment growth.

3. Treat Alternative Rails as a Strategic Asset, Not a Side Feature

According to NOWPayments transaction insights, payments routed through alternative rails consistently show:

- higher cross-border success rates,

- lower decline-driven abandonment,

- faster settlement across multi-region operations.

For global merchants, crypto rails are no longer a niche enhancement – they are a core conversion strategy.

The Bottom Line: Payments Are Becoming Decentralized

NOWPayments’ multi-year dataset reveals a payments landscape where:

- no single region defines consumer behavior,

- emerging markets push volume at scale,

- Europe provides stable, compliance-driven adoption,

- and hybrid fiat→crypto models accelerate entry for new merchants.

Digital commerce is no longer centered around one market or one rail.

The future is global, distributed, and multi-rail – and it is already here.

Merchants who invest in flexible payment infrastructure today will be positioned to serve customers everywhere, not just where traditional providers operate most effectively