Opinion: Page 2

The latest opinion pieces by industry thought leaders

If you are interested in having your voice heard on Payments Dive's Opinion page, please read our editorial guidelines and fill out the submission form here.

-

Payment tools proliferate, consolidation looms

“The winners in this consolidation won't necessarily be the biggest players,” writes a checkout technology company CEO. “They'll be the ones who understand that consumers don't want more payment options — they want better ones.”

Justin Grooms • Feb. 12, 2025 -

Why enabling FedNow ‘send’ matters

Financial institutions that “fail to adopt both send and receive functions may be exposing their organizations to competitive disadvantages as well as reputational risks,” writes one industry executive.

Mihail Duta • Jan. 17, 2025 -

Banks scramble to meet new ISO standard

“Companies that delay action risk losing out on both improved payment experiences and potential business with companies whose systems no longer sync up,” writes one industry senior vice president.

Robert Turner • Dec. 12, 2024 -

How passing the CCCA would benefit nonprofits

"Nonprofits and charities need every penny they can get to make effective change in times of crisis, yet big banks and credit card companies continue to take their cut," writes one policy analyst.

Hassan Tyler • Nov. 20, 2024 -

Payments players should embrace digital currencies

“Emerging currencies, digital assets, and even next-generation fiat options could be integrated thoughtfully, allowing companies to access new markets,” writes one industry chief revenue officer.

Ryan Miller • Nov. 15, 2024 -

DOJ’s Visa suit is unfounded

The government acknowledges payment volumes are rising, in part because of fintech growth. This competition wouldn’t be happening if a single entity, like Visa, controlled the ecosystem.

Aurelien Portuese • Nov. 5, 2024 -

Is the FTC targeting chargeback service providers?

“For better or for worse, applying pressure to payments organizations to ferret out bad-merchant actors seems to be an effective way for the FTC to make private industry police the merchant marketplace,” writes an industry lawyer.

Edward A. Marshall • Nov. 1, 2024 -

Illinois should abandon interchange law

“Illinois has made a hasty decision that, if implemented, would have government change our payments system that functions so well that we barely notice it,” writes a trade group CEO.

Jodie Kelley • Oct. 25, 2024 -

Healthcare’s paper check disease

“The persistence of paper checks for patient refunds is not just an inconvenience — it's a symptom of a larger problem that threatens the very sustainability of healthcare organizations,” one software firm CFO writes in this opinion piece.

Seton Marshall • Oct. 8, 2024 -

Who really pays for your credit card reward points?

"While rewards may feel like a bonus for those who use credit cards regularly, they ultimately come at a cost," writes one payments executive.

Parth Vatsal • Sept. 19, 2024 -

CFPB’s EWA rule may undo progress

“The CFPB’s plan to reclassify EWA as a loan could accidentally backfire on the agency by driving people right back to the payday lending industry,” writes one tech trade group professional.

Adam Kovacevich • Sept. 5, 2024 -

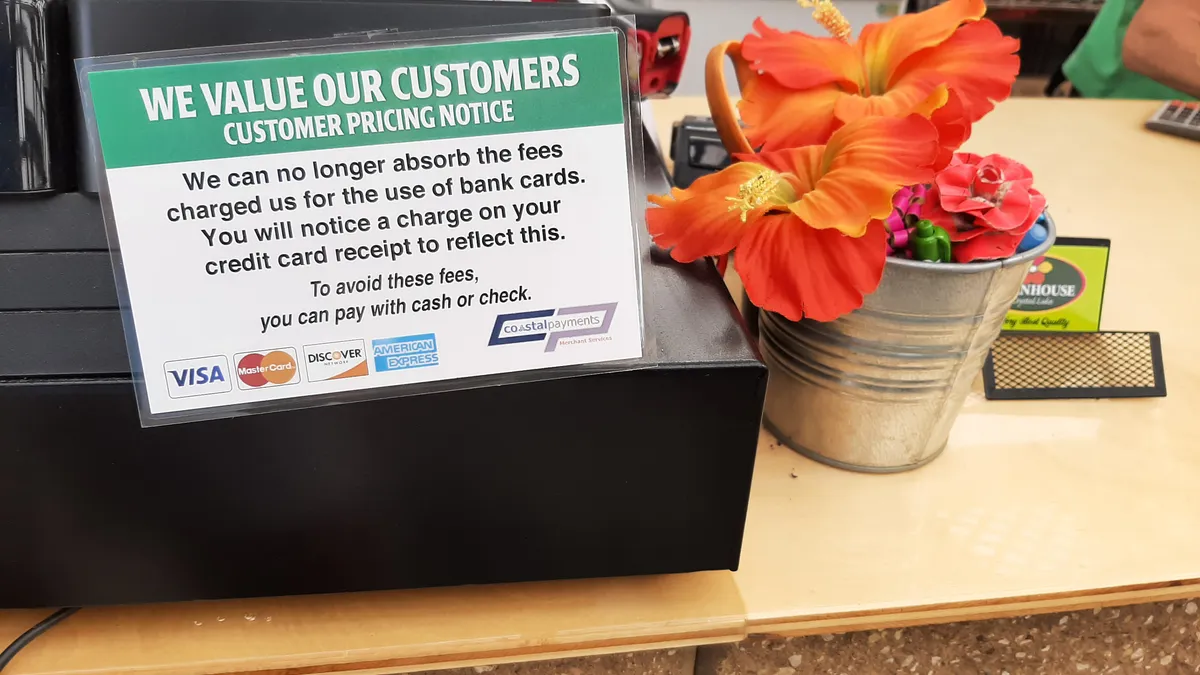

Surcharging doesn’t have to be a bad word

“The time has come to rethink surcharging not as a necessary evil but as a strategic advantage that can benefit both businesses and customers,” writes a Billtrust executive.

Nick Izquierdo • Aug. 23, 2024 -

Why the CFPB’s recent EWA rule is wrong

The Consumer Financial Protection Bureau’s earned wage access rule “could outright deny EWA to the wage earners who need it the most,” writes a trade group CEO.

Brian Tate • Aug. 14, 2024 -

Credit Card Competition proposal should become law

“In the aftermath of the CrowdStrike outage, Congress and state lawmakers should look for opportunities to build backups and redundancies into critical online systems,” writes a payments consultant.

Dan Swanson • Aug. 2, 2024 -

How to speed up FedNow adoption

“Interfaces need to be standardized to ensure a consistent and reliable payment experience for businesses and consumers,” writes one payments software executive.

Ani Narayan • July 26, 2024 -

Fighting deepfakes via payments

“Since many of these deepfake software services accept credit cards, payments providers are on the front lines of detecting these companies,” writes one corporate compliance officer.

Alan Primitivo • June 12, 2024 -

CFPB seeks to thwart cross-border junk fees. Now what?

“Putting these regulations into practice is challenging, and the success of such regulatory measures largely hinges on enforcement,” writes a Wise executive.

Rina Wulfing • May 30, 2024 -

Let’s avoid legal patchwork for credit card surcharging

“All parties in the payments ecosystem would benefit greatly from state laws that provide clarity and consistency between jurisdictions,” write two legal professionals.

Jonathan Razi and Keturah Taylor • May 23, 2024 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB should reconsider prepaid rule

The Consumer Financial Protection Bureau should revisit its rule affecting digital wallets, peer-to-peer payments and prepaid cards, writes one fintech group leader.

Brian Tate • May 17, 2024 -

Pay-by-bank holds promise

“The value proposition of pay-by-bank is clear: merchants win from drastically lower payment costs and consumers win from lower prices,” writes one fintech executive.

Eric Shoykhet • May 3, 2024 -

Why financial institutions should embrace ISO 20022

Adopting ISO 20022 payment standards can help U.S. banks and credit unions unlock richer data and stay competitive in the global financial marketplace.

Sylvie Boucheron-Saunier • April 26, 2024 -

CFPB’s new late fee cap charts ‘a better way,’ says Sunbit CEO

“The credit card industry should take a page from innovators, instead of relying on yesterday’s fee models,” argues the CEO of the payment tools provider.

Arad Levertov • April 16, 2024 -

Digital wallets must take hold in B2B

“Digital wallets, once primarily associated with consumer transactions, have now firmly established their presence in the B2B realm,” writes an industry manager.

Lakshmi Sushma Daggubati • April 12, 2024 -

EWA shouldn’t be regulated like loans

“Attempts to regulate EWA as credit threaten worker access to this innovative and consumer-friendly financial tool,” writes one earned wage access industry CEO.

Darcy Tuer • April 5, 2024 -

Fintech founder backs Google, Apple

“It’s easy for giant app companies to pick fights with Apple and Google, but when billionaire companies fight about who gets richer, it’s usually the little guy that loses,” writes CashEx’s CEO.

Kingsley Ezeani • March 15, 2024