Dive Brief:

- The Consumer Financial Protection Bureau has determined that a 2024 rule authorizing open banking is “unlawful” and should be scrapped, 15 years after Congress enacted legislation to make it easier for consumers to switch financial institutions, the agency told a federal court.

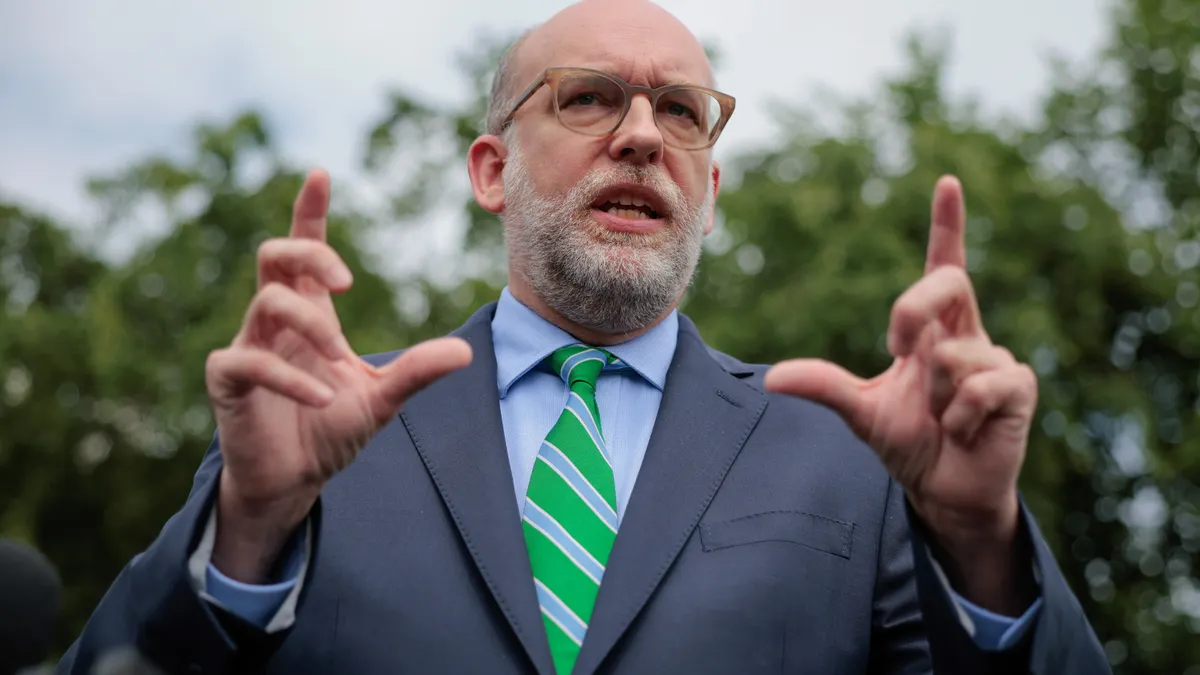

- The bureau plans to vacate the rule as part of a lawsuit in Kentucky, the CFPB’s chief legal officer, Mark Paoletta, wrote in a federal court filing Friday. “After reviewing the Rule and considering the issues that this case presents, Bureau leadership has determined that the Rule is unlawful and should be set aside,” the agency wrote in a status report filing.

- The Bank Policy Institute, which represents most of the large U.S. banks, said Friday in a press release that the bureau had acknowledged the rule’s “clear legal deficiencies.” But Financial Technology Association CEO Penny Lee in a statement Friday called the CFPB decision “a handout to Wall Street banks, who are trying to limit competition and debank Americans from digital financial services.”

Dive Insight:

The CFPB passed its final rule in October, drawing an immediate lawsuit from the Bank Policy Institute, the Kentucky Bankers Association and Kentucky-based Forcht Bank.

The banking groups argued that the rule, under Section 1033 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, imposed heavy compliance costs and did not address liability issues around fraud and misuse of consumers’ financial data. The plaintiffs also said the bureau had exceeded its authority under the act in formulating the rule.

In late March, U.S. District Court Judge Danny Reeves had stayed the lawsuit for 60 days to allow the bureau – under the leadership of acting director Russell Vought – to review its position on the matter.

The agency’s move to vacate the rule means “years of wasted work from banks and fintechs that could have been saved by amending rather than abandoning the rule,” Todd Baker, a senior fellow at the Richman Center for Business, Law & Public Policy at Columbia University, wrote Saturday on LinkedIn.

FTA members and other fintechs had hoped that the bureau would choose to revise the rule, addressing areas of contention, rather than vacate it entirely.

On May 14, Reeves ruled that the FTA can intervene to defend the lawsuit, finding that its members’ interests were not adequately protected by either party in the litigation. The CFPB’s move to vacate the rule could make the intervention moot, however.

The agency has sought to reduce about 90% of its pre-Trump staff of around 2,000 employees and Vought has requested that Congress slash the bureau’s budget as part of a budget bill House Republicans passed last week. The staff cuts remain mired in federal litigation.

The bureau said it intends to file for summary judgment in the case by Friday, the same date as the plaintiffs’ motion for summary judgment is due. An FTA spokeswoman said Monday the association will then respond to the motions and that the rule remains in effect until Reeves issues a decision.

Last week, the Financial Data & Technology Association, which represents about three dozen fintechs, wrote to Vought urging that the CFPB not dismantle the rule.

“Vacating the existing rule and starting from scratch risks prolonging regulatory uncertainty that could stall market development, stifling innovation in critical digital financial technologies, and emboldening incumbents to entrench their positions and legacy technologies rather than compete,” FDATA North America Executive Director Steve Boms wrote.

FDATA and some of its members also convened a conference call on May 19 with reporters to discuss the various problems they anticipate if the agency vacates the rule.

One primary issue several speakers cited is the CFPB’s ability to craft a new rule – as mandated in the Dodd-Frank law – with a minimal staff under Vought’s management. The current open banking rule took the bureau five years to enact, beginning in the first Trump administration.

Bloomberg Law reported May 8 that the bureau would seek to vacate the rule, citing multiple sources familiar with the strategy.