Dive Brief:

- Digital payments processor Checkout.com has submitted its application for a banking charter to the Georgia Department of Banking and Finance, the company said Friday.

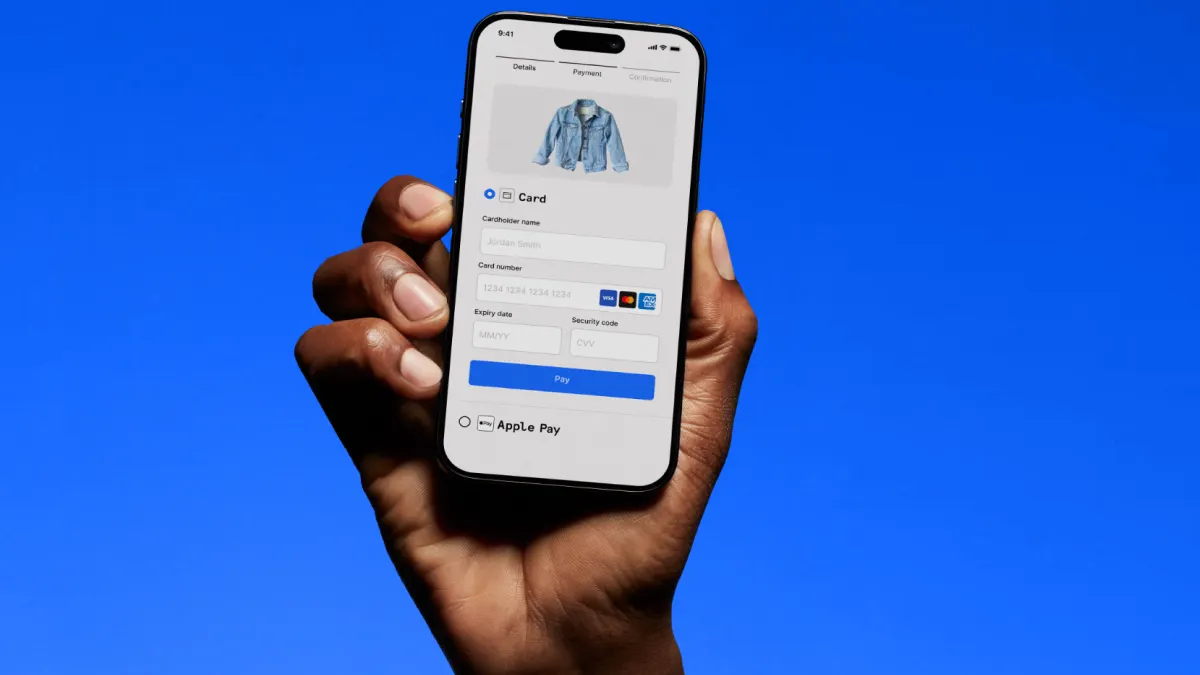

- The U.K.-based firm is seeking Georgia’s merchant acquirer limited purpose bank charter to facilitate its U.S. expansion and gain direct access to the payment networks of behemoths Visa and Mastercard.

- If the bid is successful, Checkout.com would be the third payments firm – after Fiserv and Stripe – with a Georgia special purpose banking charter. The charter allows payments processors to bypass banks to underwrite merchants, authorize and settle transactions, and provide network access to its affiliates.

Dive Insight:

Among its main features: The charter allows processors to avoid banks’ fees and better compete on price.

From a risk management standpoint, access to the Visa and Mastercard networks eliminates an integration point, explained Jordan Reynolds, Checkout.com’s North America banking head. A charter would also drive innovation for Checkout.com, he said.

“In today’s world, if we’re launching new products and services that touch any of the authorization or money movement flow, we have to work with our bank partners on the other side to drive integrations,” Reynolds said. “It certainly limits our ability to move at pace, and this charter allows us to move much faster and innovate much faster for our merchants.”

Checkout.com uses Cross River Bank and Pathward Financial as its partner banks and would keep them on after its own potential chartering, Reynolds said. Chartering is “a multi-year journey” and Checkout.com will still need the partnerships in the future, he said.

The department has three months to act on Checkout.com’s charter application, Bo Fears, a spokesperson for the Georgia banking authority, said Thursday via email.

Reynolds said he hopes to have Checkout.com’s chartered services fully operational in 2026.

Georgia’s MALPB charter is “one of a kind in the U.S.” as far as chartering goes, Reynolds said. Milwaukee-based Fiserv was granted its charter in September 2024 and Stripe received the charter three months ago.

“It’s an extension of Georgia being a fintech hub for the merchant acquiring space,” Reynolds said, whose company focuses on large digital merchants like eBay and Pinterest. Checkout.com has about 2,000 employees globally, and processes about $1 billion in daily e-commerce payment volume.

Roughly 70% of the payments processed annually worldwide are processed in Atlanta, according to the American Transaction Processors Coalition. It’s not a new trend – the ATPC claims more than 85 billion of 135 billion global payments were processed in Georgia in 2012.

The U.S. will be Checkout.com’s “largest market over the next couple of years” with the banking charter demonstrating the company’s U.S. commitment, Reynolds said.