PayPal Holdings has been building an advertising business since last September, creating a new revenue stream selling ads to the company’s existing clients and new ones.

The San Jose, California-based payments technology pioneer, which also owns the peer-to-peer business Venmo, had no such business before last year, but spotted an opportunity to use its transaction data to pitch clients on placing ads across its own portals, and those of other companies.

To get started, the company hired Mark Grether as a senior vice president and general manager of its new PayPal ads division in May 2024, bringing on board an executive who previously developed ad businesses at retail giant Amazon and ride-share titan Uber Technologies.

“I'm the guy who basically comes in and builds advertising businesses from the ground up in the context of a larger organization,” Grether said in an interview last week.

Now, he’s leading long-time PayPal customers, as well as new clients, to place their advertising on PayPal and Venmo screens. In addition, his unit is assisting those customers in posting the same targeted ads on other publishing properties.

PayPal has expanded the new business from the U.S. to the U.K. and Germany. And on Wednesday, the company said in a press release that it extended the off-site display and video ad options to those European countries as well.

Car-maker Mercedes-Benz, Uber, delivery firm DoorDash and retailer Walmart are among the company’s ad clients.

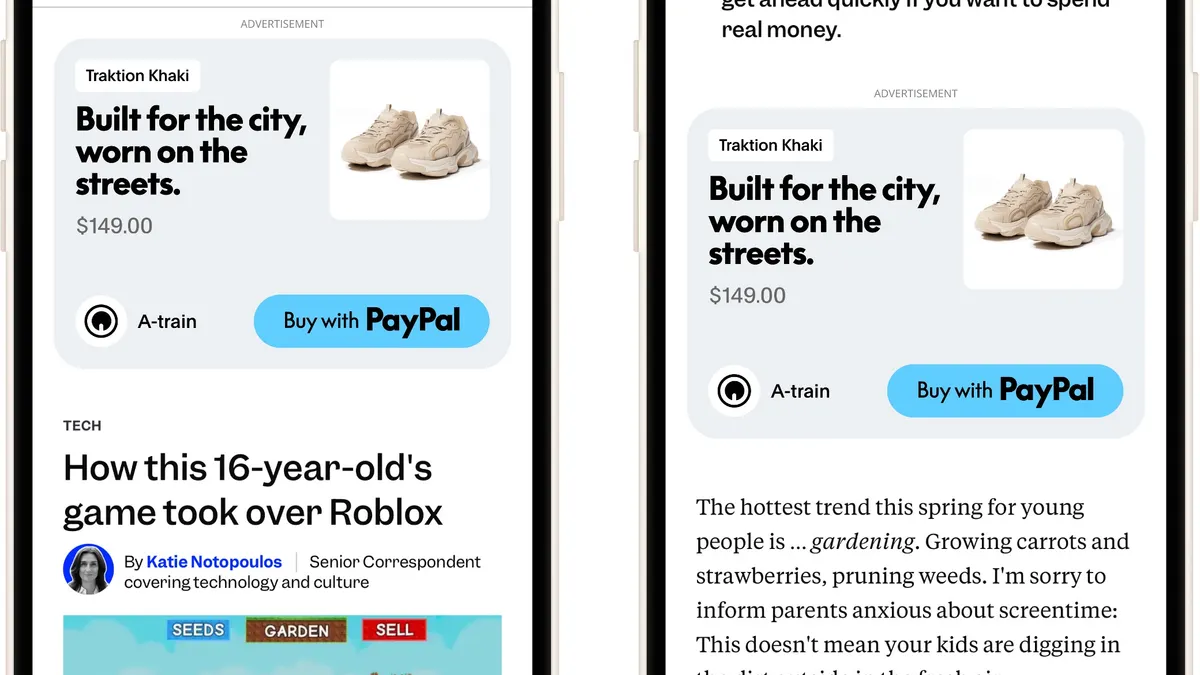

One innovation that Grether touts is the ability for advertisers to place a button on the ad that lets consumers almost instantly have the option to purchase a product if they’re a PayPal user.

PayPal is luring corporate clients as well as new customers to the ad proposition by highlighting the data the payments technology company has collected from handling consumer transactions, Grether said. PayPal’s trove of data is larger than that of retail behemoths Walmart or Amazon, he contended.

“We have access to transaction data from 30 million merchants, 400 million consumers globally,” he said, explaining how that information helps the company win over chief financial officers attracted to the notion of placing ad dollars behind more tailored campaigns.

For product makers, such as Nike, the chief financial officer wants to understand how products are being sold across retail outlets, whether that’s Dick’s Sporting Goods or Zappos, to understand what amount of ad dollars might increase the market share, Grether explained.

“We can answer this question because we’re sitting across all the merchants where Nike products get sold,” Grether said.

As far as PayPal’s revenue goals for the new ad business, Grether declined to comment, but he pointed to his past experience building billion-dollar ad businesses for Amazon and Uber. Those companies were similarly able to persuade retailers and other merchants of the power of placing ads on their uniquely placed display screens.

Grether contends that the profit margin for the new PayPal business is high, mainly carrying only the expense of a sales force. He declined to say how many employees are on his team now, but said it’s expanding with the business.