Dive Brief:

- The New York Department of Financial Services is seeking information about the buy now, pay later industry as it crafts new regulations to implement a state law enacted earlier this year.

- In a letter Friday to Adrienne Harris, superintendent of the New York Department of Financial Services, the American Fintech Council’s head of policy and regulatory affairs, Ian P. Moloney, wrote that the request “requires significant time to fulfill due to administrative collection, aggregation, and review processes across member companies.” The council requested a 30-day extension, to Sept. 30.

- The department said Monday on its website that it would extend its deadline to Sept. 13 for the “voluntary request for information” it issued July 31.

Dive Insight:

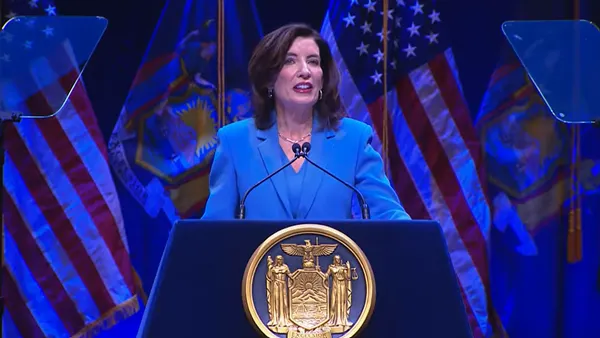

The BNPL companies, some of which are represented by the council and the Financial Technology Association, opposed New York’s legislation, which Gov. Kathy Hochul approved in May. The law will take effect 180 days after the DFS issues regulations to implement its provisions.

New York’s new law imposes a new licensing requirement for BNPL companies, and limits interest and fees on the point-of-sale installment financing it labels as “loans.” BNPL providers have battled against subjecting their services to the same laws that apply to credit card loans.

The law also requires BNPL companies to devise a framework for handling unauthorized charges and resolving disputes in New York.

The National Consumer Law Center is unaware of any other state or federal legislation similar to New York’s BNPL law, a spokesperson for the non-profit advocacy group said Monday in an email.

The state’s request for information from BNPL providers and “other interested parties” lists about two dozen questions that includes “transaction-level data as well as detailed demographic and performance metric data,” AFC’s Moloney said Monday in an emailed statement.

The requested data, “combined with other information related to policies and legal agreements, requires a significant amount of effort to compile and aggregate in a manner that properly protects consumers' information,” Moloney said in response to a question about which areas of the department’s request was requiring additional time.

The Washington, D.C.-based council represents Affirm Holdings, a BNPL company, along with fintechs such as Dave and EarnIn.

“It is our understanding that the duty of care required to ensure accurate and complete data, combined with the timing of the Department’s request could make providing the data in the originally prescribed timeframe untenable,” Moloney wrote to the DFS. “In turn, though responsible industry participants seek to provide the most accurate and comprehensive data possible, the data that NYDFS receives from this request under the current RFI deadline may have deficiencies in either its accuracy or completeness.”

Another fintech organization has also chimed in. The Financial Technology Association, which represents BNPL members Block, Klarna Group and Zip, also supported a 30-day deadline extension, CEO Penny Lee wrote Monday in an email. “We appreciate NYDFS’s focus on data-driven policy and are committed to providing accurate responses to inform their rulemaking,” she said.

The information request is designed to help the department “understand the business models of entities offering BNPL products, fee structures of those products, the underwriting process, and the impact that fee and interest limits may have on BNPL product underwriting and business more generally, among other topics,” the DFS said in its request.

Regulators’ questions include those concerning: merchant fees and discounts; how BNPL companies process returns and refunds for products or services financed by a BNPL loan, and how consumers are informed of such return and refund policies; how a BNPL company may monetize consumer data; and whether a BNPL company has a maximum number or dollar amount for consumer loans.

“We support smart, tailored regulation that fits the unique nature of interest-free BNPL, fosters innovation and ensures consumer protection,” a Klarna spokesperson said Monday in an email. “We’re committed to working with the Department of Financial Services on a better path forward.”

An Affirm spokesperson said Tuesday in an emailed statement that the company “welcomes smart regulation that protects consumers, promotes transparency, and ensures competition on a level playing field.” San Francisco-based Affirm will continue to work with the department, New York’s governor and legislative leaders “to shape a framework that keeps honest financial products like Affirm’s accessible to New Yorkers,” the statement said.

Spokespeople for other BNPL providers, including Block’s Afterpay, Sezzle and Zip, did not respond to emails Monday seeking comment on New York’s information request.