Dive Brief:

- Capital One Financial said Thursday it will buy the tech startup Brex for $5.15 billion in cash and stock, giving the bank an established financial technology company that integrates cards, payments and banking in a single offering.

- “Since our founding, we set out to build a payments company at the frontier of the technology revolution,” Capital One CEO Richard Fairbank said in a Thursday press release. “Acquiring Brex accelerates this journey, especially in the business payments marketplace.”

- Brex CEO and co-founder Pedro Franceschi will continue to lead the company after the deal closes, which is expected in mid-2026, Capital One said.

Dive Insight:

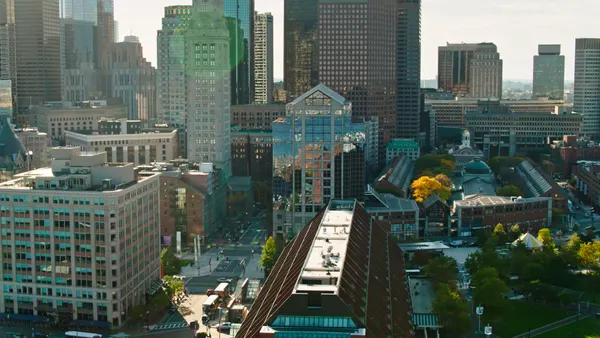

McLean, Virginia-based Capital One completed its $35.3 billion acquisition of Discover Financial last May, becoming the largest U.S. card issuer. Capital One is the sixth-largest U.S. bank by assets, according to the Federal Reserve’s most recent commercial bank data.

Beyond the corporate cards business, Brex’s technology automates expense management and “leverages AI agents to help customers automate complex workflows” that reduce manual reviews, Capital One said in the press release.

Brex competes with several fintech startups that overlap in some areas of spend management, payments, accounting and automation. The rivals include Ramp, Mercury Technologies and Expensify.

Brex oversees about $13 billion in customer deposits at partner banks and money market funds, The Wall Street Journal reported.

The sale price is nearly 60% below Brex’s $12.3 billion valuation in 2021, according to data compiled by PitchBook. The deal calls for Brex shareholders to receive $2.75 billion in cash and 10.6 million Capital One shares, the bank said Thursday in a regulatory filing.

Joining Capital One will help San Francisco-based Brex “supercharge our next chapter,” Franceschi said in the press release.

Franceschi and Henrique Dubugras founded the company in 2017 to issue corporate credit cards to startups, along with a tech platform that manages employee travel and other expenses, along with payments.

The company has expanded from serving small customers to larger corporate clients – including Anthropic, DoorDash and Zoom Communications – and says about 25,000 companies use its products.

“They found a working formula for innovating on corporate cards, expense automation and embedded payments, and now Capital One wants to bring that into its own stack to better serve its existing customers,” PitchBook senior analyst Rudy Yang said Thursday in the company’s report on the deal.

Brex has raised $1.7 billion across 14 funding rounds, according to Crunchbase data. Investors include Kleiner Perkins, Ribbit Capital, Lone Pipe Capital and PayPal Holdings co-founders Max Levchin and Peter Thiel.