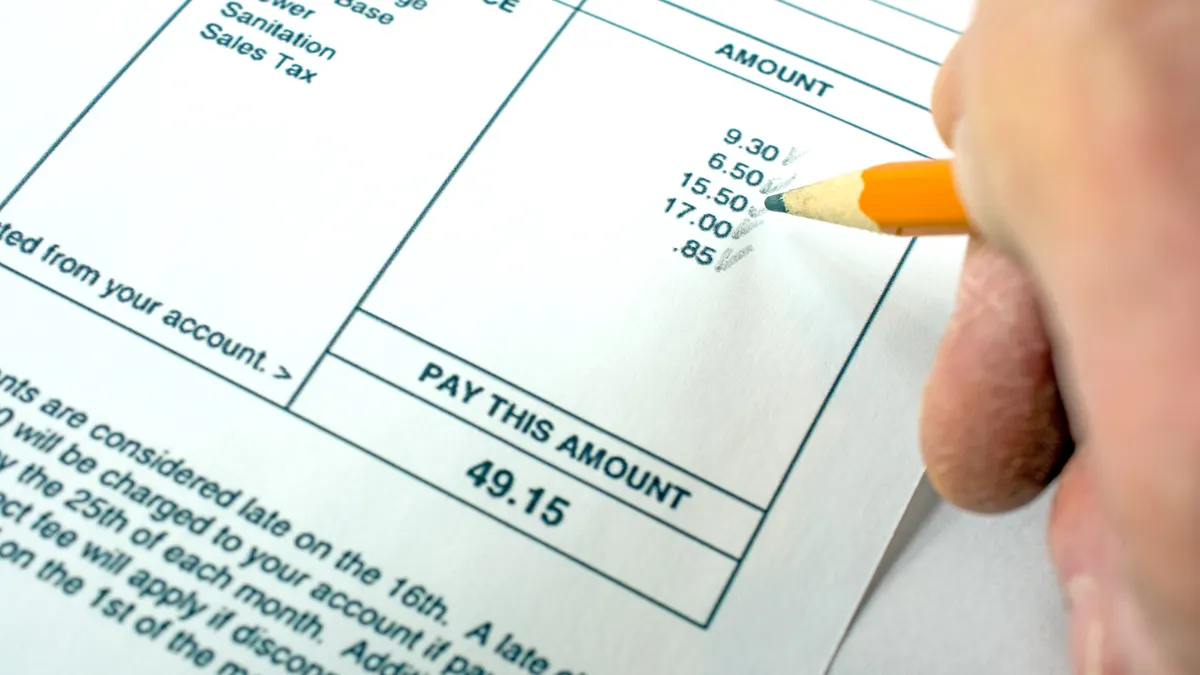

A trip to Paris is optional, but your electricity bill? Not so much.

The business-to-business software company Paymentus Holdings said this month in its quarterly earnings release that it expects annual revenue to top $1 billion this year as more companies adopt its platform for recurring consumer payments.

Paymentus provides cloud-based software for more than 2,500 utilities, governments, lenders and others to process payments, collecting a portion of each transaction.

This focus on non-discretionary, recurring payments has helped Charlotte, N.C.-based Paymentus, which went public in 2021, be profitable and consistently increase sales.

Dushyant Sharma, Paymentus’ president and chief executive officer, founded the company in 2004 and calls it “a privilege to be serving an essential side of the domestic economy.” Paymentus, which has about 1,300 employees, processed 597 million transactions last year, a 30% increase from 2023, with revenue rising 42% to $872 million. Payments Dive spoke with Sharma on May 16.

Editor’s note: This interview has been edited for clarity and brevity.

PAYMENTS DIVE: Do periods of economic recession, when late bill payments and account delinquencies tend to rise, affect Paymentus’ revenue?

DUSHYANT SHARMA: Not really. Despite the macro environment, we find ourselves in a very fortunate situation where we are serving an important part of the non-discretionary, essential, domestic economy. For a typical household, just to be able to cook, you need water, electricity and gas. These bills are fundamental and you need to pay for these services; they are not optional. Just this segment alone gets us to about half of our business. Similarly, you need to pay for a phone, for your rent, mortgage and taxes. Likewise, if you have a home, car or life insurance, to maintain coverage, you need to pay those bills.

Do you have a particular industry or area of focus?

Utilities is about half of our business. And then we have insurance, government services, telecom, property management, mortgage, auto payments. We also service banks and credit unions as well. Healthcare is another vertical. There are only 140 million households in the United States, and there are 17 billion bills. Each household is getting multiple bills. So our philosophy has been that a company that has a very vertical-agnostic platform, which services all channels and all verticals and businesses of all sizes, including the largest billing companies in the country, it becomes a very attractive long-term proposition.

Do people still send paper checks? Is that a thing?

Oh yeah. The majority of the payments are still non-digital. They’re not paid on the billing company’s website or mobile app or whatever. The payments are still paper checks and money orders and cash and offline bank systems, legacy platforms and so on. The primary reason for that is people are habitual for doing certain things a certain way. But as the digital developments continue to take effect, not only (among) the younger generation, but even (among) the folks who are … becoming more and more familiar with digital tools. Even a person who’s interacting with their grandkids, or their kids on Facebook, it starts to become more and more comfortable. There’s a huge opportunity for Paymentus because we could more than double our business just by getting more of our customers to have digital adoption.

What’s your biggest sales challenge when you talk to a prospective customer at a government or private business? Upfront costs? Technology integration?

The No. 1 challenge for us is just inertia: ‘We like your system. But give us a few months and then we will take a look at your product again.’ Our pricing model was designed for the CFOs, and the platform was designed for the customer experience executives. So that’s the way we married it. We’re going to go over to the CFOs and say, ‘Nothing can be cheaper than free. We’re going to give you our platform at no cost. We will integrate within your ERP (enterprise resource planning) systems and all your accounting systems and so on, at no cost, because Paymentus’ technology platform is very advanced.

How do interchange fees affect this business? If a company or municipality must take credit and debit, that seems like a major expense in the process.

Absolutely. You can surcharge. You can also offer convenience fees and some of those types of user-pay models. We follow the same principle as the late fee concept, that the people who are late are the ones who are covering the cost of handling the payment late. So there’s a fee for being late, but it is not amortized over all those who actually paid on time. The same thing exists in our system (for municipalities). If you want to make a payment using credit card, there could be a fee to you.

What’s the most popular payment method on your platform?

Debit and credit cards remain the most popular (for Paymentus payments), but ACH is also there. I would say debit, credit, ACH – but also what we call APMs, advanced payment methods, the digital wallets, they’re gaining steam as well.

What’s next for Paymentus, beyond market share growth?

We are serving some of the largest companies in the United States, and they not only have inbound payments, we can also do other things for them. We can bring the money in, but we can also help them send their vendor payments and manage their payouts. We can manage disbursements, like we’re also doing for the banks, taking their customers’ money and disbursing it to all the different billing companies. We believe Paymentus will be a very large payment company. We have more than tripled business in the last three, four years. It is quite possible (over) the next few years, we might be able to do the same.

You’re talking about areas like accounts receivables, invoicing, expense management?

Exactly. We consider them to be very complementary to our offering. If you’re already integrated with the ERP systems, you’ve already done all the work in terms of engagement platforms, you’ve done all the business rules, it becomes a lot easier to add more capabilities to your platform the clients are already using.