Dive Brief:

- The Center for Taxpayer Rights expressed concerns regarding underbanked and unbanked Americans no longer having a paper check option to receive tax refunds if the agency stops using paper checks in a June 30 letter to the U.S. Treasury Department. It was one of nearly 250 letters that flowed in following the department’s request for comment on a plan to transition the federal government away to electronic payments.

- U.S. households without bank accounts should have more access to accounts where they can receive payments before the transition happens, the Aspen Institute’s Financial Security Program said in a separate June 30 letter. Households lack bank accounts due to a variety of reasons, including mistrust, costs and a mismatch to needs, the organization said in its letter.

- The New York City Department of Consumer and Worker Protection raised concerns about the possibilities of New Yorkers who rely on paper checks not receiving their benefits and electronic fund transfer recipients falling victim to scams. The department also noted in its June 30 letter the need for a public awareness campaign to educate people about the change, particularly non-English speakers.

Dive Insight:

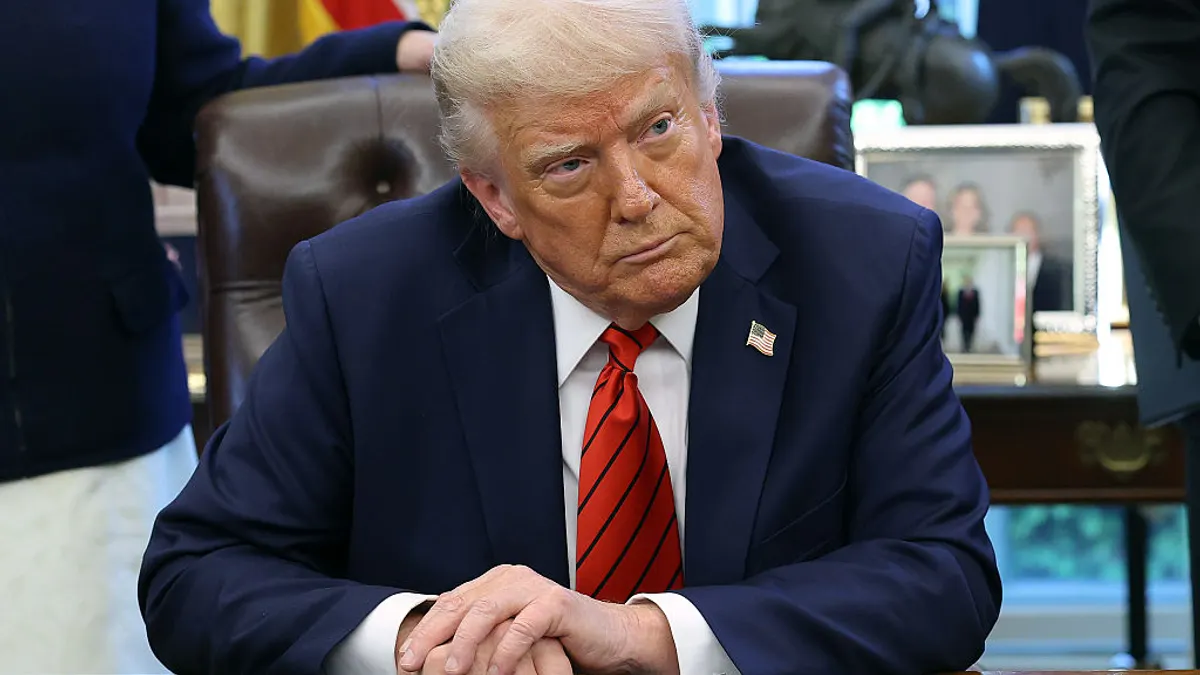

Trump issued an executive order in March calling for a shift by federal government agencies away from paper checks by September 30. Multiple organizations sent letters to the Treasury Department during the agency’s public comment period that ended June 30 raising an alarm about the potential impact such a swift, drastic change could have on marginalized Americans.

The New York City Department of Consumer and Worker Protection noted that nearly 10% of households in New York City have no bank account, citing its own research. Without a bank account, those New Yorkers won’t be able to access Social Security benefits, federal tax refunds or other payments, the agency warned.

New Yorkers without internet access may also struggle to open a bank account and use online banking, the agency said in its letter. New York City neighborhoods with the highest levels of unbanked residents are less likely to have access to the internet, the department said.

In 2023, about 5.6 million American households, equal to about 4.2%, were unbanked, meaning they don’t have an account with a financial institution, while about 19 million households, or 14.2% were underbanked, meaning they had an account, but mainly used nonbank services for their financial needs, according to a report last November from the Federal Deposit Insurance Corp.

“The proposed Executive Order has the opportunity to bring more individuals into today’s digital economy and fulfill the important goals of payment security and resource efficiency,” the New York City Consumer and Worker Protection wrote in its letter. “By working closely with cities and partners across the country, and ensuring that any transition happens slowly and intentionally, the Treasury can fulfill the Executive Order in a manner that invites new opportunities to build wealth rather than reinforce barriers that keep individuals out.”

Another organization that weighed in, the American Forest & Paper Association, warned in its June 30 letter that Americans with disabilities, rural consumers and older adults are likely to be left behind by the transition away from paper checks, because they are more likely to be unbanked and thus rely primarily on cash.

In the government’s efforts to become more efficient and save money, the Treasury Department must be careful not to pass the cost of digital payments onto consumers, the American Forest & Paper Association noted in its letter. Without paper checks, the government risks passing the cost of digital payments, including credit card, convenience or transaction fees for online payments, onto consumers, the advocacy group said.

“While digital-only interactions may offer cost savings and increased efficiency for government, the additional financial burden of required equipment to access and document government services should not be ignored,” the trade group said in its letter.

In addition to expressing concerns about rural and Indigenous Americans’ access to government payments, the Center for Taxpayer Rights also raised the alarm about stored-value debit cards as a replacement for checks. While the advocacy group acknowledged the risks associated with paper checks, its letter noted that using stored-value cards is the preferred payment method for criminals collecting fraudulent tax refunds.

The Center for Taxpayer Rights suggested that the Treasury Department take a page from the Social Security Administration’s playbook and offer prepaid cards with additional identity verification standards to ensure that tax refunds reach their intended recipients.

“To be clear, we believe it’s important to maximize electronic payments uptake by making available to taxpayers any safe commercially available options they may wish to use,” the group said in its letter. “But if the goal is to mitigate the risks of fraud and theft, then eliminating paper checks may miss the mark while also harming millions of taxpayers who prefer paper checks.”

While the Aspen Institute Financial Security Program echoed the importance of not excluding underserved consumers in the transition to electronic payments, the organization also outlined the downsides of relying on paper checks, including check-cashing fees, payment delays during crises and the fraud and scam risks associated with paper checks.

The organization urged the Treasury Department to distinguish between “genuine consumer and small business barriers and behavioral preferences.” Citing its own previous research, the institute pointed to a range of reasons why some consumers lack a bank account, including affordability, lack of trust and a mismatch between what consumers need and the services available.

“[The] Treasury’s modernization goals must go hand in hand with inclusive design,” the Aspen Institute said in its letter. “Without access to no-cost, easily accessible digital options — like universally accepted prepaid cards — efforts to digitize payments may leave the most vulnerable households further behind. Conversely, well-designed modernization efforts could be a powerful lever to bring millions into safer, more efficient financial systems.”

Recent research suggests that both cards and checks are indeed targeted by fraudsters. A Federal Reserve Financial Services survey released in April found that 73% of financial institutions named debit cards as the top payment method for fraud attempts in 2024, followed by checks (62%), non-bank payment apps (36%) and ACH transactions (31%).

The Federal Trade Commission said in March that consumers reported $2.08 billion worth of fraud last year via 47,336 bank transfer payments compared to $225 million lost in 8,098 check frauds.

As the Treasury Department sorts out the transition to digital payments, the major card networks Visa and Mastercard are pitching their services as the solution to its problem. Meanwhile fintech firms like Plaid, Modern Treasury and Early Warning Services have also thrown their names in the hat for consideration.

Industry executives have thrown their support behind the Trump initiative. For example, ACI Worldwide CEO Tom Warsop said in an April interview that the shift away from paper checks is long overdue, citing the payment method’s fraud factor and the fact that paper checks are more costly than alternatives.