Nearly 50 million Americans are locked out of the credit system. Not because they’re irresponsible, but because the system wasn’t built for them. Block’s data proves there's a better way forward.

Traditional credit was designed decades ago. It’s rigid, opaque, and exclusionary. It penalizes people for the wrong reasons and overlooks what really matters: real-time financial behavior.

When nearly half of consumers find mistakes in their credit reports, and when paying bills on time can actually hurt your score, it's clear the system is broken. We need a fundamental shift in how we assess creditworthiness.

At Block, we have cutting edge models that use near real-time data and machine learning to understand customers’ entire financial lives. And they’re working. We’re approving more people at the same risk level, not by lowering standards, but by understanding financial health comprehensively.

The Path Forward

The solution lies in looking at dynamic financial behavior rather than static credit scores. By analyzing near real-time transaction data, spending patterns, and cash flow, we can build a more accurate picture of creditworthiness. This isn't theoretical – we're seeing it in action across our ecosystem:

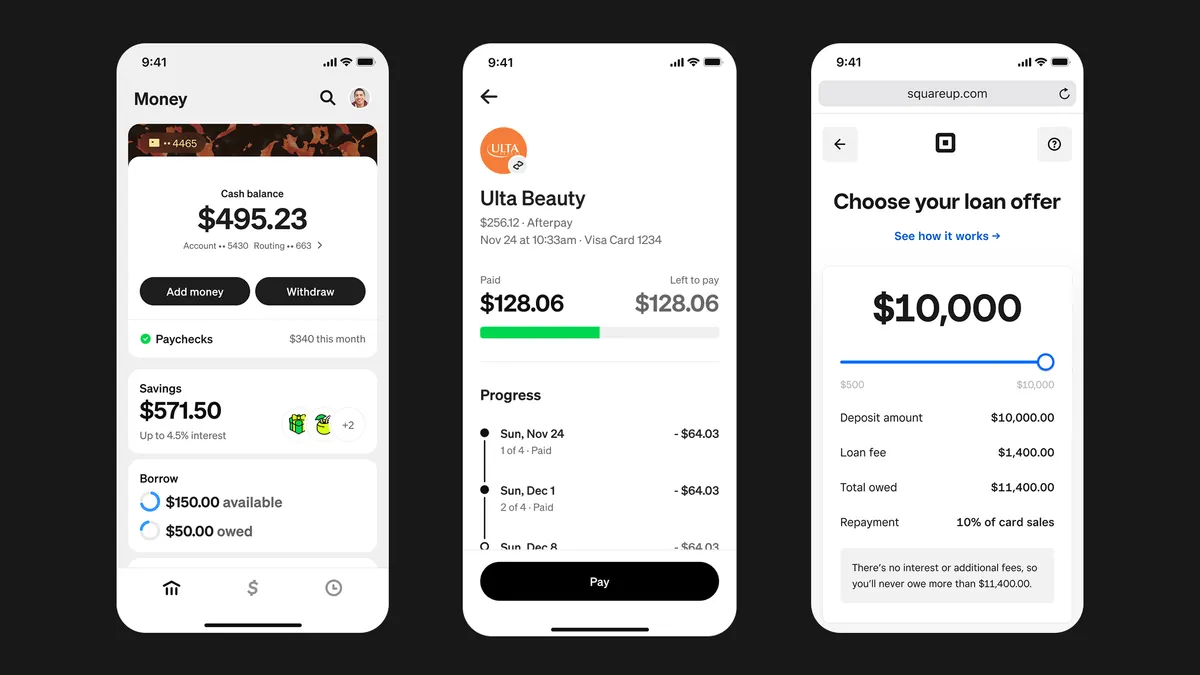

Take Cash App Borrow as an example. We've extended nearly $15 billion in short-term loans to more than 9 million actives. Repayment rates exceed 97% despite approximately 70% of our active borrowers having FICO scores below 580. Traditional financial institutions would have written these customers off, but our data tells a different story. And Afterpay sees more than 95% of installments paid on time. No interest. No traditional credit checks. Just simple, responsible behavior.

Look at Square Loans. Square Loans has provided more than $22 billion in financing to small businesses with loss rates below 3%. Nearly 60% of our loans go to women-owned businesses – triple the industry average.

These aren’t experiments. They’re working systems that prove a simple idea: creditworthiness is dynamic. We should measure it that way.

Beyond Traditional Credit Scores

The problem with traditional credit scoring isn't just its limitations – it's that the system reinforces the very inequities it creates. In the U.S., you need credit to build credit, creating a catch-22 that disproportionately affects younger generations and underserved communities. Revolving credit lines and the debt cycles they often perpetuate have become increasingly unappealing to Gen Z, with many viewing them as barriers to achieving financial freedom rather than tools for building it. Our data shows that 63%of Gen Z don't want to use credit cards, yet to participate in the current system, they still need ways to build credit history.

This misalignment between traditional credit and modern financial behaviors isn't just a market inefficiency – it's a barrier to economic progress. When creditworthy individuals can't access the financial system, everyone loses: consumers miss opportunities for advancement, businesses lose potential customers, and the economy suffers from reduced participation. Innovative, real-time credit assessment methods and alternative financial products can play a vital role in bridging this gap.

A Call for Modern Frameworks

As we look to the future, we need regulatory frameworks that recognize the power of real-time data and alternative credit assessment methods. These frameworks should:

- Reflect how people actually live and spend

- Deliver clear and measurable benefits to consumers

- Prioritize customer data control, transparency, and accuracy

The technology exists to build a more inclusive credit system. The data proves it works. Now we need the will to make it happen.

This isn't just about fixing credit – it's about building a financial system that works for everyone. When more people are included, everyone benefits: individuals, businesses, communities.

The old system is holding us back. A better one is already here. Let’s move faster.