Page 307

-

Column

Credit card bill crusade persists

Sens. Dick Durbin and Roger Marshall may have lost their latest bid to win a congressional vote on the Credit Card Competition Act, via stablecoin legislation, but proponents are undeterred.

-

CFPB, consumer groups clash over BNPL

The battle over buy now, pay later — whether it’s helpful or hurtful to users — persists even after the Consumer Financial Protection Bureau last month withdrew its rule regulating such services.

-

NY legislature backs bill to protect cash

The state’s two chambers voted in favor of a bill that requires New York retailers to accept cash, following a trend set by other states and cities.

-

Tapcheck embeds EWA in payroll

Recent integrations with HR management platforms position the Texas earned wage access startup for growth.

-

Senators push payments fraud task force

A proposed bipartisan bill would bring together regulators and law enforcement to formulate measures aimed at reducing payment scams.

-

Adyen opts for build over buy

The Dutch payments processor eschews acquisitions in favor of building its own systems to drive growth, including in the U.S. market.

-

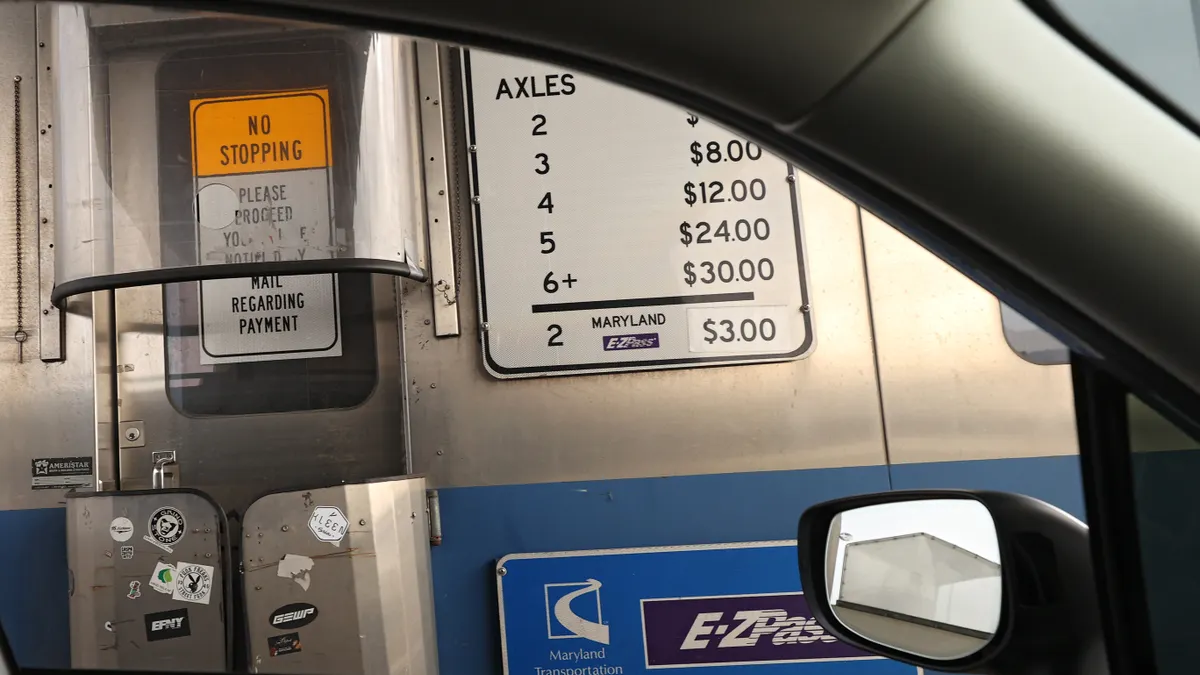

Drivers seek digital payment options

Digital payments are on the rise, but toll road payments are lagging behind.

-

Payoneer CFO sees stablecoin hurdles

The “last mile” infrastructure for stablecoin payment rails carries some challenges for the industry to resolve, Payoneer’s Bea Ordonez says.

-

Visa, Mastercard race to agentic AI commerce

The two top U.S. card networks are speeding to develop payments services that will enable bot-based buying, with digital rival PayPal also making a play.

-

Sezzle sues Shopify in BNPL battle

The buy now, pay later provider says Shopify violated antitrust laws when it sought to dominate BNPL transactions on its merchants’ platform.

-

Affirm boasts 2 million debit cards

The number of such cards the buy now, pay later provider has now made available is an increase of about 600,000 cards since January.

-

Fiserv CEO embraces stablecoins

The processor is developing an infrastructure that would let its merchant customers make use of the digital assets, Mike Lyons said.

-

Q&A

FTA CEO says open banking central to fintechs’ work

The leader of the Financial Technology Association sees a federal court battle over the Consumer Financial Protection Bureau rule as critical to innovation.

-

Opinion

GENIUS Act is just the beginning

“The bill tackles the fundamental question that has paralyzed our industry: what exactly is a stablecoin, and who gets to regulate it?” writes one Tulane University professor.

-

Deep Dive

Checkout-free payments may yet rise

Rapidly advancing artificial intelligence could let cashierless payment companies succeed where Grabango failed, industry insiders and observers say.

-

Walmart taps Mastercard, Synchrony for new cards

The retail juggernaut’s OnePay affiliate is working with the card issuer and the network to launch general purpose and private label credit cards later this year.

-

Wex eyes HSA benefit from budget amid pressure

The payments software company may get a boost if the U.S. budget allows for more consumer health savings accounts. It could use a lift, given recent shareholder dismay.

-

Fiserv buys out AIB Merchant Services

The payments processor’s deal to buy the ownership stake that it doesn’t already own is expected to give it a stronger foothold in Europe.

-

Amex leans into B2B payments

The card company aims to spur more business spending by corporate clients to buttress volume in the face of a possible recession.

-

Opinion

Don’t Turn Back the Clock on earned wage access

The Consumer Financial Protection Bureau “should settle this issue once and for all by issuing an expanded (EWA) advisory opinion,” writes a trade group leader.

-

Payments sector called “indisputable winner”

Providers of payments services generated about a third of the $378 billion in global fintech revenue last year, according to a new report. The sector is poised for more growth with AI innovation.

-

Shift4 appoints new CEO

The digital processor named Taylor Lauber to the post and appointed founder Jared Isaacman as executive chairman, a Thursday regulatory filing said.

-

Visa picks value-added services head

The global card network is shuffling its executive leadership as it bolsters efforts to sell ancillary software and advisory services.

-

Bill taps PayPal veteran as CFO

Rohini Jain is set to become Bill’s finance chief in July, replacing John Rettig who will assume the role of president and chief operating officer.

-

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.