The Latest

-

Cash-strapped homeowners tap BNPL

Researchers at the JPMorgan Chase Institute found that homeowners are most likely to use buy now, pay later tools when their bank accounts are low or their credit cards are maxed out.

-

PayPal pivots for 2026

The digital payment player aims to keep scaling its collection of integrated businesses, the company’s chief financial and operating officer said.

-

Shift4 promotes Global Blue execs

The payments processor promoted three executives to leadership roles, naming Pier Francesco Nervini as head of its international division.

-

Meta revamps ad payment policy

The social media company is mandating that some of its advertisers make their monthly payments via invoice or debit starting next month.

-

Par Tech faces investor pressure

One of the point-of-sale software company’s largest shareholders began urging it to consider “strategic alternatives,” such as a sale, last week.

-

Q&A

AWS leaps into agentic payments

Amazon Web Services, the tech giant’s cloud computing network, is gearing up for armies of AI-powered agents and transactions.

-

Clarity Act stokes debate on crypto

The bill aims to identify which agencies should regulate digital currencies.

-

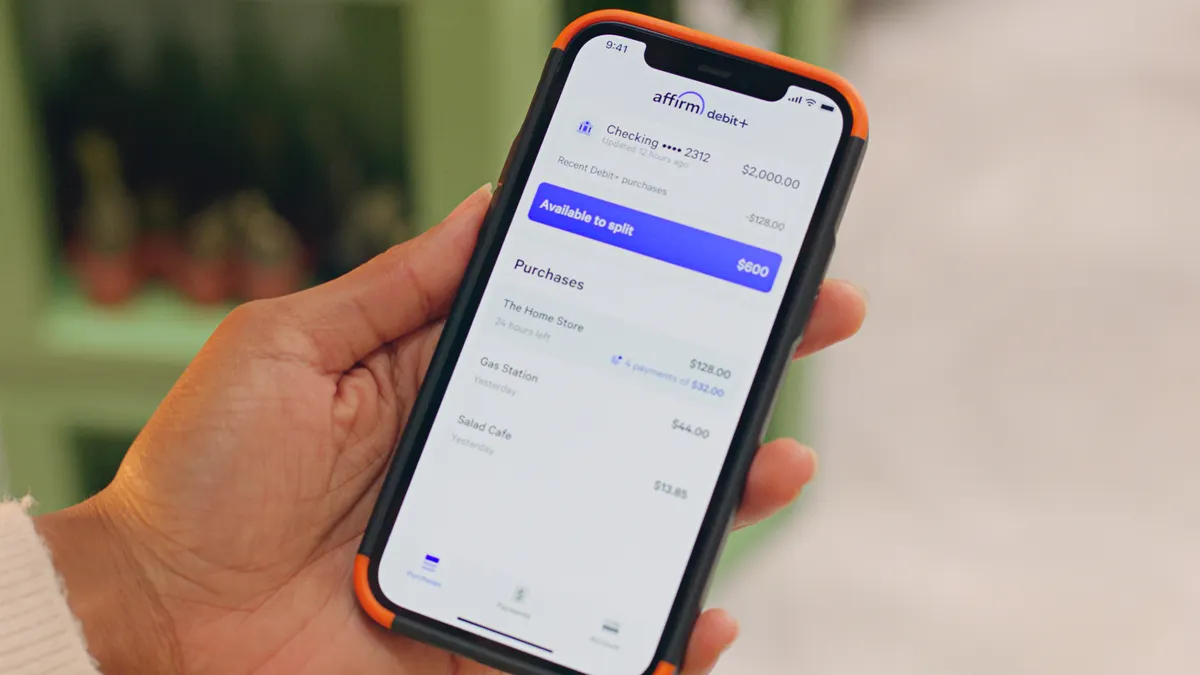

Affirm pursues affluent consumers

Shoppers with more purchasing power spend more, and are more likely to use the company’s products again, an executive said.

-

Boston Fed touts FedNow

The Federal Reserve has been updating its instant payments service, FedNow, to attract more banks and ultimately reach more consumers.

-

Opinion

Why EWA services matter

“We’re already seeing high-growth from restaurant and hospitality companies that now view instant payments, including digital tips, as a competitive advantage,” writes one earned wage access CEO.

-

Retrieved from Pilot.

Retrieved from Pilot.

Pilot, NCR Voyix agree to 5-year pact

The retailer, which has used NCR’s self-checkout kiosks for years, will now also deploy the payment service company’s point-of-sale technology.

-

Visa, Mastercard jockey to set agentic standards

The card networks are locking arms with big tech players and digital payments to shape the evolving agentic commerce ecosystem.

-

Capital One cuts Discover employees

Numbers shared with the state of Illinois indicate 1,075 people will be let go in May, and another 81 on June 1.

-

SoFi’s stablecoin joins Mastercard’s network

The card company is fulfilling its ambitions to bring more stablecoins into its payment network.

-

Q&A

Inside a startup building tools for AI agents

Funded by Stripe and Samsung, Circuit & Chisel wants to set the protocol for how artificial intelligence agents navigate the web autonomously.

-

Amex taps customers for fraud fight

Conversations with cardholders are crucial in developing countermeasures to deter scammers, a top executive for the card company said.

-

CCCA seeks new path to passage

Sens. Dick Durbin and Roger Marshall are angling to attach their credit card interchange fee legislation to a major housing bill before Congress.

-

Getting paid faster in construction

A Tennessee software startup is trying to automate accounts receivable for large contractors, some of whom still deal with paper-based payments.

-

Bill open to M&A deals, CEO says

Consolidation in business payments and finance automation affirms a growing interest in the space, the software firm’s founder said.

-

Column

Would a bank buy PayPal?

Whether major banks, such as JPMorgan Chase and Capital One, might have an interest in owning PayPal could turn on their ability to monetize that two-sided network.

-

Apple, Google wallets get personal

Beyond payments, the digital wallet is a platform for commerce with software startup Badge trying to help brands expand their wallet presence.

-

Shift4 taps xAI for customer service

The payment processor announced it would partner with Elon Musk's artificial intelligence company for a range of uses.

-

Amex doubles down on NYC

The credit card juggernaut plans to build a new global headquarters in Manhattan, becoming the owner and only occupant of a 55-floor skyscraper.

-

Inside Toast’s 2025 hiring binge

The point-of-sale provider added 800 employees in 2025 as others were making steep cuts.

-

Block swaps 4,000 workers for AI

CEO Jack Dorsey told investors Thursday that Block’s headcount will drop about 40% as it leans on artificial intelligence for efficiencies.