The Latest

-

Merchants seek hearing on card pact

Large retailers opposing a swipe-fee settlement with Visa and Mastercard want a judge to hear oral arguments before he rules on the proposal.

-

GAO details CFPB’s downsizing

The scope of the CFPB’s downsizing were explored in two reports released Monday, one of which concludes that the changes cost consumers $19 billion.

-

Fiserv struggles with financial business

Revenue in the company’s financial services and banking sectors fell year-over-year, which executives attributed to market share loss among credit unions.

-

EWA products aren’t loans: fintechs

Trade groups representing fintechs filed briefs urging a U.S. appeals court to reverse two district court rulings against earned wage access providers.

-

Block to chop up to 10% of employees

The company is reducing its workforce to trim overhead costs and stay below a 12,000 employee cap, analysts said.

-

Fed ‘skinny’ account idea draws criticism

A prototype payment account carries undue restrictions, fintech groups said in response to a Fed proposal that offers expanded real-time payments access.

-

Payoneer CFO eyes stablecoin, AI innovation

Bea Ordonez said the payments company is focused on expanding its core ecosystem, strengthening partnerships, and building out strategies for stablecoin and AI.

-

Q&A

How to fix subscription pay friction

What can a subscription-based company do when a customer hasn’t canceled but their payment fails? Butter has an algorithmic fix.

-

Zip debuts pay-in-2 option

The buy now, pay later company on Wednesday started letting U.S. customers split everyday payments in half, rather than into four installments.

-

Opinion

Modernizing payments is essential

“The shift toward a 24/7 payments ecosystem is inevitable...organizations that are prepared to support instant payments will have a distinct competitive advantage,” writes one industry executive.

-

Visa, Amex vie for small businesses

The card networks are each pitching new services to mom-and-pop stores, including financing options as well as tools for expense management and fraud mitigation.

-

Spire names new CEO to grow pay-by-bank

The company hired former Fiserv executive Jennifer LaClair and raised $10 million to expand services enabling consumers to make direct payments from their bank accounts to merchants.

-

Arizona mulls card rate cap

A state senator has introduced a bill that follows President Donald Trump’s lead in seeking to cap credit card interest rates.

-

What went wrong at PayPal

Slow merchant adoption of the digital payment pioneer’s latest technology and lagging growth of its legacy checkout services stymied growth plans.

-

How AI commerce threatens eBay, Amazon

Agentic robots that shop and pay without human involvement could potentially render retail marketplaces obsolete – and big merchants are responding.

-

Mastercard offers agentic AI tools

The payments giant plans to provide agentic AI capabilities to merchants using its services by the end of June.

-

PayPal appoints new CEO

The digital payments company tapped former HP CEO Enrique Lores as its new chief executive Tuesday, casting aside Alex Chriss.

-

Visa pushes real-time payments into China

The company is partnering with UnionPay International to bring direct payments to debit cardholders in one of the largest remittance markets.

-

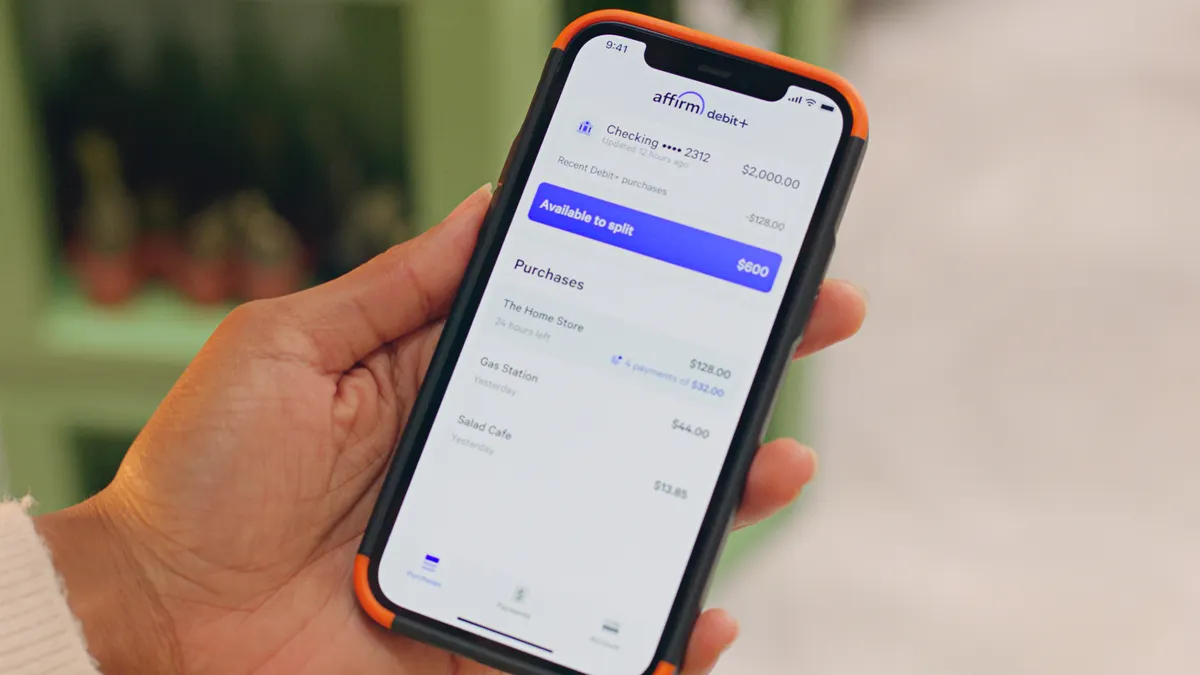

Why some payments companies want to be banks

Banking charters let those companies streamline their services and save money by not partnering with banks.

-

Amex buoyed by big spenders

The card network reported a 15% year-over-year increase in cardholder spending at luxury merchants.

-

Maine, DC weigh EWA regulations

Supporters of earned wage access are seeking to shape regulation being considered in Maine and the District of Columbia.

-

Visa doles out stablecoin advice

The company began offering clients strategic counsel on the digital assets last month, but doesn’t foresee many U.S. consumer use cases.

-

Block opens Dublin office

The location, announced Thursday, will include a demonstration lab to show off products to potential European customers.

-

Embedded finance to ‘explode’: panel

Tucking financial services, like payments, into a broader range of consumer situations is about to take off, bank executives said Thursday.

-

Deep Dive

Bot payments lag in agentic commerce

Within the emerging world of agentic commerce, a broad gap exists between bot shopping and autonomous payments.